Chapter21

•Credit and Inventory

Management

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

Chapter 21 – Index of Sample

Problems

•

•

•

•

•

•

•

•

•

•

Slide # 02 - 03

Slide # 04 - 06

Slide # 07 - 09

Slide # 10 - 11

Slide # 12 - 13

Slide # 14 - 15

Slide # 16 - 21

Slide # 22 - 25

Slide # 26 - 27

Slide # 28 - 30

Accounts receivable

Discount terms

Credit policy switch

Switch break-even point

One-time sale

Repeat sale

Economic order quantity (EOQ)

One-shot approach

Accounts receivable approach

Discounts and default risk

2: Accounts receivable

Over the past five years, your firm has had average daily sales of

$26,780. The average collection period is 34 days.

What is the average accounts receivable balance you would expect

to find if you analyzed the monthly balance sheets of your firm?

3: Accounts receivable

Averageaccountsreceivable Averagedaily sales Averagecollectionperiod

$26,780 34

$910,520

4: Discount terms

Today, June 10, you purchased $5,000 worth of materials from one

of your suppliers. The terms of the sale are 3/15, net 45.

What is the discounted price?

By what day do you have to pay to receive the discount?

What is the effective annual rate of the discount?

5: Discount terms

Discountedprice $5,000 (1- .03)

$5,000 .97

$4,850

Final day for discount June 10 15 days June 25

6: Discount terms

Daysin period 45 - 15 30

Periods per year

365

12.1667

30

.03 $5,000

Interestratefor 30 days

(1- .03) $5,000

$150

$4,850

.03093

Effectiveannualrate (1 .03093)12.1667 1

.44862

44.86%

7: Credit policy switch

Currently, your firm has a cash only policy. Under this policy, your

monthly sales are 70 units at a selling price of $50 a unit. The variable cost

is $34 a unit. You are trying to decide if you want to change your credit

policy to net 30. You estimate that if you switch your credit policy that

your monthly sales will increase to 90 units. The applicable monthly

interest rate is .5%.

What is the incremental cash inflow from the proposed switch in your

credit policy?

What is the net present value of the proposed switch?

8: Credit policy switch

Incrementa

l cash inflow (P - v)(Q'-Q)

($50 $34)(90 70)

$16 20

$320

9: Credit policy switch

(P v)(Q'Q)

NP V [(P Q v(Q'Q)]

R

($50 $34) (90 70)

[($50 70) $34 (90 70)]

.005

$320

[$3500 $680]

.005

$4,180 $64,000

$59,820

10: Switch break-even point

Your brother owns a company that also has a cash only credit

policy. He, too, is considering switching to a net 30 credit

policy. His current sales per month are 85 units at an average

selling price of $60 a unit. His variable cost is $42 a unit. His

applicable monthly interest rate is 1.5%.

Your brother wants to know how many additional units he

would have to sell to break-even on this proposed credit

policy switch. What should you tell him?

11: Switch break-even point

Pv

Q'Q P Q

v

R

$60 $42

Q'85 ($60 85)

$42

.015

Q'85 $5,100 ($1,200 $42)

Q'85 $5,100 $1,158

Q'85 4.404

12: One-time sale

A customer just walked into your store and wants to buy some

electronics costing $89. The customer states that he is from out of

town and is just passing through on an extended vacation. Thus,

you know that this is a one-time sale. Your variable cost for this

merchandise is $50 and your relevant interest rate is 1.5% per

month. Since this customer had not planned on making this

purchase, he does not have sufficient funds with him to pay for it

and thus asks for credit for one month until he arrives back home.

Should you grant credit to this customer if you feel there is a 30%

chance that he will default?

13: One-time sale

P

NPV v (1 )

1 R

$50 (1 .30) $89

1 .015

$50 (.7 $87.68)

$50 $61.38

$11.38

14: Repeat sale

A new customer just walked into your store. She says that she is

new to the area and is out checking out the various retail stores to

decide where she will shop in the future. She’s looking at some

merchandise costing $250 but states that she won’t have that

much money until next month. You know that your variable cost in

the item is $180 and that your monthly interest rate is 1.7%.

Should you offer her credit for one month if you feel that the

chance of default is 10%?

15: Repeat sale

Pv

NP V v (1 )

R

$250 $180

$180 (1 .10)

.017

$180 (.90 $4,117.647)

$180 $3,705.88

$3,525.88

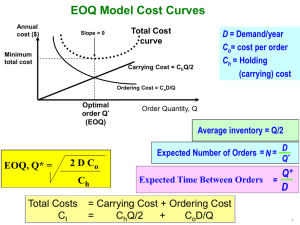

16: Economic Order Quantity (EOQ)

You have just accepted a job as the purchasing manager for a local

retailer. You have identified one key item that you believe needs

close monitoring. You’ve been told that your store sells 31,200

units of this item each year. The fixed costs per order are $75. The

carrying cost per unit is $1.10.

What is the economic order quantity?

17: Economic Order Quantity (EOQ)

EOQ

2T F

CC

2 31,200 $75

$1.10

$4,680,000

$1.10

4,254,545.46

2,062.65 unit s

18: Economic Order Quantity (EOQ)

You sell 12,000 units of a product each year at an average price of

$15 each. Your variable cost per unit is $9. Your carrying cost per

unit is $.60. You allow your inventory of this product to drop to

zero before restocking. Each order you place is for 2,500 units. The

fixed cost per order is $40.

What is your annual total carrying cost?

What is your annual total restocking cost?

What is the EOQ?

19: Economic Order Quantity (EOQ)

T otalcarryingcost Averageinventory Carryingcost per unit

2,500 0

$.60

2

1,250 $.60

$750

12,000

$40

2,500

4.8 $40

$192.00

T otalrestockingcost

20: Economic Order Quantity (EOQ)

EOQ

2T F

CC

2 12,000 $40

$.60

$960,000

$.60

1,600,000

1,264.91

21: Economic Order Quantity (EOQ)

T ot alcarryingcost Averageinvent ory Carryingcost per unit

1,264.91 0

$.60

2

632.455 $.60

$379.47

12,000

$40

1,264.91

9.48684 $40

$379.47

T otalrestockingcost

22: One-shot approach

Your firm currently sells 200 units each month at a price of $24

each. The variable cost per unit is $14 and the monthly interest

rate is 1.5%. If you switch your credit policy from cash only to net

30, you think you can increase your sales to 215 units a month.

Use the one-shot approach to compute the NPV of the switch.

23: One-shot approach

Current net income (P - v) Q

($24- $14) 200

$2,000

24: One-shot approach

Proposed income P Q'

$24 215

$5,160

Proposedcost v Q'

$14 215

$3,010

$5,160

P roposedNP V - $3,010

1 .015

$3,010 $5,083.74

$2,073.74

25: One-shot approach

Mont hlygain fromswit ch $2,073.74- $2,000

$73.74

NPV of switch $73.74 $73.74

.015

$4,989.74

$4,990

26: Accounts receivable approach

Your firm currently sells 200 units each month at a price of $24

each. The variable cost per unit is $14 and the monthly interest

rate is 1.5%. If you switch your credit policy from cash only to net

30, you think you can increase your sales to 215 units a month.

Use the accounts receivables approach to compute the NPV of the

switch.

27: Accounts receivable approach

(P v)(Q'Q) {[ P Q v(Q'Q)] R}

R

[($24 $14) (215 200)] {[($24 200) $14 (215 200)] .015}

.015

[$1015] {[$4,800 $210] .015}

.015

$150 $75.15

.015

$74.85

.015

$4,990

PV

28: Discounts and default risk

Currently, you sell 50 units per period at $22.50 a unit. You are

considering implementing a net 30 credit policy along with

increasing your credit price to $24. If you make this change, you

expect that your sales will remain at their current level. You also

expect all of your customers to take advantage of the credit period

and that 2% of them will default. The applicable monthly interest

rate is 1.5%.

What is the net present value of this proposed credit policy?

What is the break-even default rate?

29: Discounts and default risk

P' P

P'

$24.00 $22.50

$24.00

.0625

6.25%

d

d

NP V P Q P' Q

R

($22.50 50) ($24 50)

$1,125 $3,400

$2,275

.0625 .02

.015

30: Discounts and default risk

d R (1 d )

.0625 .015 (1 .0625)

.0625 .0141

.0484

4.84%

Chapter21

•End of Chapter 21

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.