Problem Set for Lectures 8 and 9

advertisement

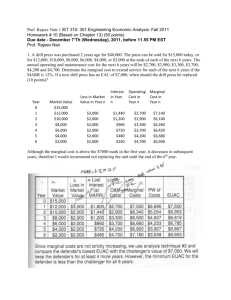

Problem Set for Lectures 8-9: 1 Imagine that your company has purchased equipment 2 years ago for $30,000. The current market price for your used equipment is $20,000. The salvage value at the end of the year 1 is estmated to be $17,000; at the end of year 2 -- $14,000; at the end of year 3 -- $11,000; and at the end of year 4 -- $7,000. The maintanance costs at year 1 amount to $9,500, and increase by $100 each year the equipment is in use. Calculate the equivalent uniform annual cost (EAUC) of the equipment, and find its optimal economic life given that MARR=10%. 2 As a continuation of problem 1 consider now new “challenger” equipment with the following characteristics. Current cost is $80,000; salvage value at the end of year 1 is $75,000; at the end of year two -- $70,000; at the end of year three -- $66,000; and at the end of year four -$62,000. The new equipment comes with a two-year full service guarantee, so the maintanance costs for the first two years are equal to 0, while they are $1,000 for the year 3, and $3,000 for the year 4. Find the optimal economic life of the new equipment and determine should we replace the equipmentof keep the old one (the one from problem 1).