SYDE 331 MANAGERIAL AND ENGINEERING ECONOMICS Spring

advertisement

SYDE 331

MANAGERIAL AND ENGINEERING ECONOMICS

Spring 2002

Final Exam Review Questions

Warning: Some of these questions consider the impact of inflation to a greater extent than you are responsible

for!!

1. A company is about to build a new warehouse costing $400,000. It is expected to be in service for

25 years. It is not clear, however, whether the Canadian tax laws classify the building as class 3 (CCA

rate = 5%) or as class 6 (CCA rate = 10%), since both classes include Abuildings@. Both classes use the

declining balance method.

The company=s accountant is going to the tax office to argue that the building should fall under one

class or the other. Which class (3 or 6) do you think the accountant will argue for the company?

Justify your answer.

2. A company that manufactures control panels has been contracting out the drilling of the back

planes. The cost of this practice was $12 000 in 1987, and if continued, the future cost is expected to

rise at the rate of inflation. The purchase of a drill press is under consideration for the end of 1987.

The cash flow details in real dollars (of 1987 purchasing power) for the two candidates are as follows:

Machine

First Cost

Lifetime, in years

Salvage Value

Annual Operating Cost

Press A

$7,000

3

$900

$11,000 in first year of operation,

increasing by $2,000 per year

Press B

$8,000

4

$1000

$9,000 per year

The company=s finance department has provided the following:

CCA declining balance rate = 20%

Income tax rate = 40%

Real, after-tax MARR = 10%

Inflation forecast = 6% per year for 15 years

Assume that all tax deductions will be applied against revenues; assume identical replacements. Do an

after-tax, present worth analysis, and make a recommendation.

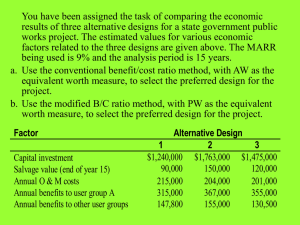

3. Three mutually exclusive investment proposals have estimated costs and revenues (in thousands of

real dollars) as shown below.

Proposal

First Cost

Annual Receipts

Annual Costs

Calculated IRR

I

200

90

70

8.8%

II

300

120

80

12.7%

III

390

140

90

12.1%

All three proposals have lifetimes of 25 years, and the real, before-tax MARR is 9%.

a.

b.

Make a recommendation, based on the internal rate of return method.

Make a recommendation, based on the payback period method.

4. The following table shows the cash flow estimates for two mutually exclusive alternatives, A and B.

Each alternative has a life of 5 years.

Alternatives

A

B

First Cost

$12,000

$17,000

Annual Net Receipts

$3,000

$4,000

Salvage Value

$2,000

$3,000

Use the internal rate of return method to choose the better alternative. The minimum attractive rate

of return is 5%.

5. A new pickup truck costs $10,000. Its salvage value is expected to be $7,500 at the end of the first

year; in later years, the salvage value is expected to be 75% of the previous year=s salvage value.

Annual operation and maintenance costs are expected to be $5,000 in the first year, and to increase at

the rate of 15% per year in later years. All of the above cash flow estimates are in real dollars. The

MARR is 15%. Calculate the economic life of the truck, under the assumption of cyclic replacements,

and ignoring tax effects. (Hint: you need not consider any time longer than five years.)

6. The managers of Tristar Investments Company are trying to decide whether to build a 3-storey, 6storey, 9-storey or 12-storey office building on a lot that the company owns in Kitchener. From

estimates of the construction and operating costs, rental receipts, taxes and resale values in 20 years

(the length of the study period), the following payback periods and real, after-tax internal rates of

return have been calculated:

Size

Payback Period

Real After-tax IRR

3-storey

9.4 years

10.30%

6-storey

8.7 years

11.10%

9-storey

10.2 years

11.90%

12-storey

11.4 years

10.80%

Tristar=s real, after-tax MARR is 9% per year.

One manager suggests that Tristar should choose the 6-storey design because it has the shortest

payback period, while another manager advocates the 9-storey design because if has the highest IRR.

Comment on the two managers= suggestions and their decision rules. State what you think is a

correct use of IRR calculations and payback periods, and give brief justifications.

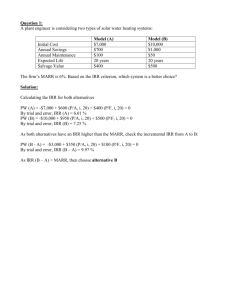

7. The Waterloo Widget Company must choose between two models of a new drill press, A and B.

They perform the same service. The real, before-tax cash flow estimates for the presses are in the table

below:

Model

A

B

First Cost

$19,000

$12,000

Annual Cost

$16,000

$19,000

Lifetime

4 years

4 years

Salvage Value

$3,000

$2,000

The CCA rate for drill presses is 35%, and the tax rate is 40%. The tax rules are the post-1981 rules.

Inflation is expected to be 5% per year for the foreseeable future. The company=s real, after-tax

minimum attractive rate of return is 9% per year. Perform a present worth analysis and recommend

which press to buy.

8. The following table summarizes information for 3 projects:

Project

1

2

3

a.

b.

First Cost

$100 000

$200 000

$250 000

IRR on overall

investment

19%

18%

16%

IRR on increments of investment

compared with project:

1

2

17%

12%

13%

If the projects are independent, which projects should be undertaken if the MARR is 16%?

If the projects are mutually exclusive, which project should be undertaken if the MARR is

15%. Indicate what logic you have used.

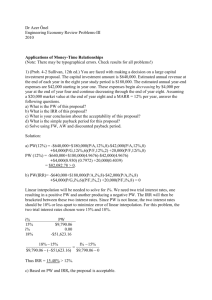

9. You are in the process of arranging a marketing contract for a new software package that will allow

easy access to the world wide web. It still needs more development, so your contract will pay you

$5,000 today to finish the prototype. You will then get royalties of $10,000 at the end of the second

and third years. At the end of the 1st and 4th year you will be required to do $20,000 and $10,000 in

upgrades, respectively. What is the appropriate rate of return on this project, assuming a MARR of

20%? Should you accept the contract?

10. The UCC for a firms' automobiles at the end of 1997 was $10,000. There was one truck in service at

this time. At the beginning of 1998, they purchased two trucks for a total of $50,000. At the beginning

of 2000, they purchased another truck for $20,000. At the beginning of 2001, the truck owned in 1997

was salvaged for $3,000. The CCA rate for automobiles is 30%. What was the firm's UCC at the end of

2001? Show your work.

Solutions to Final Exam Review Questions

Question 1.

PW (tax savings) = P(1-CCTFNew)

A larger d makes a larger PW of tax shields, and this increases the PW of the investment.

Therefore, he will argue for class 6 since it has a higher CCA rate.

Question 2.

Choose a 12-year study period. (n = 12)

i = (Real i) =10%.

d = 20%, t = 40%, f = 6%

PW(contracting out, in real dollars) = B12,000(P/A, i, n)(1 B t) = B49,058.58

Actual ia = (1+i)(1+ f) B 1 = 16.6%

CCTFnew = 1- td(1 + 0.5 ia)/[( ia + d)(1 + ia)] = 0.79698

CCTFold = 1- td/( ia + d) = 0.78142

PW(A)

={-7000 CCTFnew + 900(P/F, i, 3) CCTFold B [11000 + 2000 (A/G, i, 3)](P/A, , i, 3)(1-t)} * {1+ (P/F, i,

3) + (P/F, i, 6) + (P/F, i, 9)}

= -66,465.78

PW(B) = {-8000 CCTFnew + 1000 (P/F, i, 4) CCTFold B 9000 (P/A, , i, 4)(1-t)}

* {1+ (P/F, i, 4) + (P/F, i, 8) }

= -49,351.69

So, contracting out is the best option (the lowest PW of cost).

Question 3.

(a) Reject I; II is acceptable; is III B II worthwhile?

PW(IIIBII) = B(390 B 300) + [(140 B 120) B (90 B 80)](P/A, i, 25)

= B90 + 10(P/A, i, 25) = 0

PW(i = 10%) = 0.77

IRR(III B II) MARR=9%; choose III.

(b) Payback period of I = 10 years; II = 7.5 years; III = 7.8 years. Choose II.

(b) There is a bend in the total cost curve at 12,000 widgets/mo. The breakdown is at 23,200 per

month.

Question 4.

(a) Alternative A:

PWA = B12000 + 3000 (P/A, iA, 5) + 2000 (P/F, iA, 5) = 0

PWA = 274.30 at iA = 11%, and PWA = B51.04 at iA = 12%.

IRRA = 11.84% 11.8%

Alternative B: PWB = B17000 + 4000 (P/A, iB, 5) + 3000 (P/F, iB, 5) = 0

PWB = 25.91 at iB = 10%, and PWB = - 436.45 at iB = 11%.

Using the linear interpolation, IRRB = 10.055% 10.1%

(b) Since alternative AA@ has lowest initial investment and IRRA = 11.8% > MARR (=5%),

AA@ becomes Defender.

Since projects are mutually exclusive, B becomes the sole challenger.

0 = PWBBA = B(17000 B 12000) + (4000 B 3000)(P/A, i, 5) + (3000 B 2000)(P/F, i, 5)

= B5000 + 1000(P/A, i, 5) + 1000(P/F, i, 5)

PWB-A = 113 at i = 5%, and PWB-A = - 40.38 at i = 6%.

i should be between 5% and 6%.

Select project B, since incremental investment has i > MARR=5%.

Question 5.

EACk = {P[1 B (1-d)k(P/F, i, k)] +Ao(P/A, g, i, k)}(A/P,i,k)

= {10000*(1-[0.75/1.15] k) + 5000(P/A, (1+i)/(1+g)-1,k)/(1+g)}(A/P,15%,k)

={10000*(1-0.65217 k) + 4347.83k}(A/P, 15%, k)

Year

EACk

1

$9,000.00

2

$8,883.72

3

$8,877.61

4

$8,960.57

5

$9,116.32

The economic life of the truck is 3 years.

Question 6.

Two drawbacks of payback period:

(a) ignores time-value of money

(b) doesn=t account for cash flow after payback period

In the case of large projects such as this building, the final resale value can be very significant in the

comparison but is not reflected in the payback approach (i.e., point (b) above).

Since the payback method is a quick and dirty approach to calculate when initial cost is recovered, it

is highly inaccurate when the result is a long time period as in this problem, because:

(i) discounting can be very significant

(ii) uncertainty makes long payback period unacceptable

Summary: A simple decision based on payback for such a large project, especially with the results so

close, is an unacceptable procedure.

Based on IRR, all alternatives are feasible since > MARR (=9%). However, closing the project with

the largest IRR could be erroneous (for mutually exclusive projects) since it does not justify that IRR

> MARR for each incremental investment. An incremental IRR analysis should be performed,

assuming that unspent capital can be invested elsewhere for at least 9% (real rate of return).

Question 7.

d = 35%, t = 40%, f = 5%, real interest rate ir = 9%.

Actual interest rate: ia = (1 + ir)(1 + f) B 1 = (1.09)(1.05) B 1 = 14.45%

CCTFnew = 1- td(1 + 0.5 ia)/[( ia + d)(1 + ia)] = 0.73476

CCTFold = 1- td/( ia + d) = 0.71689

(P/F, ir, 4) = 0.70843, and (P/A, ir, 4) = 3.2397

PW = P* CCTFnew + A (1-t) (P/A, ir, N) B S (P/F, ir, N) CCTFold

Therefore,

PWA = -19,000(0.73476) -16,000(1- 0.4)(3.2397) + 3,000(0.70843)(0.71689) = - 43,537.96

PWB = -12,000(0.73476) -19,000(1- 0.4)(3.2397) + 2,000(0.70843)(0.71689) = - 44,733.97

Conclusion: Based on this analysis, machine A is marginally cheaper.

Question 8.

(a) With a MARR of 16%, do projects 1, 2 and 3 as their IRRs meet or exceed 16%.

(b) MARR = 15%

Step 0: cannot screen any projects

Step 1: the current best is alternative 1 (the least first cost)

Step 2: Challenge 1 with 2: incremental IRR is 17%; challenge succeeds; 2 is current best

Step 3: Challenge 2 with 3: incremental IRR is 13%; challenge fails.

Conclusion: pick 2

Question 9.

Since there are a number of sign changes, IRR method would give the multiple solutions. So we need

to use ERR method.

To calculate the ERR,

set FW(receipts @ MARR) = FW(disbursements @ ERR):

5(F/P, 20%, 4)+10(F/P, 20%, 2) + 10(F/P, 20%, 1) = 20(F/P, i, 3) + 10

(F/P, i, 3) = (1+ i)3 = {5(2.0736) +10(1.44) + 10(1.2) -10} / 20 = 1.3384 i = 10.20%

Since the ERR is less than MARR, the offer should be rejected.

Question 10.

1997

1998

1999

2000

2001

Adjustments

Base UCC

CCA

50,000

0

20,000

B3,000

10,000+ 50,000/2

49,500

34,650 + 20,000/2

41,255 - 3,000

10,500

14,850

13,395

11,476.5

The UCC at the end of 2001 was $26,778.50.

Remaining

10,000

49,500

34,650

41,255

26,778.5