(15 min.) Alternative allocation bases for a professional services firm

advertisement

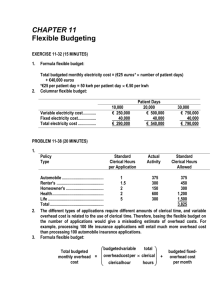

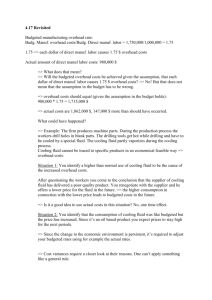

5-18 (15 min.) Alternative allocation bases for a professional services firm. 1. Client (1) SEATTLE DOMINION Wolfson Brown Anderson TOKYO ENTERPRISES Wolfson Brown Anderson Direct Professional Time Rate per umber Total of Hours Hour (2) (3) (4) = (2) × (3) Support Services Rate (5) Amount Billed to Total Client (7) = (4) + (6) (6) = (4) × (5) $500 120 80 15 3 22 $7,500 360 1,760 30% 30 30 $2,250 108 528 $ 9,750 468 2,288 $12,506 $500 120 80 2 8 30 $1,000 960 2,400 30% 30 30 $300 288 720 $1,300 1,248 3,120 $5,668 2. Direct Professional Time Support Services Rate per umber Rate per Hour of Hours Total Hour Total (2) (3) (5) (4) = (2) × (3) (6) = (3) × (5) Client (1) SEATTLE DOMINION Wolfson Brown Anderson TOKYO ENTERPRISE S Wolfson Brown Anderson Amount Billed to Client (7) = (4) + (6) $500 120 80 15 3 22 $7,500 360 1,760 $50 50 50 $ 750 150 1,100 $ 8,250 510 2,860 $11,620 $500 120 80 2 8 30 $1,000 960 2,400 $50 50 50 $ 100 400 1,500 $1,100 1,360 3,900 $6,360 Seattle Dominion Tokyo Enterprises Requirement 1 $12,506 5,668 $18,174 Requirement 2 $11,620 6,360 $17,980 Both clients use 40 hours of professional labor time. However, Seattle Dominion uses a higher proportion of Wolfson’s time (15 hours), which is more costly. This attracts the highest supportservices charge when allocated on the basis of direct professional labor costs. 3. Assume that the Wolfson Group uses a cause-and-effect criterion when choosing the allocation base for support services. You could use several pieces of evidence to determine whether professional labor costs or hours is the driver of support-service costs: a. Interviews with personnel. For example, staff in the major cost categories in support services could be interviewed to determine whether Wolfson requires more support per hour than, say, Anderson. The professional labor costs allocation base implies that an hour of Wolfson’s time requires 6.25 ($500 ÷ $80) times more support-service dollars than does an hour of Anderson’s time. b. Analysis of tasks undertaken for selected clients. For example, if computer-related costs are a sizable part of support costs, you could determine if there was a systematic relationship between the percentage involvement of professionals with high billing rates on cases and the computer resources consumed for those cases. 5-20 (10–15 min.) ABC, process costing. Rates per unit cost driver. Activity Cost Driver Machining Machine-hours Rate $375,000 ÷ (25,000 + 50,000) = $5 per machine-hour Set up Production runs $120,000 ÷ (50 + 50) = $1,200 per production run Inspection Inspection-hours $105,000 ÷ (1,000 + 500) = $70 per inspection-hour Overhead cost per unit: Machining: $5 × 25,000; 50,000 Set up: $1,200 × 50; $1,200 × 50 Inspection: $70 × 1,000; $70 × 500 Total manufacturing overhead costs Divide by number of units Manufacturing overhead cost per unit Mathematical $125,000 60,000 70,000 $255,000 ÷ 50,000 $ 5.10 Financial $250,000 60,000 35,000 $345,000 ÷100,000 $ 3.45 2. Mathematical Financial Manufacturing cost per unit: Direct materials $150,000 ÷ 50,000 $300,000 ÷ 100,000 Direct manufacturing labor $50,000 ÷ 50,000 $100,000 ÷ 100,000 Manufacturing overhead (from requirement 1) Manufacturing cost per unit $3.00 $3.00 1.00 5.10 $9.10 1.00 3.45 $7.45 5-32 (30 min.) Plantwide versus department overhead cost rates. 1. Molding Manufacturing department overhead Service departments: Power Maintenance Total budgeted plantwide overhead $21,000 Amounts (in thousands) Component Assembly $16,200 $22,600 Budgeted direct manufacturing labor-hours (DMLH): Molding Component Assembly Total budgeted DMLH Plantwide overhead rate = = 2. Total $59,800 18,400 4,000 $82,200 500 2,000 1,500 4,000 Budgeted plantwide overheard Budgeted DMLH $82,200 = $20.55 per DMLH 4,000 The department overhead cost rates are shown in Solution Exhibit 5-32 3. MumsDay Corporation should use department rates to allocate plant overhead because: (1) the cost drivers of resources used in each department differ and (2) the departments do not use resources from the support departments in the same proportion. Hence, department rates better capture cause-and-effect relationships at MumsDay than does a plantwide rate. 4. MumsDay should further subdivide the department cost pools into activity-cost pools if (a) significant costs are incurred on different activities within the department, (b) the different activities have different cost drivers, and (c) different products use different activities in different proportions. Budgeted Rate (Budgeted overhead ÷ Alloc. Base) 2 (b) Allocation Base Total budgeted overhead of manufacturing departments 2 (a) Departmental overhead costs Allocation of maintenance costs (direct method) $4,000 × 90/125, 25/125, 10/125 Allocation of power costs $18,400 × 360/800, 320/800, 120/800 2,760 SOLUTIO EXHIBIT 5-32 $ 0 (18,400) $18,400 $ 0 2,880 (4,000) $36.75/MH 875 MH $32,160 8,280 $21,000 $4,000 1,500 DMLH $25,680 7,360 320 $22,600 Assembly $12.18/DMLH $17.12/DMLH 2,000 DMLH $24,360 800 $16,200 Departments (in thousands) Service Manufacturing Power Maintenance Molding Component