ENSC 201 Assignment 4. Due 10 Oct

advertisement

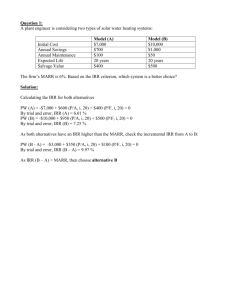

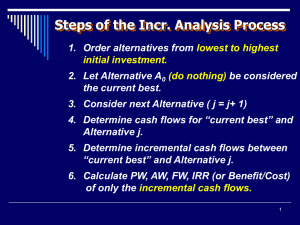

ENSC 201 Assignment 4. Due 10 Oct 4.1 General Cars is considering the purchase of a welding robot. The robot costs $40 000 and has an expected life of 12 years, with a final salvage value of $20 000. Major maintenance is required at the end of the 3th, 6th and 9th years, at $4 000/occasion. If the robot is acquired, operating costs for the company will go down by $50 000/year over the robot’s life. The company’s MARR is 20% per annum. On the basis of the IRR, should this investment be made? Answer: The present worth of payments is (in thousands of dollars) 40+ 4((P/F, i, 3) + (P/F, i, 6) + (P/F, i , 9)) The present worth of receipts is -50(P/A, i, 12) + 20(P/F, i, 12) So the net present worth is PW = 40+ 4((P/F, i, 3) + (P/F, i, 6) + (P/F, i , 9)) - 50(P/A, i, 12) + 20(P/F, i, 12) And the IRR is the value of i that makes this zero. We evaluate the expression for three values of i: 0%, 20%, and infinity. PW is positive for an interest rate of zero, and becomes negative as the interest rate increases without limit. Since the MARR is 20%, the question is whether the graph of present worth versus interest rate crosses the axis at an interest rate greater than 20%. Evaluating the present worth at i=20%, we find it is positive ($179 773 ). So the IRR must be greater than 20%, and the project is therefore acceptable. 4.2 SFU Residence and Housing is planning to renovate one of its buildings for Fall 2013. Four building are considered: Hamilton Hall, Shell House, Town Houses, and Louis Riel. These alternatives involve immediate costs of $10 000, $12 000, $15 000 and $20 000 respectively. A government granting agency will pay the University for making the renovations, but it will be a year before the government grant is paid. The grant available for each of the buildings is $11 200, $13 800, $16 950 and $22 500, again respectively. If the University will invest in any project that generates a rate of return of 10% or more, which location should be chosen? (Use incremental analysis based on the internal rate of return.) If SFU residence has enough budget to handle multiple projects which one(s) should be chosen? The approach here is to construct a table of incremental rates of return: Alternative Initial Cost Revenue IRR Hamilton Hall (`W’) 10 000 11 200 12% Shell House (`X’) 12 000 13 800 15% Town Houses (`Y’) 15 000 16 950 13% Louis Riel (`Z’) 20 000 22 500 12.5% W to X 2 000 2 600 30% X to Y 3 000 3 150 5% X to Z 8 000 8 700 8.7% All the projects individually have rates of return greater than 10%, so if they are not mutually exclusive, SFU Residence and Housing should do all of them. If they are mutually exclusive, we find that the incremental rate of return upgrading from Hamilton Hall to Shell House is 30%, while the rates of return for upgrading from Shell House to anything else are less than 10%. So , SFU Residence and Housing should consider Shell House for reconstruction 4.3 A project has £400 start-up costs, generates £400, £200, and £200 income in the first, second, and third years of operation respectively, then has a wind-up cost of £100 in the fourth year. The external interest rate, which is also the firm’s MARR, is 10%. Find the IRR and ERR of the project, and say whether it should be carried out. Answer: The IRR for the project is the solution to PW = -400+400/(1+i)+200/(1+i)2+200/(1+i)3-100/(1+i)4 = 0 We can solve this by plotting a graph of PW versus i, which gives IRR = 0.486, or 48.6%. This number is high, and rests on the assumption that we could invest the receipts at 48.6%, which may not be possible. So it is desirable to calculate the approximate ERR as a check. The future worth of the project expenditures at the end of the project is -100 - 400(1+j)4 where j is the ERR, and the future worth of the income is 400(1+0.1)+200(1+0.1)2+300(1+0.1)3 So FW = 400(1+0.1)3+200(1+0.1)2+200(1+0.1) – 100 - 400(1 + j)4 = 0 This is simple enough to solve analytically if we want to, or we can use a graph again. It gives us j=22%. This is greater than 10%, so the project should go ahead. 4.4 Facebook company in Ireland has decided to expand one of its branches. There are two alternatives available. One of the options is buying a new office building, which will cost £60 000 000. The other option is to lease a building, which is £4 000 000 payable at the beginning of each year. In either case, the company must pay city taxes, maintenance, and utilities. The office will be active for 15 years. They will either sign a 15-year lease or buy the building. If they buy the building, they will then sell it after 15 years. The value of the building at that time is estimated to be £150 000 000. What rate of return will Facebook company receive by buying the office building instead of leasing it? Answer: The city taxes, maintenance and utilities don’t come into the calculation, since they’re the same in either case. Note that the lease is paid at the beginning of each year, so it’s an initial payment of £4 000 000 followed by a 14-year annuity. The rate of return can be calculated as the IRR on the incremental investment necessary to buy the building rather than lease it. If we upgrade from leasing to buying, we have an initial additional expenditure of (£60 000 000 - £4 000 000) We save £4 000 000 a year in rent for the next 14 years, and we get an additional £150 000 000 at the end of the 15th year. So the present worth, in millions, is: PW = -(60 - 4) + 150(P/F, i, 15) + 4(P/A,4, i,14) To find the IRR, we equate this to 0 and solve for i: 4(P/A, i, 14) + 150(P/F, i, 15) – 56 = 0 For i = 11 %, the result is 4(P/A,11%,14) + 150(P/F,11%,15) – 56 = 4(6.9819) + 150(0.20900) – 56 = 3.2781 For i= 12%, 4(P/A,12%,14) + 150(P/F,12%,15) – 56 = 4(6.6282) + 150(0.1827) = - 2.0829 A linear interpolation between 11% and 12% gives the IRR i = 11% + (3.2781)/( 3.2781 + 2.0829) = 11.61% (We don’t know whether Facebook should go ahead, since we don’t know their MARR, but 11.6% is a pretty good rate of return, and Facebook’s main line of business isn’t doing that well, so probably they should go for it.)