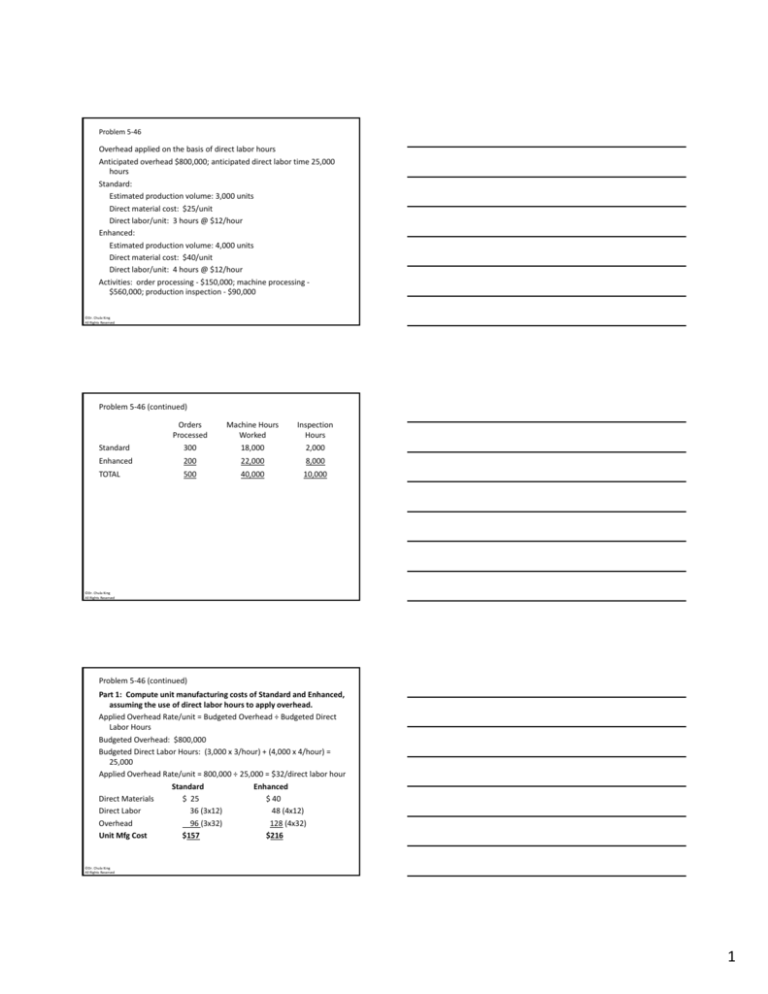

Problem 5‐46

Overhead applied on the basis of direct labor hours

Anticipated overhead $800,000; anticipated direct labor time 25,000 hours

Standard:

Estimated production volume: 3,000 units

Direct material cost: $25/unit

Direct labor/unit: 3 hours @ $12/hour

Direct labor/unit: 3 hours @ $12/hour

Enhanced:

Estimated production volume: 4,000 units

Direct material cost: $40/unit

Direct labor/unit: 4 hours @ $12/hour

Activities: order processing ‐ $150,000; machine processing ‐

$560,000; production inspection ‐ $90,000

©Dr. Chula King

All Rights Reserved

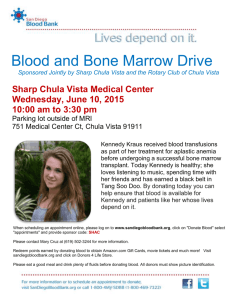

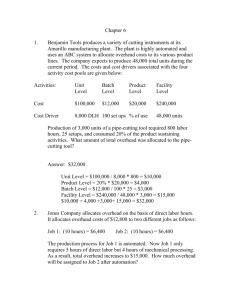

Problem 5‐46 (continued)

Orders Processed

Machine Hours

Worked

Inspection Hours

Standard

300

18,000

2,000

Enhanced

200

22,000

8,000

TOTAL

500

40,000

10,000 ©Dr. Chula King

All Rights Reserved

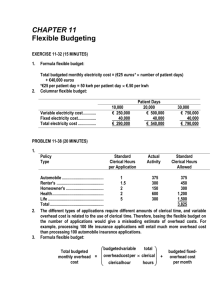

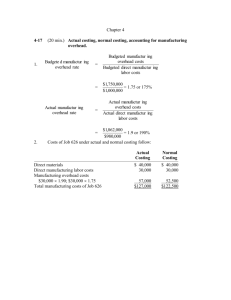

Problem 5‐46 (continued)

Part 1: Compute unit manufacturing costs of Standard and Enhanced, assuming the use of direct labor hours to apply overhead.

Applied Overhead Rate/unit = Budgeted Overhead ÷ Budgeted Direct Labor Hours

Budgeted Overhead: $800,000

Budgeted Direct Labor Hours: (3,000 x 3/hour) + (4,000 x 4/hour) = 25,000

Applied Overhead Rate/unit = 800,000 ÷

l d

h d

/

25,000 = $32/direct labor hour

$ /d

l b h

Standard

Enhanced

Direct Materials

$ 25

$ 40

Direct Labor

36 (3x12)

48 (4x12)

128 (4x32)

Overhead

96 (3x32)

$216

Unit Mfg Cost

$157

©Dr. Chula King

All Rights Reserved

1

Problem 5‐46 (continued)

Part 2: Compute unit manufacturing costs of Standard and Enhanced using ABC

Activity

Cost

Cost Driver

Application Rate

Order processing $150,000 500 Orders Proc $300/Order Proc

Machine processing 560,000 40,000 MH

14/MH

Product inspection 90,000 10,000 Insp. Hr

9/Insp Hr

Standard

Enhanced

Order Processing $ 90,000 (300 x $300) $ 60,000 (200 x $300)

Machine Processing

252,000 (18,000 x $14) 308,000 (22,000 x $14)

72,000 (8,000 x $9)

Product Inspection

18,000 (2,000 x $9)

Total

$360,000

$440,000

# units

÷ 3,000

÷ 4,000

OH Cost/unit

$ 120

$ 110

©Dr. Chula King

All Rights Reserved

Problem 5‐46 (continued)

Part 2 (continued)

Direct Materials

Direct Labor

Mfg Overhead

Total Cost/Unit under ABC

Standard

$ 25

36 (3 x 12)

120

$ 181

Enhanced

$ 40

48 (4x12)

110

$ 198

©Dr. Chula King

All Rights Reserved

Problem 5‐46 (continued)

Part 3(a): If direct labor hours is used to allocate overhead, determine which product is overcosted and which product is undercosted, and by what amount.

Standard

Enhanced

Cost/unit using direct labor hours

$157

$216

198

Cost/unit using ABC 181

(undercosted)/overcosted

$( 24)

$ 18

Part 3(b): Is it possible that the undercosting/overcosting are contributing to the company’s profit woes?

Yes, because the selling price is primarily based on cost. If the product is overcosted, its resulting selling price could be too high, causing customers to go elsewhere for a comparable product with a lower price. If the product is undercosted, its resulting selling price may be too low to properly cover the cost of the product.

©Dr. Chula King

All Rights Reserved

2