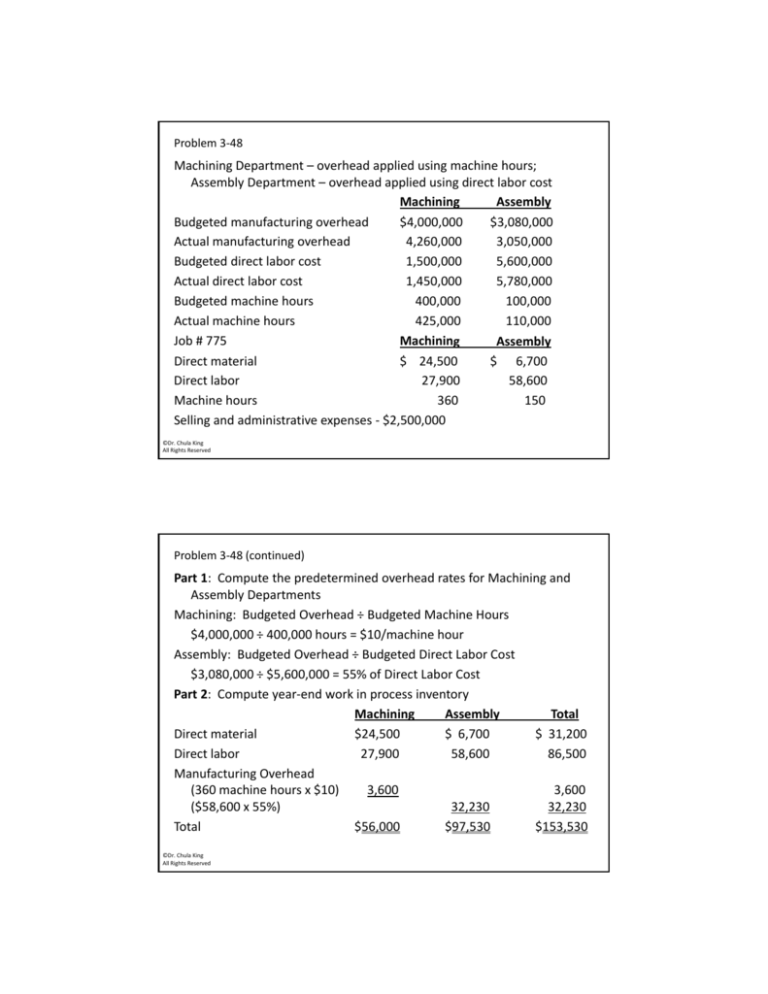

Problem 3‐48

Machining Department – overhead applied using machine hours; Assembly Department – overhead applied using direct labor cost

Machining

Assembly

Budgeted manufacturing overhead

$4,000,000

$3,080,000

Actual manufacturing overhead

4,260,000

3,050,000

Budgeted direct labor cost

1,500,000

5,600,000

Actual direct labor cost

1,450,000

5,780,000

Budgeted machine hours

400,000

100,000

Actual machine hours

425,000

110,000

Job # 775

Machiningg

Assemblyy

Direct material

$ 24,500

$ 6,700

Direct labor

27,900

58,600

Machine hours

360

150

Selling and administrative expenses ‐ $2,500,000

©Dr. Chula King

All Rights Reserved

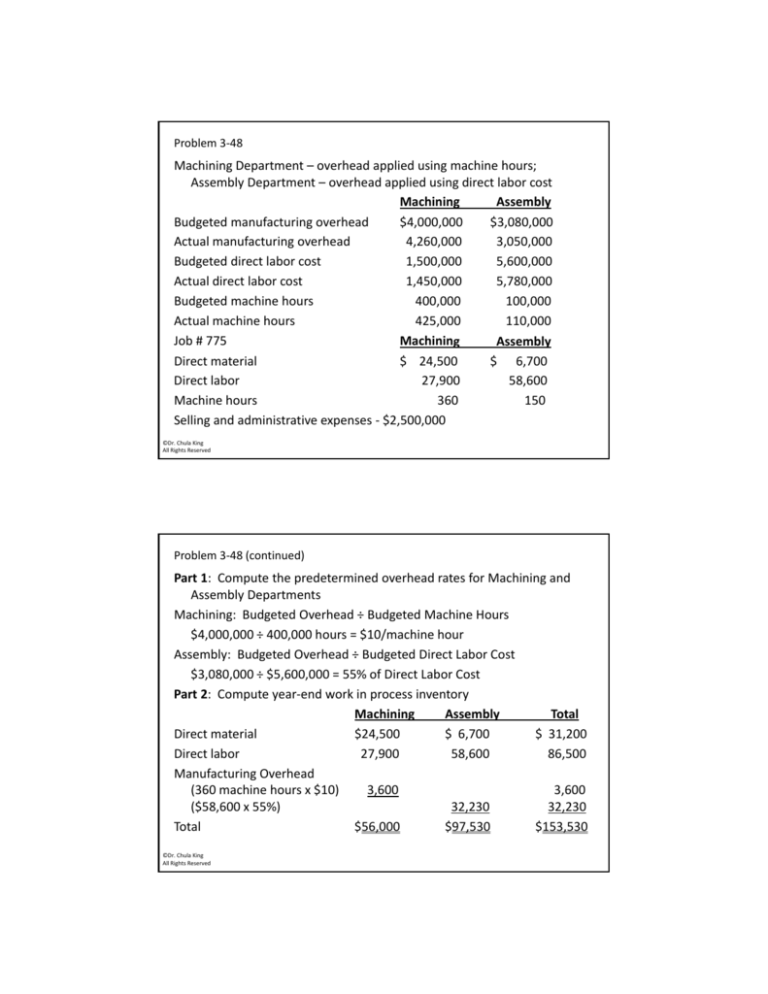

Problem 3‐48 (continued)

Part 1: Compute the predetermined overhead rates for Machining and Assembly Departments

Machining: Budgeted Overhead ÷ Budgeted Machine Hours

$4,000,000 ÷ 400,000 hours = $10/machine hour

Assembly: Budgeted Overhead ÷ Budgeted Direct Labor Cost

$3,080,000 ÷ $5,600,000 = 55% of Direct Labor Cost

Part 2: Compute year‐end work in process inventory

Machining

Assembly

Total

Direct material

$24,500

$ 6,700

$ 31,200

Direct labor

27,900

,

58,600

,

86,500

,

Manufacturing Overhead

3,600

(360 machine hours x $10)

3,600

32,230

($58,600 x 55%)

32,230

Total

$56,000

$97,530

$153,530

©Dr. Chula King

All Rights Reserved

Problem 3‐48 (continued)

Part 3: Is overhead overapplied or underapplied in the Machining Department?

Applied manufacturing overhead (425,000 hours x $10) $4,250,000

Actual manufacturing overhead

4,260,000

Underapplied manufacturing overhead

$ 10,000

Part 4: Is overhead overapplied or underapplied in the Assembly Department?

Applied manufacturing overhead ($5,780,000 x 55%)

$3,179,000

Actual manufacturing overhead

3,050,000

Overapplied manufacturing overhead

$ 129,000

©Dr. Chula King

All Rights Reserved

Problem 3‐48 (continued)

Part 5: What happens to Cost of Goods Sold if the overapplied/ underapplied overhead is closed to that account?

The net overapplied overhead is $119,000 ($129,000 ‐ $10,000), which would be a credit balance. The entry to close the overapplied

overhead to Cost of Goods Sold is:

overhead to Cost of Goods Sold is:

Manufacturing overhead

119,000

Cost of Goods Sold

119,000

Therefore, Cost of Goods Sold would be decreased

Part 6: How much overhead was charged to Work in Process?

Work in process is charged for the applied overhead of $7,429,000 ($4,250,000 + $3,179,000)

Part 7: Comment on the appropriateness of the company’ss cost drivers

Part 7: Comment on the appropriateness of the company

cost drivers

Machining Department is heavily automated. Its cost driver is machine hours which should be strongly correlated to the amount of overhead incurred. The Assembly Department performs a number of manual‐

assembly activities. The cost driver, direct labor cost should be highly correlated to the amount of overhead incurred.

©Dr. Chula King

All Rights Reserved