23.Schulz Corporation applies overhead based upon machine

advertisement

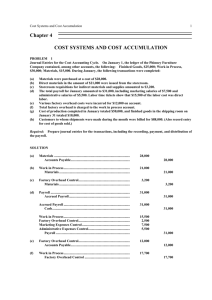

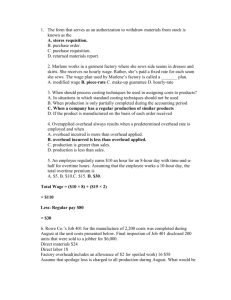

23.Schulz Corporation applies overhead based upon machine-hours. Budgeted factory overhead was $266,400 and budgeted machine-hours were 18,500. Actual factory overhead was $287,920 and actual machine-hours were 19,050. Before disposition of under/overapplied overhead, the cost of goods sold was $560,000 and ending inventories were as follows: Direct materials$ 60,000 WIP190,000 Finished goods 250,000 Total$500,000 Required: a.Determine the budgeted factory overhead rate per machine-hour. 266400/18500 = $14.40 per machine hour b.Compute the over/underapplied overhead. 19050*14.4 = 274320-287920 = $13600 under applied c.Prepare the journal entry to dispose of the variance using the write-off to cost of goods sold approach. Accounts Debit Cost of goods Sold 13600 Factory overhead under applied or FOH control account Credit 13600 d.Prepare the journal entry to dispose of the variance using the proration approach. Accounts Cost of goods Sold WIP Debit 7616 2584 Finished goods`` 3400 Factory overhead under applied or FOH control account Credit 13600 29.Four Seasons Company makes snow blowers. Materials are added at the beginning of the process and conversion costs are uniformly incurred. At the beginning of September, work in process is 40% complete and at the end of the month it is 60% complete. Other data for the month include: Beginning work-in-process inventory 1,600 units Units started2,000 units Units placed in finished goods3,200 units Conversion costs$200,000 Cost of direct materials$260,000 Beginning work-in-process costs: Materials$154,000 Conversion$ 82,080 Required: a.Prepare journal entries to record transferring of materials to processing and from processing to finished goods assuming the weighted-average method. Accounts WIP Debit 260000 Material Inventory Finished Goods Credit 260000 630400 WIP 630400 D.M 260000+154000/3600 = 115 CC 200000+82080/3440 = 82 Total cost to complete =197 3200*197 = 630400 30. Pet Products Company uses an automated process to manufacture its pet replica products. For June, the company had the following activities: Beginning work in process inventory 4,500 items,1/4 complete Units placed in production15,000 units Units completed17,500 units Ending work in process inventory 2,000 items, 3/4 complete Cost of beginning work in process$5,250 Direct material costs, current$16,500 Conversion costs, current$23,945 Direct materials are placed into production at the beginning of the process and conversion costs are incurred evenly throughout the process. Required: a. Compute the equivalent units for materials and conversion costs. Materials = 17500-4500 +2000 = 15000 Conversion = 17500-4500+4500*3/4 +2000 *3/4 = 17875 Current unit cost 16500/15000 = 1.1 23945/17875 = 1.35 b.Compute the dollar value of the ending inventory. Material = 2000 x 1.1 =2200 CC = 1500 *1.35 = 2025 Total inventory value = 4225 39. Bagley Company has two service departments and two producing departments. Square footage of space occupied by each department follows: Custodial services1,000 ft General administration3,000 ft Producing department A8,000 ft Producing department B8,000 ft 20,000 ft The department costs of Custodial Services are allocated on a basis of square footage of space. If Custodial Services costs are budgeted at $38,000, the amount of cost allocated to General Administration under the direct method would be? Nil as no service department cost is allocated to another service department under this method. Answer the following questions 40-41 using the information below: The RAH Manufacturing Company has two service departments: Maintenance and Accounting. The Maintenance Department's costs of $300,000 are allocated on the basis of machine hours. The Accounting Department's costs of $120,000 are allocated on the basis of the number of employees within a specific department. The direct departmental costs for A and B are $300,000 and $500,000, respectively. MaintAcctgAB Machine hours Number of employees 480 2 202,`300 2 8 200 4 40. What is the Maintenance Department's cost allocated to Department B using the step method and assuming the Maintenance Department's costs are allocated first? 200/702 x 300000 =85470 41. What is the cost of the Accounting Department's cost allocated to Department A using the step method and assuming the Maintenance Department's costs are allocated first? Cost of maintenance to accounting = 202/702 * 300000 = 86325 Total accounting cost -= 120000+86325 = 206325 To department A = 8/12 *206325 = 137550