Slide Presentation

advertisement

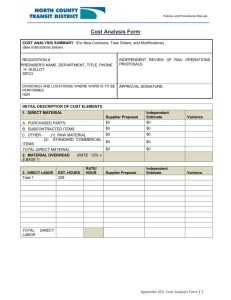

WELCOME! Small Business Boot Camp 3 What are Rates, Build Ups, Pricing and Cost Centers? Purpose To Provide and useful overview of components involved in building rates for all types of service contracts i.e.: Cost Plus Fixed Fee, Time and Material, Cost Plus Award Fee, Firm Fixed Price What is Direct Labor? What is a Fully Burdened Rate? How do I get a Fully Burdened Rate? Can someone please explain what a cost center is? Direct Labor Rate Fully Burdened Rate Covers the basic labor cost of the employee Proposed by offeror to cover direct labor, indirect costs, and profit under a service contract. • FRINGE BENEFITS • DEFINITION: The costs associated with benefits provided to employees working for the corporation. • • • • • • • • • • • • • FRINGE BENEFITS Paid Leave Paid Holidays Medical and Dental Short and Long Term Disability Life Insurance Retirement Programs Bonuses Severance Pay Social Security, Federal , and State Taxes Employee Morale and Welfare Tuition Assistance Workman’s Compensation • OVERHEAD (OH) • DEFINITION: Overhead is traditionally defined as costs to operate local corporate operations providing indirect support to clients and direct support to contractor employees working for the client. Overhead costs are usually broken down into two separate rates: • OVERHEAD (OH) - CLIENT SITE: This is a rate normally applied to the cost of a contractor who is working at a government or client site. - CORPORATE SITE: This is a rate normally applied to the cost of a contractor who is working in support of a client, but working at an off-site location. This rate is normally higher for the client because the corporation must pay for additional facilities and equipment to provide the required support. • OVERHEAD (OH) • Supervisory Labor and Benefits • Recruiting and Hiring • Human Resource Support to Employees • Security Clearance Processing • Regional Office Staff Labor • Operating Supplies/Materials • Leases, Rent, and Utilities • Repairs and Maintenance • Licenses/Taxes • Depreciation • Travel • Professional Development • GENERAL AND ADMINISTRATIVE EXPENSES (G&A) • DEFINITION: Costs associated with the overall management and operation of a business (corporate headquarter costs). • GENERAL AND ADMINISTRATIVE EXPENSES (G&A) • Corporate Staff Labor & Benefits • Operating Supplies/Materials • Leases, Rent, and Utilities • Repairs and Maintenance • Licenses/Taxes/Insurance • Accounting/Banking Fees • Depreciation • Travel/Conferences • Business and Development • Professional Development • PROFIT • DEFINITION: The dollar amount over and above allowable costs that is paid to the firm for contract performance. • Remember that companies are in business to make a profit, and that in addition to covering the costs of running their businesses, they must also make a profit for growth (investment) and their shareholders (increase shareholder equity). • What is Fee then? • Is it the same as profit? • Wrap Rate Someone said Wrap Rate. What is that?! What is a good one? Why does the Government look at that? • So, I know what components make up pricing so how does it work? • What gets added to what?! • Attachment 3 - Sub Pricing Model boot camp.xls Cost and Price Analysis Determining whether the proposed labor and indirect rates are fair and reasonable may require using various evaluation techniques with input from Government sources, such as: Defense Contract Audit Agency (DCAA) Administrative Contracting Officers (ACO) Procuring Contracting Officer (PCO) Cost and Price Analysis We have all heard this one before: COST REALISM…What the heck is that? Who get to decide how realistic my pricing is and why? Let’s put the government on the spot. Thank you! And a big thank you to our panelist volunteers!!!