presentation source

advertisement

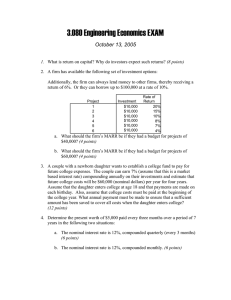

Chapter IV Examples 1. a. Determine the PW, FW, and AW of the following engineering project when the MARR is 15 % per year. Proposal A Investment cost 10,000 Expected life 5 years Market (salvage) value - 1,000 Annual receipts 8,000 Annual expenses 4,000 A negative salvage value means that there is a net cost to dispose of an asset, b. Determine the IRR of the project. Is it acceptable? c. What is the ERR for this project? Assume = 15% per year. (a) PW(15%) = 10,000 + ( 8,000 - 4000)(P/A,15%,5) - 1,000 (P/F,15%,5) = - 10,000 + 4000(3.3522) - 1,000 (0.4972) = 2911.6 FW(15%) = - 10,000 (F/P,15%,5) + ( 8,000 - 4000) (F/A,l5%,5) - 1,000 = - 10,000 (2.0114) + 4000(6.7424) - 1,000 = 5855.6 AW(15%) = 8,000 - 4000 - [ 10,000(A/P,15%,5) - (- 1000)(A/F,15%,5)] = 4000 - [ 10,000(0.2983) + 1,000(0.1483)] = 868.70 (b) PW(i’%) = 0 = - 10,000 + (8,000 - 4,000)(P/A, i’%, 5) - 1,000(P/F, i’ %,5) PW(15%)= 2,911.60 > 0 => i’% > 15% PW(25%) = 429.50 > 0, => i’% > 25% PW(30%) = - 526.90 < 0, => i’% < 30% Linear interpolation between 25% and 30% yields: i’% = 27.2% Since the IRR> MARR, the project is acceptable. (c) [10,000 + 1,000(P/F, 0.15, 5)] (F/P, i, 5) = 4,000 (F/A, 0.15, 5) => (F/P, i, 5) = 2.569 => i = 0.21 A company is considering constructing a plant to manufacture a proposed new product. The land costs 300,000, the building costs 600,000, the equipment costs 250,000, and 100,000 additional working capital is required. It is expected that the product will result in sales of 750,000 per year for 10 years, at which time the land can be sold for 400,000, the building for 350,000, and the equipment for 50,000. All of the working capital would be recovered. The annual expenses for labor, materials, and all other items are estimated to total 475,000. If the company requires an MARR of 25% per year on projects of comparable risk, determine if it should invest in the new product line. Use the PW method. Capital Investment = - 300,000 - 600,000 - 250,000 - 100,000 = - 1,250,000 Revenue = 750,000 per year Market Value = 400,000 + 350,000 + 50,000 + 100,000 = 900,000 Expenses = - 475,000 per year PW(25%) = - 1,250,000 + ( 750,000 - 475,000) (P/A,25%, 10) + 900,000(P/F,25%, 10) = - 1,250,000 + 275,000(3.5705) + 900,000(0.1074) = - 171.452.50 < 0 3. A 20-year bond with a face value of 5,000 is offered for sale at 3,800. The nominal rate of interest on the bond is 7%, paid semiannually. This bond is now 8 years old (i.e., the owner has received 16 semiannual interest payments). If the bond is purchased for 3,800, what effective annual rate of interest would be realized on this investment opportunity? 3,800 = 5,000 (P/F,i’%,24) + 175 (P/A,i’%,24) PW(5%) = 165.26 > 0, => i’% > 5% PW(6%) = - 368.68 <0, => i’% < 6% Linear interpolation between 5% and 6% yields: i’% = 5.3% per six month period. i/yr (1.053)2 - 1 = 0.1088 or 10.88% /year 4. Refinancing Example : Susie Queue has a 100,000 mortgage on her deluxe townhouse in urban Philadelphia. She makes monthly payments on a 10% nominal interest rate (compounded monthly) loan and has a 30-year mortgage. Home mortgages are presently available at a 7% nominal interest rate on a 30-year loan. Susie has lived in the town house for only two years, and she is considering refinancing her mortgage at a 7% nominal interest rate. The mortgage company informs her that the one-time cost to refinance the present mortgage is 4,500. How many months must Susie continue to live in her townhouse to make the decision to refinance a good one? Her MARR is the return she can earn on a 30-month certificate of deposit that pays 0.5 % per month (6% nominal interest). Original Mortgage Payment: i /mo = 10%/12 = 0.833% A = l00,000(A/P,0.833%,360) = l00,000(0.0087757) = 877.57 Reinaining principal after two years of payments: P24 = 877.57(P/A,0.833%,336) = 877.57(1 12.61763) = 98,829.86 New payment if refinanced over remaining 28 years: i / mo = 0.07/12 = 0.583% A = 98,829.86(A/P,0.583%,336) = 98,829.86(0.0067961) = 671.66 Savings per month if refinanced = 877.57 - 671.66 = 205.91 Number of months Susie should remain in her townhouse to make this a worthwhile venture: 4,500 = 205.91(P/A,0.5%,N) (P/A,0.5%,N) = 4,500/205.91 = 21.8542 From Table C-2, N ~ 24 months. 5. Suppose that you borrow 1,000 from the Easy Credit Company with the agreement to repay it over a 5-year period. Their stated interest rate is 9% per year. They show you the following items in determining the monthly payment: Principal 1,000 Total interest: 0.09 (5 years) (1,000) 450 They ask you to pay 20% of the interest immediately, so you leave with 1,000 - 90 = 910 in your pocket. Your monthly payment is calculated as follows: (1,000 + 450) / 60 = 24.17 / month a. Draw a cash flow diagram of this transaction. b. Determine the effective annual interest rate. 910 = 24.17 (P/A, i’%/month, 60), so (P/A, i’%, 60) = 37.65 (P/A, 1%, 60) = 44.9550 and (P/A,2%,60) = 34.7609. Therefore, 1% <i’% <2% Linear interpolation yields: i’% = 1.7% per month i’% / year = (1+ 0.017)12 - 1 = 0.224 or 22.4%/year 6. A small company purchased now for 23,000 will lose 1,200 each year the first four years. An additional 8,000 invested in the company during the fourth year will result in a profit of 5,500 each year from the fifth year through the fifteenth year. At the end of 15 years the company can be sold for 33,000. a. Determine the IRR. h. Calculate the FW if MARR = 12%. c. Calculate the ERR when e 12%. (a) PW(i’%) =0= - 23,000 - 1,200 (P/A, i’ %,4) - 8,000 (P/F,i’%,4) + 5,500 (P/A,i’%, 11)(P/F, i’%,4) + 33,000 (P/F, i’%,15) By linear interpolation, i’% = IRR = 10% (b) FW (12%) = - 23,000 (F/P,12%, 15) 1,200 (F/A,12%,4) (F/p,12%,11) + 8,000(F/P,12%,11) + 5,500 (F/A, 12%,1 1) + 33,000 = -2707025 (c) [23,000 + 1,200(P/A,12%,4) + 8,000(P/F,12%,4)](F/P, i’%,15) = 5,500(F/A,12%,11) + 33,000 31,728.76 (1 + i’)15 = 146,600.30 i’ = ERR = 0.1074 or 10.74% 7. A man who wanted to borrow 10,000 for one year was informed that he would have to pay only 2,000 in interest (i.e., a 20% interest rate). The lender stated that the total owed to him, 12,000, would be repaid at the rate of 1,000 per month for 12 months. What was the true effective annual interest rate being charged in this transaction? Why is it greater than the apparent rate of 20%? 10,000 = 1,000 (P/A,i’%, 12) => (P/A, i’%, 12) = 10 By trial and error, i = 2.9% / month Thus, i / year = (1.029)12 - 1 = 0.4092, or 40.92% per year. The interest rate is much higher because of the compounded monthly payment effect. 8. A company has the opportunity to take over a redevelopment project in an industrial area of a city. No immediate investment is required, but it must raze the existing buildings over a 4-year period and at the end of the fourth year invest 2,400,000 for new construction. It will collect all revenues and pay all costs for a period of 10 years. at which time the entire project, and properties thereon, will revert to the city. The net cash flow is estimated to be as follows: Tabulate the PW versus the interest rate and determine whether multiple IRRs exist. If so, use the ERR method when = 8% per year to determine a rate of return. Year End Net Cash Flow 1 500,000 2 300,000 3 100,000 4 - 2,400,000 5 150,000 6 200,000 7 250,000 8 300,000 9 350,000 10 400,000 IRR method: PW(i’%) = 0 = 500,000(P/F, i’ % l) + 300,000(P/F i’%, 2) + [100,000 + 100,000(P/A, i’%, 7) + 50,000(P/G, i’%, 7)](P/F, i’%, 3) - 2,500,000 (P/F, i’%, 4) i’% 1 2 3 4 5 Present Worth 103,331.55 63,694.68 30,228.14 2,175.18 -21,130.28 i’% 30 31 32 Present Worth -12,186.78 - 5,479.09 1,182.76 There are two internal rates of return: 4.9% and 31.2%: ERR Method: 2,400,000 (P/F,8%,4)(F/P,i’%,10) = 500,000(F/P,8%,9) +300,000(F/P,8%,8) + 100,000(F/P,8%,7) + 150,000(P/A,8%,6)(F/P,8%,6) + 550,000(P/G,8%,6)(F/P,8%,6) => = 7.6%