2071t2review

advertisement

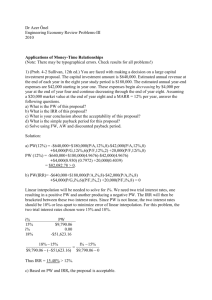

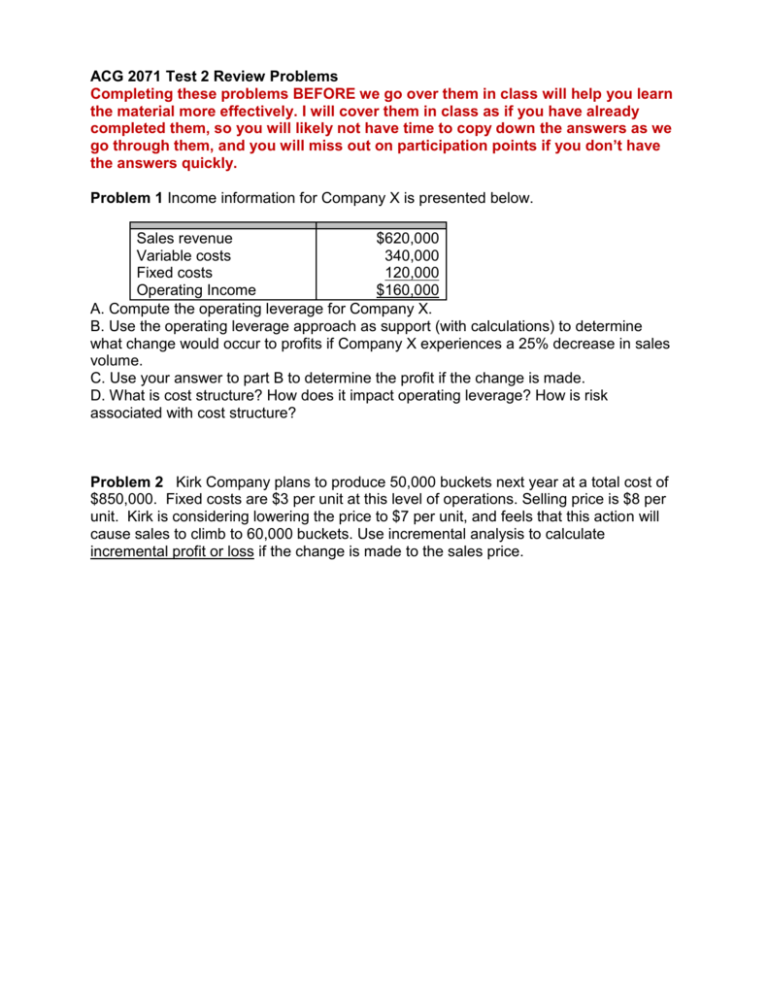

ACG 2071 Test 2 Review Problems Completing these problems BEFORE we go over them in class will help you learn the material more effectively. I will cover them in class as if you have already completed them, so you will likely not have time to copy down the answers as we go through them, and you will miss out on participation points if you don’t have the answers quickly. Problem 1 Income information for Company X is presented below. Sales revenue $620,000 Variable costs 340,000 Fixed costs 120,000 Operating Income $160,000 A. Compute the operating leverage for Company X. B. Use the operating leverage approach as support (with calculations) to determine what change would occur to profits if Company X experiences a 25% decrease in sales volume. C. Use your answer to part B to determine the profit if the change is made. D. What is cost structure? How does it impact operating leverage? How is risk associated with cost structure? Problem 2 Kirk Company plans to produce 50,000 buckets next year at a total cost of $850,000. Fixed costs are $3 per unit at this level of operations. Selling price is $8 per unit. Kirk is considering lowering the price to $7 per unit, and feels that this action will cause sales to climb to 60,000 buckets. Use incremental analysis to calculate incremental profit or loss if the change is made to the sales price. Use Case A and Case B for problems 3 through 7. CASE A Elpers, Inc. is contemplating the purchase of a new piece of equipment for expansion. This would alleviate $4,800 per year in rental costs for the current machine which is quite antiquated. The following information pertains to the new equipment: Initial cost of proposed new equipment $152,000 Estimated useful life 6 years Estimated disposal value at end of useful life $28,000 Elpers estimates the new equipment will cause revenues to increase from the current level of $300,000 to $355,000 per year. Cash operating expenses related to the increase in revenue are expected to be $20,800 per year. Elpers uses straight-line depreciation. Elper’s required rate of return is 8.7%, its cost of capital is 5.6% and its income tax rate is 30%. CASE B Murphy, Inc. is contemplating the purchase of a new piece of equipment for expansion. Murphy’s required rate of return is 7.2%. its cost of capital is 5.3% Its income tax rate is 33%. The following information pertains to the decision: Initial cost of proposed new equipment $266,000 Predicted useful life 8 years Predicted disposal value at end of useful life $17,000 Murphy predicts its revenues will be $102,000 more per year as a result of acquiring the machine. It also expects to save $12,000 a year in machine rental costs. Cash operating expenses related to the increase in revenue are expected to be $40,000 per year. Murphy uses straight-line depreciation. Problem 3: For case A and case B, calculate the incremental operating cash flow if the new equipment is purchased. Problem 4: For case A and case B, draw a time line of all cash flows. Problem 5: For case A and case B, determine the NPV and IRR using Excel. Explain the meaning of your answers. Problem 6: For case A and case B, determine the NPV and IRR using the BAII plus professional calculator. Show field names and all input into the BAIIPP as part of your answer. Problem 7: For case A and case B, determine the payback period, ARR, and the depreciation tax shield. Explain the meaning of these answers. Problem 8 Jackson, Inc. purchases a machine for $40,000 that has an estimated salvage value of $4,000, and an estimated life of 4 years. Jackson’s required rate of return is 11%. The machine is expected to generate the following cash flows and income over the next 4 years: Operating cash flows Operating income Year 1 $15,300 6,300 Year 2 $16,700 7,700 Year 3 $16,000 7,000 Year 4 $14,600 5,600 Round final answers to two decimal places. Use the BAIIPP when necessary. Show field names and all input into the BAIIPP as part of your answer. A. Determine the machine's payback period. B. Determine the IRR of the machine. C. Determine the ARR D. Determine the payback period. E. Interpret each answer. Should the machine be purchased? Why or why not? Problem 9 The following table shows the results of two budgeting calculations for three possible investments, each with a six year expected useful life: Method Cash payback method Net present value Proposal T4 Proposal H6 Proposal Z8 7 $800 6 ($200) 5 $100 Problem 10 JP Company received the following requests for capital investments for the year 2003: Project Amount of Investment Projected Rate of Return (%) A $102,000 14 B 250,000 16 C 98,000 16.5 D 265,000 20 E 180,000 15 F 100,000 19 The company's minimum rate of return is 17 percent and $725,000 is available for capital investments for the year 2003. Which capital investment proposals should JP Company consider? Rank the proposals in order, with the most desirable first.