Question 3:

advertisement

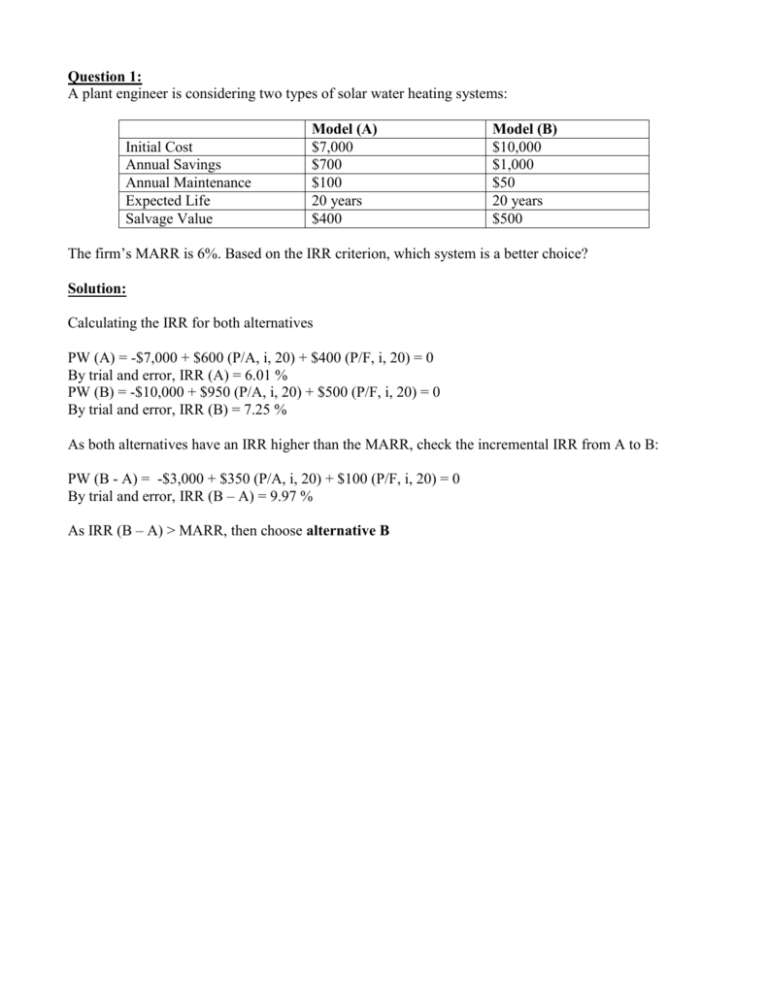

Question 1: A plant engineer is considering two types of solar water heating systems: Initial Cost Annual Savings Annual Maintenance Expected Life Salvage Value Model (A) $7,000 $700 $100 20 years $400 Model (B) $10,000 $1,000 $50 20 years $500 The firm’s MARR is 6%. Based on the IRR criterion, which system is a better choice? Solution: Calculating the IRR for both alternatives PW (A) = -$7,000 + $600 (P/A, i, 20) + $400 (P/F, i, 20) = 0 By trial and error, IRR (A) = 6.01 % PW (B) = -$10,000 + $950 (P/A, i, 20) + $500 (P/F, i, 20) = 0 By trial and error, IRR (B) = 7.25 % As both alternatives have an IRR higher than the MARR, check the incremental IRR from A to B: PW (B - A) = -$3,000 + $350 (P/A, i, 20) + $100 (P/F, i, 20) = 0 By trial and error, IRR (B – A) = 9.97 % As IRR (B – A) > MARR, then choose alternative B Question 2: A half dozen cost-reduction proposals have been forwarded by the industrial engineering department. A 20% rate of return is expected, and all equipment investments are to be written off in 5 years with no salvage value. Use the IRR method to answer the following: Proposal Combine Rearrange Modify Eliminate Up Quality Make Safer Equipment Cost 25,000 60,000 20,000 20,000 40,000 30,000 Net Annual Savings 9,500 21,500 7,000 9,000 17,000 10,000 (a) Which proposal should be selected if only one can be accepted? (b) Which proposal(s) should be selected if all proposals are independent and there is effectively unlimited capital available for cost-reduction projects? (c) Which combination of alternatives should be chosen for a total investment cost of at least $50,000, but not less than $100,000 (proposals are independent)? Solution: MARR = 20% N=5 Sorting the proposals by their benefits in an ascending order: Proposal Annual Savings 7,000 (P/A, i, 5) 2.8571 IRR A: Modify Annual Cost 20,000 B: Eliminate 20,000 9,000 2.2222 34.9 C: Combine D: Make Safer E: Up Quality F: Rearrange 25,000 30,000 40,000 60,000 9,500 10,000 17,000 21,500 2.6315 3.0000 2.3529 2.7906 22.1 AB BC -ve BD -ve BE 28.65% EF 4.06% 26.1 19.9 31.8 23.2 a) If only one solution would be accepted (Mutually exclusive): Choose Alternative E. (Up Quality) b) In case of independent alternatives with unlimited funds Choose All alternatives (IRR >20%), that is all alternatives except alternative D (make safer) c) Which Combination of Projects with limited resources? Proposal 1: A + E 2: B + E 3: A + B + C 4: C + E 5: A + F 6: A + B + E 7: B + F 8: A + C + E 9: B + C + E 10: C + F Cost Annual Savings IRR 60 60 65 65 80 80 80 85 85 85 24 26 25.5 26.5 28.5 33 30.5 33.5 35.5 31 28.6 32.9 27.7 29.6 22.9 30.2 26.2 27.9 30.9 24.1 Choose proposal # 9 (Eliminate + Combine + Up quality) Accept Accept 24 -ve Accept 26 22.11 Accept 69 41.04 Question 3: The capital budget for a company included $50,000 for the purchase of new machine. The MARR is 10% after taxes. Its useful life is four years and expected salvage after 4 years is $5,000. During the four years, it is estimated to save $20,000 per year in maintenance costs while its annual operating costs are $5,000. The machine is in class 29 (CCA rate of 50% straight-line class -- half year rule is applicable). The firm has an effective income tax rate of 42%. Should the machine be bought? i=10%, t=42% (1) Year 0 1 2 3 4 (2) BTCF -50000 15000 15000 15000 15000 (3) CCA rate 25% 50% 25% - (4) CCA 12500 25000 12500 - (5)=(2)-(4) Taxable Income (6) Tax @42% 2500 -10000 2500 15000 1050 -4200 1050 6300 (7) ATCF -50000 13950 19200 13950 8700 Salvage 5000 Disposal tax effect -2100 End of year 4: UCC=0. Since Salvage > UCC, CCA Recapture applies. Disposal tax effect =(S-UCC)t= (5000 - 0)0.42 = $2,100.00 PW = -50,000+13,950(P/F,i,1)+19,200(P/F,i,2)+13,950(P/F,i,3)+(8700+5000-2100)(P/F,i,4) = $-3,046.70 <0 Therefore, do not buy. Question 4: For the investment problem described in question 3, assume that a loan of $30,000 is obtained at 9%, to be repaid over a 4 year period in equal annual amounts covering repayment of principle and interest. All other aspects of this problem are the same as described in question 3. Should the machine be bought? Loan = 30,000 @ 9%. A=30,000(A/P,9%,4)=$9260 (1) (2) (3) (4) (5) Year BTCF CCA Loan Interest Repayment on loan 0 1 2 3 4 -50000 +30000 =20000 15000 15000 15000 15000 (6)=(2)-(3)-(5) Taxable income (7) Tax @ 42% (8)=(2)-(4)-(7) ATCF -20000 12500 25000 12500 0 9260 9260 9260 9260 2700 2109.60 1466 764.5 -200 -12109.60 1034 14235.5 -84 -5086 434 5979 5824 10826 5306 -239 5000 salvage -2100 Disposal tax effect Interest calculation: Yr.1: 30000x0.09 = 2700 Yr.2: [30000-(9260-2700)](0.09)= 23440x0.09=2109.60 Yr.3: [23440-(9260-2109.6)](0.09) = 16289x0.09=1466 Yr.4: [16289-(9260-1466)](0.09)= 8495x0.09 = 764.50 PW=-20000+5824(P/F,i,1)+ ….+(5000-2100-239)(P/F,i,4) = +$45.60 (Buy the machine)