Chapter 11 - Flexible Budgeting and Analysis of Overhead Costs

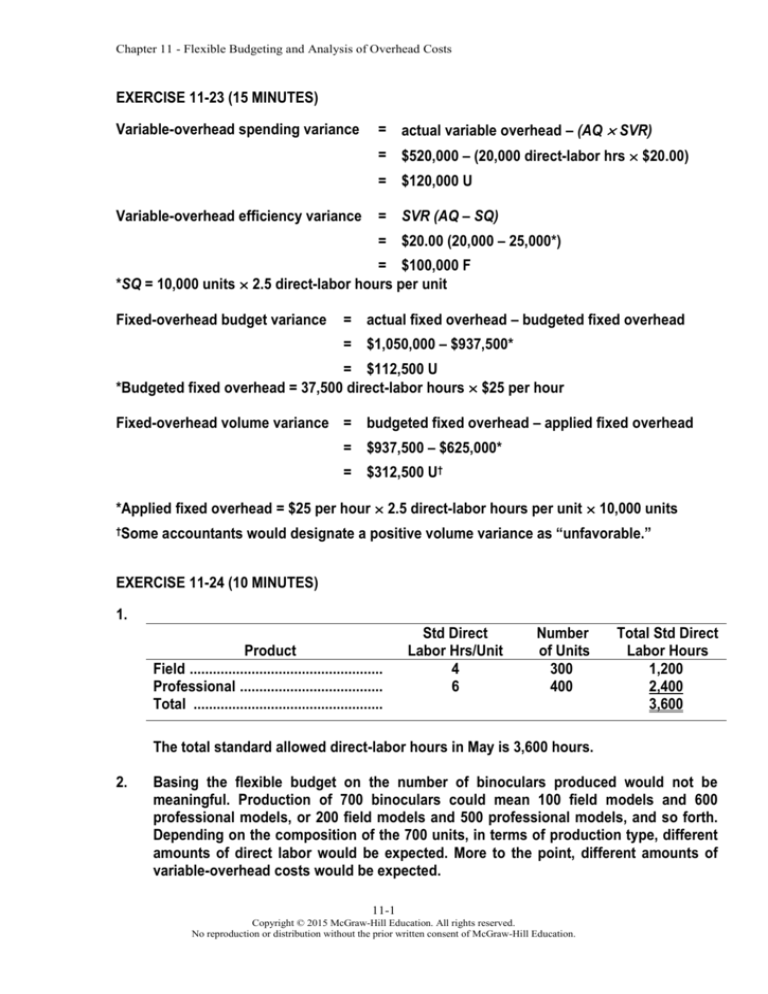

EXERCISE 11-23 (15 MINUTES)

Variable-overhead spending variance

= actual variable overhead – (AQ SVR)

= $520,000 – (20,000 direct-labor hrs $20.00)

= $120,000 U

Variable-overhead efficiency variance = SVR (AQ – SQ)

= $20.00 (20,000 – 25,000*)

= $100,000 F

*SQ = 10,000 units 2.5 direct-labor hours per unit

Fixed-overhead budget variance

= actual fixed overhead – budgeted fixed overhead

= $1,050,000 – $937,500*

= $112,500 U

*Budgeted fixed overhead = 37,500 direct-labor hours $25 per hour

Fixed-overhead volume variance = budgeted fixed overhead – applied fixed overhead

= $937,500 – $625,000*

= $312,500 U†

*Applied fixed overhead = $25 per hour 2.5 direct-labor hours per unit 10,000 units

†Some

accountants would designate a positive volume variance as “unfavorable.”

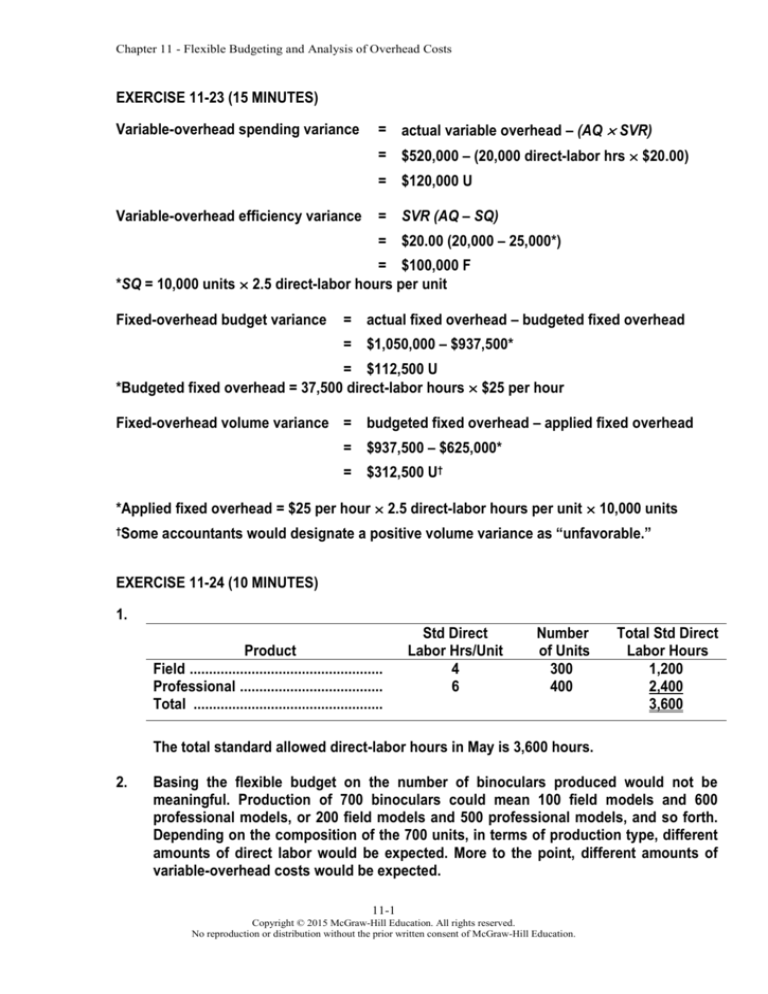

EXERCISE 11-24 (10 MINUTES)

1.

Product

Field ..................................................

Professional .....................................

Total .................................................

Std Direct

Labor Hrs/Unit

4

6

Number

of Units

300

400

Total Std Direct

Labor Hours

1,200

2,400

3,600

The total standard allowed direct-labor hours in May is 3,600 hours.

2.

Basing the flexible budget on the number of binoculars produced would not be

meaningful. Production of 700 binoculars could mean 100 field models and 600

professional models, or 200 field models and 500 professional models, and so forth.

Depending on the composition of the 700 units, in terms of production type, different

amounts of direct labor would be expected. More to the point, different amounts of

variable-overhead costs would be expected.

11-1

Copyright © 2015 McGraw-Hill Education. All rights reserved.

No reproduction or distribution without the prior written consent of McGraw-Hill Education.

Chapter 11 - Flexible Budgeting and Analysis of Overhead Costs

EXERCISE 11-25 (20 MINUTES)

1.

Variable-overhead spending variance

= actual variable overhead – (AQ SVR)

= $120,000 – (5,000 $20.00)

2.

= $20,000 U

Variable-overhead efficiency variance = SVR(AQ – SQ)

= $20.00(5,000 – 4,000*)

3.

= $20,000 U

*SQ = 4,000 direct-labor hrs. = 2,000 units 2 direct-labor hrs. per unit

Fixed-overhead budget variance = actual fixed overhead – budgeted fixed overhead

= $28,500 – $30,000

4.

Fixed-overhead volume variance

= $1,500 F

= budgeted fixed overhead – applied fixed overhead

= $30,000 – $24,000†

†Applied

fixed overhead

=

=

= $6,000 U**

predetermined fixed standard allowed

overheadrate direct labor hours

$30,000

(2,000 2)

2,500 2

= $24,000

** Some accountants would designate a positive volume variance as "unfavorable."

EXERCISE 11-31 (45 MINUTES)

Budgeted fixed overhead .........................................................................................

$ 25,000

Actual fixed overhead ..............................................................................................

$ 32,500a

Budgeted production in units ..................................................................................

12,500

Actual production in units ......................................................................................

12,000c

Standard machine hours per unit of output ...........................................................

4 hours

Standard variable-overhead rate per machine hour ..............................................

$8.00

Actual variable-overhead rate per machine hour ...................................................

$9.00b

Actual machine hours per unit of output ................................................................

3d

Variable-overhead spending variance ....................................................................

$ 36,000 U

Variable-overhead efficiency variance ....................................................................

$ 96,000 F

Fixed-overhead budget variance .............................................................................

$ 7,500 U

Fixed-overhead volume variance ............................................................................

$ 1,000g U*

Total actual overhead ...............................................................................................

$356,500

Total budgeted overhead (flexible budget) .............................................................

$409,000e

Total budgeted overhead (static budget) ................................................................

$425,000f

Total applied overhead .............................................................................................

$408,000

11-2

Copyright © 2015 McGraw-Hill Education. All rights reserved.

No reproduction or distribution without the prior written consent of McGraw-Hill Education.

Chapter 11 - Flexible Budgeting and Analysis of Overhead Costs

*Some accountants would designate a positive fixed-overhead volume variance as

unfavorable.

Explanatory Notes:

a.

Fixed-overhead budget variance = actual fixed overhead – budgeted fixed overhead

$7,500 U = X – $25,000

X = $32,500 = actual fixed overhead

b.

Total actual overhead = actual variable overhead + actual fixed overhead

$356,500 = X + $32,500

X = $324,000 = actual variable overhead

Variable-overhead spending variance

= actual variable overhead – (AQ SVR)

$36,000 U = $324,000 – (AQ $8)

$8AQ = $288,000

AQ = 36,000

Actual variable-overhead

rate per machine hour

=

actual variable overhead

actual machine hours

$324,000

$9 per machine hour

36,000

budgeted fixed overhead

budgetedmachine hours

=

c.

Fixed-overhead rate

=

=

$25,000

(12,500 units)(4 hrs. per unit)

= $.50 per machine hr.

Total standard

overhead rate = standard variable overhead rate + fixed-overhead rate

$8.50 = $8.00 + $.50

Total applied

overhead

= total std machine hours total std overhead rate

$408,000 = X $8.50

X = 48,000 = total standard machine hrs.

Actual production =

=

total standardmachine hrs.

standardmachine hrs. per unit

48,000

12,000 units

4

11-3

Copyright © 2015 McGraw-Hill Education. All rights reserved.

No reproduction or distribution without the prior written consent of McGraw-Hill Education.

Chapter 11 - Flexible Budgeting and Analysis of Overhead Costs

d.

Actual machine hrs. per

unit of output

=

total actual machine hrs.

actual production

36,000 machine hrs.

3 machine hrs. per unit

12,000 units

Total budgeted overhead (flexible budget)

=

e.

= budgeted fixed overhead + (SVR SQ)

= $25,000 + ($8.00 12,000 units 4 machine hrs. per unit)

= $409,000

f.

Total budgeted overhead (static budget)

=

total standard budgeted standardmachine hrs.

per unit

overheadrate production

= ($8.50)(12,500)(4)

= $425,000

g.

Fixed overhead volume variance

= budgeted fixed overhead – applied fixed overhead

= $25,000 – ($.50)(12,000 4)

= $1,000 U*

* Some accountants would designate a positive volume variance as "unfavorable."

EXERCISE 11-32 (15 MINUTES)

1.

Formula flexible budget:

Total budgeted monthly electricity cost = (€25 euros* number of patient days)

+ €40,000 euros

*€25 per patient day = 50 kwh per patient day €.50 per kwh

2.

Columnar flexible budget:

10,000

€ 250,000

40,000

€ 290,000

Variable electricity cost ............

Fixed electricity cost.................

Total electricity cost .................

Patient Days

20,000

€ 500,000

40,000

€ 540,000

11-4

Copyright © 2015 McGraw-Hill Education. All rights reserved.

No reproduction or distribution without the prior written consent of McGraw-Hill Education.

30,000

€ 750,000

40,000

€ 790,000

Chapter 11 - Flexible Budgeting and Analysis of Overhead Costs

PROBLEM 11-38 (20 MINUTES)

1.

Policy

Type

Standard

Clerical Hours

per Application

Actual

Activity

1

1.5

2

2

5

375

300

150

600

300

Automobile .......................................

Renter's ............................................

Homeowner's ...................................

Health ................................................

Life ....................................................

Total ..................................................

Standard

Clerical Hours

Allowed

375

450

300

1,200

1,500

3,825

2.

The different types of applications require different amounts of clerical time, and variable

overhead cost is related to the use of clerical time. Therefore, basing the flexible budget on

the number of applications would give a misleading estimate of overhead costs. For

example, processing 100 life insurance applications will entail much more overhead cost

than processing 100 automobile insurance applications.

3.

Formula flexible budget:

total

budgeted variable

Total budgeted

overhead

cost

per

clerical

+

monthly overhead =

cost

hours

clerical hour

Total budgeted monthly overhead cost = ($5.00 X) + $3,000

where X denotes total clerical time in hours.

4.

Budgeted overhead cost for May

= ($5.00 3,825) + $3,000

= $22,125

PROBLEM 11-39 (25 MINUTES)

1.

Let X = budgeted fixed overhead

X ÷ 2,000 machine hours = $20.00 per hour

X = $40,000

2.

Variable-overhead spending variance:

Actual machine hours x actual rate

2,200 hours x $11.50*…………………... $ 25,300

11-5

Copyright © 2015 McGraw-Hill Education. All rights reserved.

No reproduction or distribution without the prior written consent of McGraw-Hill Education.

budgeted fixedoverhead cost

per month

Chapter 11 - Flexible Budgeting and Analysis of Overhead Costs

Actual machine hours x standard rate

2,200 hours x $12.00…………………….

26,400

Variable-overhead spending variance…... $ 1,100 Favorable

* $25,300 ÷ 2,200 hours

3.

Fixed-overhead volume variance:

Budgeted fixed overhead………………………………

Standard machine hours allowed x standard rate

750 hours* x $20.00………………………………

Fixed-overhead volume variance……………………

$ 40,000

15,000

$ 25,000 U†

* 1,500 units x .5 machine hours per unit

†The

fixed-overhead volume variance is positive;

some managerial accountants would interpret it as

an unfavorable variance.

4.

Lackawanna Licorice Company spent more than anticipated. Actual fixed

overhead amounted to $50,500 ($75,800 - $25,300) when the budget was

set at $40,000. The fixed-overhead budget variance is $10,500 unfavorable

($50,500 - $40,000).

5.

Variable overhead is underapplied by $16,300:

Actual overhead: Actual machine hours x actual rate

2,200 hours x $11.50………………………………………….. $ 25,300

Applied overhead: Standard machine hours allowed x

standard rate

750 hours x $12.00…………………………………………….

9,000

Underapplied variable overhead………………………………... $ 16,300

6.

Without having complete information, it is difficult to be 100% certain.

However, by an analysis of data related to the volume variance, a lengthy

strike appears to be a strong possibility. Lackawanna had planned to

work 2,000 machine hours during the period, giving the company the

capability of producing 4,000 finished units (2,000 hours x 2 units per

hour). Actual production amounted to only 1,500 units, leaving the firm far

shy of its production goal. A strike is a plausible explanation.

11-6

Copyright © 2015 McGraw-Hill Education. All rights reserved.

No reproduction or distribution without the prior written consent of McGraw-Hill Education.