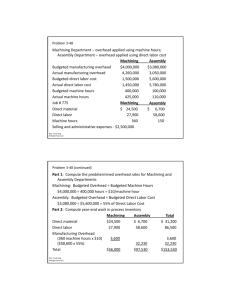

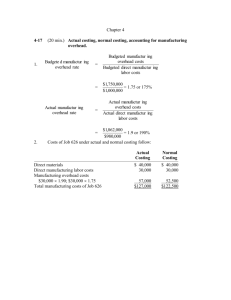

4.17 Revisited Budgeted manufacturing overhead rate: Budg. Manuf

advertisement

4.17 Revisited Budgeted manufacturing overhead rate: Budg. Manuf. overhead costs/Budg. Direct manuf. labor = 1,750,000/1,000,000 = 1.75 1.75 => each dollar of direct manuf. labor causes 1.75 $ overhead costs Actual amount of direct manuf labor costs: 980,000 $ => What does that mean? => Will the budgeted overhead costs be achieved given the assumption, that each dollar of direct manuf. labor causes 1.75 $ overhead costs? => No! But that does not mean that the assumption in the budget has to be wrong. => overhead costs should equal (given the assumption in the budget holds): 980,000 * 1.75 = 1,715,000 $ => actual costs are 1,862,000 $, 147,000 $ more than should have occurred. What could have happened? => Example: The firm produces machine parts. During the production process the workers drill holes in blank parts. The drilling tools get hot while drilling and have to be cooled by a special fluid. The cooling fluid partly vaporizes during the cooling process. Cooling fluid cannot be traced to specific products in an economical feasible way => overhead costs. Situation 1: You identify a higher than normal use of cooling fluid to be the cause of the increased overhead costs. After questioning the workers you come to the conclusion that the supplier of cooling fluid has delivered a poor quality product. You renegotiate with the supplier and he offers a lower price for the fluid in the future. => the higher consumption in connection with the lower price leads to budgeted costs in the future. => Is it a good idea to use actual costs in this situation? No, one time effect. Situation 2: You identify that the consumption of cooling fluid was like budgeted but the price has increased. Since it’s an oil based product you expect prices to stay high for the next periods. => Since the change in the economic environment is persistent, it’s required to adjust your budgeted rates using for example the actual rates. => Cost variances require a closer look at their reasons. One can’t apply something like a general rule.