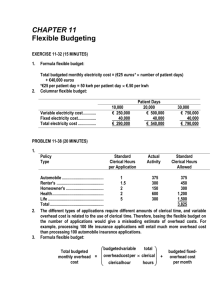

Winter 2009 Midterm

advertisement

BUS 3230 Intermediate Management Accounting Winter 2009 Midterm Exam February 26, 2009 DO NOT WRITE YOUR NAME ON THE PAPER Student Number ___________________________________ During the Examination no questions will be answered. Write your assumptions in the space for the question. Part marks will be granted. The exam is 80 minutes long Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 Total www.uofgexamnetwork.com /15 /13 /12 /17 /24 /10 /90 1 SHORT ANSWER. Write the word or phrase that best completes each statement or answers the question. 1) Seamless Gutter sells 10 metre sections of eaves trough for $12. The unit variable costs per section are $8.80. Fixed costs total $4,800. Required: a. What is the contribution margin per section? b. What is the breakeven point in sections? . . . in dollars? c. How many sections must be sold to earn a pretax income of $4,000? d. What is the margin of safety assuming 1,800 sections are sold 2)General Hospital uses an indirect overhead job costing system for all patients. In March the critical care and special care facilities had budgeted allocation bases of 4,000 nursing days and 3,000 nursing days, respectively. The budgeted nursing care charges for each department for the month were $2,106,000 and $1,500,000, respectively. The general care area had budgeted costs of $2,700,000 and 7,500 nursing days for the month. Patient Jim Hansen spent 5 days in critical care and 4 days in special care during April. Required: a. Determine the budgeted overhead rate for each department. b. What are the total charges to Mr. Hansen if he was in the facility the entire month? www.uofgexamnetwork.com 3 3)Brewery, Inc. operates many bottling plants around the globe. At its Toronto plant, where six different brands are bottled, the following costs are incurred to produce 5,000,000 cans of beer: 1. New-product development costscosts of adding new products to those being produced. "Light Beer Plus" was added at a cost of $307,000. 2. Incoming material handling costscosts of inspecting and handling concentrate, bottles, packages, and so on. Driver is hours of materials handling time, which is highly correlated with hours of bottling time ($216,750). 3. Incoming materials purchase costscan be directly traced to individual products being bottled and packaged. Costs are purely variable with output level ($1,106,500). 4. Energy coststhe cost driver is hours of bottling time ($85,750). 5. Plant supervision and safety coststhese costs are for plant infrastructure management, land rates, and plant insurance ($311,500). Required: a. Classify each of the preceding costs as output unit-level, batch-level, product-sustaining, or facility-sustaining. b. Compute unit costs for (a) the output unit-level costs, and (b) the total manufacturing costs. 4) Frame Antique manufactures picture frames. Sales for May are expected to be 20,000 units of various sizes. Historically, the average frame requires three metres of framing, one square metre of glass, and two square metres of backing. Beginning inventory includes 3,000 metres of framing, 1,000 square metres of glass, and 1,000 square metres of backing. Current prices are $0.20 per metre of framing, $4.00 per square metre of glass, and $1.50 per square metre of backing. Ending inventory should be 150 percent of beginning inventory. Purchases are paid for in the month acquired. Required: a. Determine the quantity of framing, glass, and backing that is to be purchased during May. b. Determine the total costs of direct materials for May purchases. www.uofgexamnetwork.com 5 5) Littrell Company produces chairs and has determined the following direct cost categories and budgeted amounts: Category Direct Materials Direct Labor Direct Marketing Standard Inputs for 1 output 1.00 0.30 0.50 Standard Cost per input $7.50 9.00 3.00 Actual performance for the company is shown below: Actual output: (in units) Direct Materials: Materials costs Input purchased and used Actual price per input Direct Manufacturing Labor: Labor costs Labor-hours of input Actual price per hour Direct Marketing Labor: Labor costs $5,880 Labor-hours of input Actual price per hour 4,000 $30,225 3,900 $7.75 $11,470 1,240 $9.25 2,100 $2.80 Required: a. What is the combined total of the flexible-budget variances? b. What is the price variance of the direct materials? c. What is the price variance of the direct manufacturing labour and the direct marketing labour, respectively? d. What is the efficiency variance for direct materials? e. What are the efficiency variances for direct manufacturing labour and direct marketing labour, respectively? 6) Everjoice Company makes clocks. The fixed overhead costs for 2007 total $720,000. The company uses direct labourhours for fixed overhead allocation and anticipates 240,000 hours during the year for 480,000 units. An equal number of units are budgeted for each month. During June, 42,000 clocks were produced and $63,000 were spent on fixed overhead. Required: a. Determine the fixed overhead rate for 20X5 based on units of input. b. Determine the fixed overhead static-budget variance for June. c. Determine the production-volume overhead variance for June. www.uofgexamnetwork.com 7 Solutions 1) 2) a. b. Contribution margin per section = $12.00 - $8.80 = $3.20 N = Breakeven point in sections $12.00N - $8.80N - $4,800 = 0 $3.20N - $4,800 = 0 N = $4,800/$3.20 N = 1,500 sections Breakeven dollars = 1,500 x $12 = $18,000 c. N = Target sales in sections $12.00N - $8.80N - $4,800 - $4,000 = 0 $3.20N - $8,800 = 0 N = $8,800/$3.20 N = 2,750 sections d. Margin of safety = Sales - Breakeven sales = ($12.00 x 1,800) - $18,000 = $21,600 - $18,000 = $3,600 4) 3 2 3 3 Overhead rate critical care = $2,106,000/4,000 nursing days = $526.50 per day. 2 Overhead rate special care = $1,500,000/3,000 nursing days = $500 per day 2 Overhead rate general 2 = $2,700,000/7,500 nursing days = $360 per day b. Mr. Hansen: Critical care $526.50 x 5 days = Special care $500.00 x 4 days = General care $360.00 x 21 days = Total overhead charges 3) 3 $ 2,632.50 2,000.00 7,560.00 $12,192.50 2 2 2 1 a. Output unit-level: material handling, material purchase costs, energy costs Batch-level: none Product-sustaining: new product development Facility-sustaining: plant supervision and safety costs 1 1 1 b. i. Material handling Material purchase costs Energy costs Total output-level costs $1,409,000/5,000,000 = $ 216,750 1,106,500 85,750 $1,409,000 $0.2818 3 2 ii. Output-level costs Product sustaining costs Faculty sustaining costs Total costs $2,027,500/5,000,000 = $1,409,000 307,000 311,500 $2,027,500 $0.4055 2 2 a. Framing Desired ending inventory Production needs (20,000 units) Total needs 64,500 Less: beginning inventory Purchases planned b. Glass 4,500 60,000 21,500 3,000 61,500 Backing 1,500 1,500 20,00040,000 41,500 1,000 1,000 20,50040,500 3 3 1 3 Cost of direct materials: Framing (61,500 x $0.20) Glass (20,500 x $4.00) Backing (40,500 x $1.50) Total $155,050 5) a. Direct materials $30,225 Direct manufacturing labour Direct marketing labour $47,575 $12,300 82,000 60,750 2 2 2 1 Actual Result $30,000 11,470 5,880 $46,800 Flexible Budget $225 U 10,800 670 6,000 120 $775 U Variances 2 2 U 2 F 2 1 b. ($7.75 — $7.50) x (3,900) = $975 unfavourable 3 c. Manufacturing Labour ($9.25 — $9.00) x 1,240 = $310 unfavourable Marketing Labour ($2.80 — $3.00) x 2,100 = $420 favourable 3 3 d. [3,900 — (4,000 units x 1.00)] x $7.50 = $750 favourable e. Manufacturing Labour = [1,240 hours — (4,000 x 0.30 hours)] x $9.00 = $360 U3 Marketing Labour = [2,100 hours — (4,000 x 0.50 hours)] x $3.00 = $300.00 U 2 3 6) a. Fixed overhead rate = $720,000/240,000 = $3.00 per hour 2 b. Fixed overhead static budget variance = $63,000 — ($720,000/12) = $3,000 unfavourable 3 c. Budgeted fixed overhead rate per output unit = $720,000/480,000 = $1.50 2 Denominator level in output units = (40,000 — 42,000) x $1.50 = $3,000 favourable 3 www.uofgexamnetwork.com 9