Select Design 3

advertisement

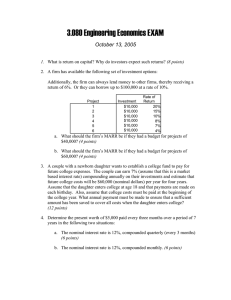

You have been assigned the task of comparing the economic results of three alternative designs for a state government public works project. The estimated values for various economic factors related to the three designs are given above. The MARR being used is 9% and the analysis period is 15 years. a. Use the conventional benefit/cost ratio method, with AW as the equivalent worth measure, to select the preferred design for the project. b. Use the modified B/C ratio method, with PW as the equivalent worth measure, to select the preferred design for the project. Factor Capital investment Salvage value (end of year 15) Annual O & M costs Annual benefits to user group A Annual benefits to other user groups Alternative Design 1 2 3 $1,240,000 $1,763,000 $1,475,000 90,000 150,000 120,000 215,000 204,000 201,000 315,000 367,000 355,000 147,800 155,000 130,500 (a) Design 1: CR (9%) = 1,240,000(A/P,9%,15) - 90,000(A/F,90/o,15) =150,815 B/C= 315,000 + 147,800 = 1.27 > 1 150,815 + 215,000 Design I is an acceptable base alternative. Annual Benefits Capital Recovery Amount Annual O&M Conventional B/C Increment Justified? Current Best Design (3-1) 22,700 28,141 -14,000 1.61 Yes 3 Select Design 3. (2-3) 36,500 34,718 3,000 0.97 No 3 (b) Design 1: B/C = (315,000 + 147,800 - 215,000)(P / A, 9%, 15) = 1.64 >1 1,240,000 - 90,000 (P/F, 9%, 15) Design 1 is an acceptable base alternative. PW (benefits - 0 & M) Capital Investment PW (Market Value) Modified B/C Increment Justified? Current Best Design Select Design 3. (3-1) 295,828 235,000 8,235 1.30 Yes 3 (2-3) 270,033 288,000 8,235 0.97 No 3 9-28 Your company manufactures circuit boards and other electronic parts for various commercial products. Design changes in part of the product line, which are expected to increase sales, will require changes in the manufacturing operation. The cost basis of new equipment required is $220,000 (MACRS five-year property class assets). Increased annual revenues, in year zero dollars, are estimated to be $360,000. Increased annual expenses, in year zero dollars, are estimated to be $239,000. The estimated market value of equipment at the end of the six-year analysis period is $40,000. General price inflation is estimated at 4.9% per year; the total escalation rate on annual revenues is 2.5%, and for annual expenses it is 5.6%; the after-tax MARR (in market terms) is 10% per year; and t = 39%. • a. Based on an after-tax, actual dollar analysis, what is the maximum amount that your company can afford to spend on the total project (i.e., changing the manufacturing operations)? Use the PW method of analysis. • b. Develop (show) your ATCF in real dollars. Annual revenues in year k (A$) = 360,000(1.1025)k Annual expenses in year k (A$) = - 239,000(l.056) k The values in the following table are expressed in A$. Eoy 0 1 2 3 4 5 6 6 Annual Revenues 369,000 378,225 387,681 397,373 407,307 417,490 Annual Expenses -252,384 - 266,518 - 281,442 - 297,203 - 313,847 - 331,422 BTCF Depr TI T(39%) ATCF (A$) -220,000 116,616 111,707 106,239 100,170 93,460 86,068 40,000 — 44,000 70,400 42,240 25,344 25,344 12,672 — — 72,616 41,307 63,999 74,826 68,116 73,396 40,000 — -28,320 - 16,110 - 24,960 - 29,182 - 26,565 - 28,624 - 15,600 -220,000 88,296 95,597 81,279 70,988 66,895 57,444 24,400 PW(10%) = ATCFk (P/F, 10%,k) = $136,557 Total investment that can be afforded (including new equipment) = 136,557 + 220,000 = 356,557 (b) ATCFk (R$) = ATCF(A$)(P/F, 4.9%, k) Year, k ATCFk (A$) (P/F,4.9%,k) 0 - 220,000 1.0000 1 88,296 0.9533 2 95,597 0.9088 3 81,279 0.8663 4 70,988 0.8258 5 66,895 0.7873 6 57,444 0.7505 6 24,400 0.7505 ATCF(R$) - 220,000 84,173 86,879 70,412 58,622 52,666 43,112 18,312 10 - 13 A new steam flow monitoring device must be purchased immediately by a local municipality. These most likely estimates have been developed by a group of engineers Capital investment Annual savings Useful life Market value (end of year 12) MARR - $140,000 $25,000 12 years $40,000 10%/year Because considerable uncertainty surrounds these estimates, it is desired to evaluate the sensitivity of PW to ± 50% changes in the most likely estimates of (a) annual savings, (b) useful life, and (c) interest rate (MARR). Graph the results and determine to which factor the decision is most sensitive. Annual Savings PW(l0%) Life PW(l0%) MARR PW(i%) -50 12,500 - 42,084 6 - 8,539 5% 103,855 % Change in Factor -25 0 25 18,750 25,000 31,250 501 43,086 85,672 9 15 12 20,940 43,086 59,728 7.5% 12.5% 10% 70,176 43,086 21,070 50 37,500 128,257 18 72,229 15% 2,991 At the most likely estimates: PW(10%) = - 140,000 + 25,000 (P/A, 10%, 12) + 40,000 (P/F, 10%, 12) = 43,086 At a -50% change in Life(example): PW(10%) = - 140,000 + 25,000 (P/A, 10%, 6) + 840,000 (P/F, 10%, 6) = - 140,000 + 25,000 (4.3553) + 40,000 (0.5645) = - 8,538 Decision is most sensitive to the estimate of Annual Saving