Chapter 01 Selected Problem Solutions

advertisement

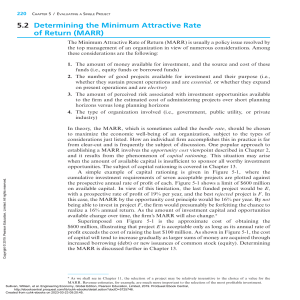

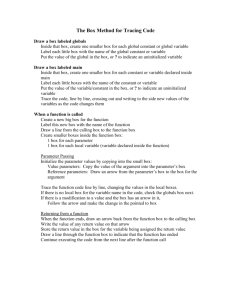

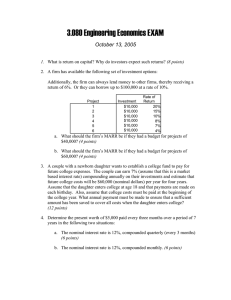

Solution to every third end-of-chapter problem Basics of Engineering Economy, 2nd edition Leland Blank and Anthony Tarquin Chapter 1 Foundations of Engineering Economy 1.1 If the alternative that is actually the best one is not even recognized as an alternative, it obviously will not be able to be selected by using any economic analysis tools. 1.4 The analysis techniques that are used in engineering economic analysis are only as good as the accuracy of the cash flow estimates. 1.7 In engineering economy, the evaluation criterion is financial units (dollars, pesos, etc). 1.10 Time value of money means that there is a certain worth in having money and that worth changes as a function of time. 1.13 The term that describes compensation for “renting” of money is time value of money, which manifests itself as interest. 1.16 Minimum attractive rate of return is the lowest rate of return (interest rate) on a project that companies or individuals consider to be high enough to induce them to invest their money. 1.19 (a) Equivalent cost in 1 year = 38,000 + 38,000(0.10) = $41,800 (b) Since $41,600 is less than $41,800, the firm should remodel 1ater (i.e. 1 year from now). 1.22 Rate of return = (45/966)(100%) = 4.7% 1.25 Rate of return = (2.3/6)(100%) = 38.3% 1.28 Amount of earnings in year one = 400,000,000(0.25) = $100,000,000 1.31 The engineer is wrong, unless the MARR is exactly equal to the cost of capital. Usually, the inequality ROR ≥ MARR > cost of capital is used, and the MARR is established higher than the cost of capital so that profit, risk and other factors are considered. 1 1.34 F = P + Pni 100,000 = 1000 + 1000(n)(0.1) 99,000 = 1000(n)(0.10) n = 990 years 1.37 P(1.20)(1.20) = 20,000 P = $13,888.89 1.40 F = P + P(n)(i) 3P = P + P(n)(0.20) n = 10 years 1.43 All engineering economy problems will involve i and n 1.46 P = $50,000; F = ?; i = 15%; n = 3 1.49 F = $400,000; n = 2; i = 20% per year; P = ? 1.52 P = $16,000,000; A = $3,800,000; i = 18% per year; n = ? 1.55 The difference between cash inflows and cash outflows is known as net cash flow. 1.58 Assuming down is negative: down arrow of $40,000 in year 5; up arrow in year 0 identified as P =?; i = 15% per year. 1.61 (a) FV is F (b) PMT is A 1.64 For built-in spreadsheet functions, a parameter that does not apply can be left blank when it is not an interior one. For example, if no F is involved when using the PMT function, it can be left blank because it is an end parameter. When the parameter involved is an interior one (like P in the PMT function), a comma must be put in its position. 1.67 (a) Assuming that Carol’s supervisor is a trustworthy and ethical person himself, going to her supervisor and informing him of her suspicion is probably the best of these options. This puts Carol on record (verbally) as questioning something she heard at an informal gathering. (b) Another good option is to go to Joe one-on-one and inform him of her concern about what she heard him say at lunch. Joe may not be aware he is on the bid evaluation team and the potential ethical consequences if he accepts the free tickets from Dryer. 1.70 Answer is (a) (c) NPER is n 2 (d) IRR is i (e) PV is P 1.73 F = P(1+i)n 16,000 = 8000(1 + i)9 21/9 = 1 + i 1.08 = 1 + i i = 0.08 (8%) Answer is (b) 1.76 2P = P + P(n)(0.05) 1 = 0.05n n = 20 Answer is (d) 3