11f

advertisement

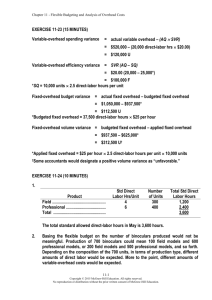

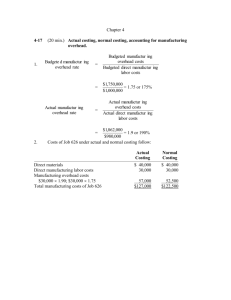

CHAPTER 11 Flexible Budgeting EXERCISE 11-32 (15 MINUTES) 1. Formula flexible budget: 2. Total budgeted monthly electricity cost = (€25 euros* number of patient days) + €40,000 euros *€25 per patient day = 50 kwh per patient day €.50 per kwh Columnar flexible budget: Variable electricity cost ............ Fixed electricity cost................. Total electricity cost ................. 10,000 € 250,000 40,000 € 290,000 Patient Days 20,000 € 500,000 40,000 € 540,000 30,000 € 750,000 40,000 € 790,000 PROBLEM 11-38 (20 MINUTES) 1. Policy Type 2. 3. Standard Clerical Hours per Application Actual Activity Standard Clerical Hours Allowed Automobile ....................................... 1 375 375 Renter's ............................................ 1.5 300 450 Homeowner's ................................... 2 150 300 Health ................................................ 2 600 1,200 Life .................................................... 5 300 1,500 Total .................................................. 3,825 The different types of applications require different amounts of clerical time, and variable overhead cost is related to the use of clerical time. Therefore, basing the flexible budget on the number of applications would give a misleading estimate of overhead costs. For example, processing 100 life insurance applications will entail much more overhead cost than processing 100 automobile insurance applications. Formula flexible budget: total budgeted variable Total budgeted overhead cost per clerical + monthly overhead = clerical hour cost hours budgeted fixedoverhead cost per month Total budgeted monthly overhead cost = ($5.00 X) + $3,000 4. where X denotes total clerical time in hours. Budgeted overhead cost for May = ($5.00 3,825) + $3,000 = $22,125 PROBLEM 11-40 (30 MINUTES) 1. A static budget is based on a single expected activity level. In contrast, a flexible budget reflects data for several activity levels. 2. Given the focus on a range of activity, a flexible budget would be more useful because it incorporates several different activity levels. 3. Static budget vs. actual experience: Direct material used ($40.00) ........................ Direct labor ($10.00) ...................................... Variable production overhead ($12.50) ........ Depreciation ................................................... Supervisory salaries ..................................... Other fixed production overhead ................. Total .......................................................... Static Budget: 24,000 Units Actual: 20,000 Units Variance $ 960,000 240,000 300,000 48,000 72,000 480,000 $2,100,000 $ 865,000 221,200 304,000 48,000 75,600 478,000 $1,991,800 $ 95,000 F 18,800 F 4,000 U ---3,600 U 2,000 F $108,200 F Calculations: Direct material used: $2,880,000 ÷ 72,000 units = $40.00 per unit Direct labor: $720,000 ÷ 72,000 units = $10.00 per unit Variable production overhead: $900,000 ÷ 72,000 units = $12.50 per unit Depreciation: $144,000 ÷ 3 months = $48,000 per month Supervisory salaries: $216,000 ÷ 3 months = $72,000 per month Other fixed production overhead: ($1,800,000 - $144,000 $216,000) ÷ 3 months = $480,000 per month 4. Flexible budget vs. actual experience: Flexible Budget: 20,000 Units Actual: 20,000 Units Variance Direct material used ($40.00).......................... Direct labor ($10.00) ........................................ Variable production overhead ($12.50) ......... Depreciation .................................................... Supervisory salaries ....................................... Other fixed production overhead ................... Total............................................................ 5. $ 800,000 200,000 250,000 48,000 72,000 480,000 $1,850,000 $ 865,000 221,200 304,000 48,000 75,600 478,000 $1,991,800 A performance report based on flexible budgeting is preferred. The report compares budgeted and actual performance at the same volume level, eliminating any variations in activity. In essence, everything is placed on a “level playing field.” The general manager’s warning is appropriate because of the sizable variances that have arisen. With the static budget, performance appears favorable, especially with respect to variable costs. Bear in mind, though, that volume was below the original monthly expectation of 24,000 units, presumably because of the plant closure. A reduced volume will likely lead to lower variable costs than anticipated (and resulting favorable variances). When the volume differential is removed, variable cost variances total $140,200U ($65,000U + $21,200U + $54,000U), or 11.2% of budgeted variable costs ($800,000 + $200,000 + $250,000). The incurrence of variable cost appears excessive with respect to all components of the total: direct material, direct labor, and variable production overhead. $ 65,000 U 21,200 U 54,000 U ---3,600 U 2,000 F $141,800 U