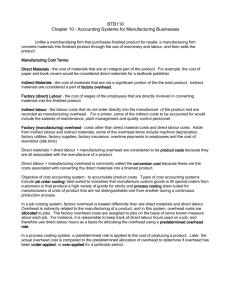

BASIC CONCEPT OF COST ACCOUNTING:

advertisement

Cost Accounting

nd

(2

session)

Prof. Amit De

BASIC CONCEPT

OF

COST ACCOUNTING:

Cost Accounting

Cost Accounting and Financial

Accounting

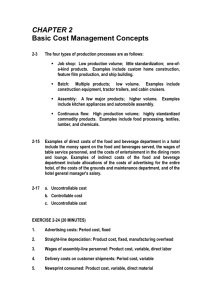

DIFFERENT TYPES OF COST

Direct cost

Prime cost

Indirect cost

Fixed cost/Fixed overhead/Period

cost

Variable cost

MATERIAL COSTING

STOCK LEVELS

► Maximum stock level.

Maximum level = Recording level + Recording quantity –

Min. consumption

= Recording level + Reordering quantity – { Min.

consumption per period x Min. Recording period }

► Minimum stock level.

Minimum Level = Reordering level – { Normal usage per

period x Average delivery time }

► Re-order level.

Re-order Level = maximum consumption during the period

x Maximum period required for delivery.

► Danger level.

ECONOMIC ORDER

QUANTITY. EOQ

Determination of EOQ by algebraic formula

EOQ =

2 x Annual consumption x Cost of

placing an order

Cost of carrying one unit inventory

for one year

LABOUR COSTING

Methods of Remuneration

Time Rate System

Payment by Result

A. PIECE-RATE SCHEMES

Straight piece work system.

Wages = Number of units produced x

piece rate per unit

Differential Piece Work System.

Taylor Differential rate System

80% of piece rate when below standard.

125% of piece rate when at or above standard.

MERRICK DIFFERENTIAL OR

MULTIPLE PIECE RATE SYSTEM

■ Up to 83-1/3%

Normal piece rate

applicable

■ Above 83-1/3%

10% above

normal rate

of efficiency

but up to 100%

■ Above 100%

20% above

normal rate

PREMIUM BONUS PLANS

Halsey Plan.

Formula for Halsey Premium Plan under 50%

Sharing Scheme

Actual hrs. worked x Rate per hr. + 50/100

(Standard hrs. – Actual hrs.) x Rate per hour.

Rowan Plan.

Group Bonus System.

ELEMENTS OF OVERHEAD.

Indirect material cost.

Indirect labour cost.

Indirect services cost.

MANUFACTURING

OVERHEAD

Allocation.

Apportionment.

Primary distribution of overhead.

SECONDARY DISTRIBUTION

►

Methods of Redistribution.

1. Direct Redistribution Method.

2. Step Method.

3.

Reciprocal Service Method.

4. Trial and Error Method.

5. Repeated Distribution Method.

6. Simultaneous Equation Method.

OVERHEAD ABSORPTION

Overhead rate for the period

=

Amount of overhead for the period

Total number of units of base for the period

METHODS OF ABSORPTION

1. Production Unit Method.

2. Percentage on Direct Wages.

3. Percentage on Direct Material Cost.

4. Percentage of Prime Cost.

5. Direct Labour Hour Method.

6. Machine Hour Rate.