ROR Analysis - Halil POSACI

advertisement

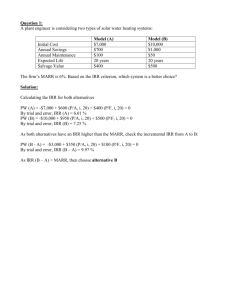

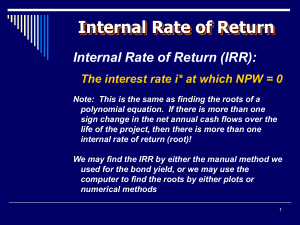

ISE 220 Engineering Economics Rate-Of-Return Analysis – Ch. 7 Izmir University of Economics Halil POSACI 2012, İzmir 1 Agenda • • • • Rate Of Return Analysis Decision Rule Simple and non-simple cash flows Comparing Mutually Exclusive Projects – Incremental Analysis • Class work 2 Rate Of Return Analysis Interest earned (or Lost) on a project cash flow Marginal Efficiency Of Capital Rate Of Return (ROR) Yield Internal Rate of Return (IRR) PW(i) = 0 3 Rate Of Return Analysis Decision Rule Solve for i Accept if i > MARR PW = -10 + 1.8(P/A, i, 8) + 2.8(P/F, i, 8) = 0 = IRR(cell range) 4 Rate Of Return Analysis Simple Versus Non-simple Cash Flows 5 Rate Of Return Analysis Simple Versus Non-simple Cash Flows 6 Rate Of Return Analysis Simple Versus Non-simple Cash Flows 7 Example 7.3 8 Example 7.3 Exact Solution PW = -10 + 1.8(P/A, i, 8) + 2.8(P/F, i, 8) = 0 = IRR(cell range) 9 7.4 Real Bond Yield 10 7.4 Real Bond Yield -996.25 + 48.13(PIA, i, 20) + 1000 (P/F, i, 20) Solve for i 11 IRR Decision Rule 12 7.5 Economics of Wind 13 7.5 Economics of Wind Number of wind turbines to be built: 200 units Power capacity: 310,000kW Capital investment required: $338,000,000 Project life: 20 years Salvage value of the wind turbines after 20 years: $0 Annual net cash flows (after all deductions): $41,391,160 A = $41,391,160 0 20 MARR = 10% $338,000,000 -338000000 + 41391160(P/A, i,20) = 0 Solve for i 14 7.6 Non-simple Project 15 7.6 Non-simple Project $2,300 $1,320 PW (i) $1,000 1 i (1 i)2 0 16 7.6 Non-simple cash flows 17 Mutually Exclusive Projects Incremental Analysis 18 Mutually Exclusive Projects Incremental Analysis Step 1: Compute the cash flows for the difference between the projects (A,B) by subtracting the cash flow of the lower investment cost project (A) from that of the higher investment cost project (B). Step 2: Compute the IRR on this incremental investment (IRRB-A ). Step 3: Accept the investment B if and only if IRR B-A > MARR NOTE: Make sure that both IRRA and IRRB are greater than MARR. 19 Example 7.7 Incremental Analysis 20 Example 7.8 Three Alternatives 21 Example 7.9 – Cost Only Project Cellular or Flexible Manufacturing system 22 Example 7.9 – Cost Only Project Cellular or Flexible Manufacturing system Although we cannot compute the IRR for each option without knowing the revenue figures, we can still calculate the IRR on incremental investment. IRRFMS-CMS = 12.43% < 15%, Select the CMS option. 23 Example 7.10 Unequal Service Lives 24 Example 7.10 Unequal Service Lives MARR = 12% Option 2 is better 25 Classwork / Homework 26