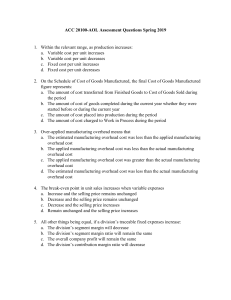

Target Costing & ROI Exercise Solutions

advertisement

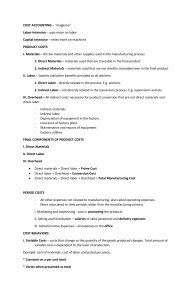

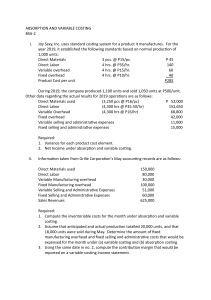

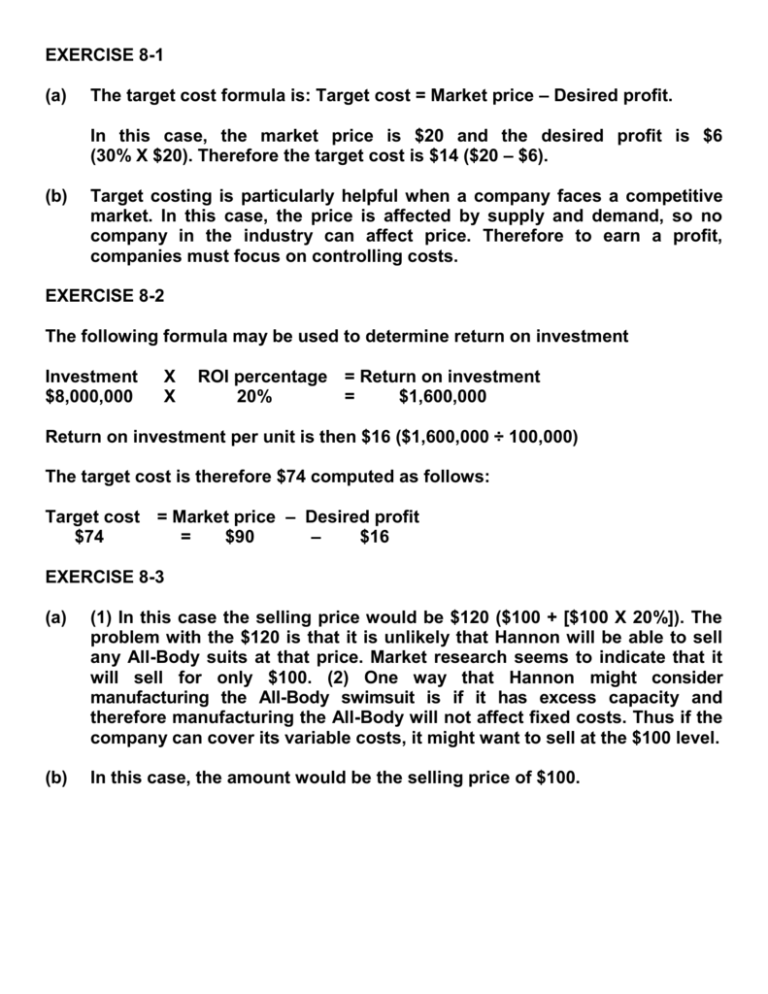

EXERCISE 8-1 (a) The target cost formula is: Target cost = Market price – Desired profit. In this case, the market price is $20 and the desired profit is $6 (30% X $20). Therefore the target cost is $14 ($20 – $6). (b) Target costing is particularly helpful when a company faces a competitive market. In this case, the price is affected by supply and demand, so no company in the industry can affect price. Therefore to earn a profit, companies must focus on controlling costs. EXERCISE 8-2 The following formula may be used to determine return on investment Investment $8,000,000 X X ROI percentage = Return on investment 20% = $1,600,000 Return on investment per unit is then $16 ($1,600,000 ÷ 100,000) The target cost is therefore $74 computed as follows: Target cost = Market price – Desired profit $74 = $90 – $16 EXERCISE 8-3 (a) (1) In this case the selling price would be $120 ($100 + [$100 X 20%]). The problem with the $120 is that it is unlikely that Hannon will be able to sell any All-Body suits at that price. Market research seems to indicate that it will sell for only $100. (2) One way that Hannon might consider manufacturing the All-Body swimsuit is if it has excess capacity and therefore manufacturing the All-Body will not affect fixed costs. Thus if the company can cover its variable costs, it might want to sell at the $100 level. (b) In this case, the amount would be the selling price of $100. EXERCISE 8-3 (Continued) (c) The highest acceptable cost would be the target cost. The target cost is $80 as shown below: Target cost = Market price – Desired profit $80 = $100 – $20 EXERCISE 8-4 (a) Total cost per unit: Direct materials ......................................................................... Direct labor ................................................................................ Variable manufacturing overhead ............................................ Fixed manufacturing overhead ($300,000/30,000) ................................................................... Variable selling and administrative expenses ......................... Fixed selling and administrative expenses ($150,000/30,000) ................................................................... Per Unit $17 8 11 10 4 5 $55 (b) Target selling price = $55 + (40% X $55) = $77 EXERCISE 8-5 (a) Total cost per unit: Direct materials ......................................................................... Direct labor ................................................................................ Variable manufacturing overhead ............................................ Fixed manufacturing overhead ($3,000,000/500,000) .............................................................. Variable selling and administrative expenses ......................... Fixed selling and administrative expenses ($1,500,000/500,000) .............................................................. (b) Desired ROI per unit = (25% X $26,000,000)/500,000 = $13 Per Unit $ 7 9 15 6 14 3 $54 EXERCISE 8-5 (Continued) (c) Markup percentage using total cost per unit: $13 $54 = 24.07% (d) Target selling price = $54 + ($54 X 24.07%) = $67