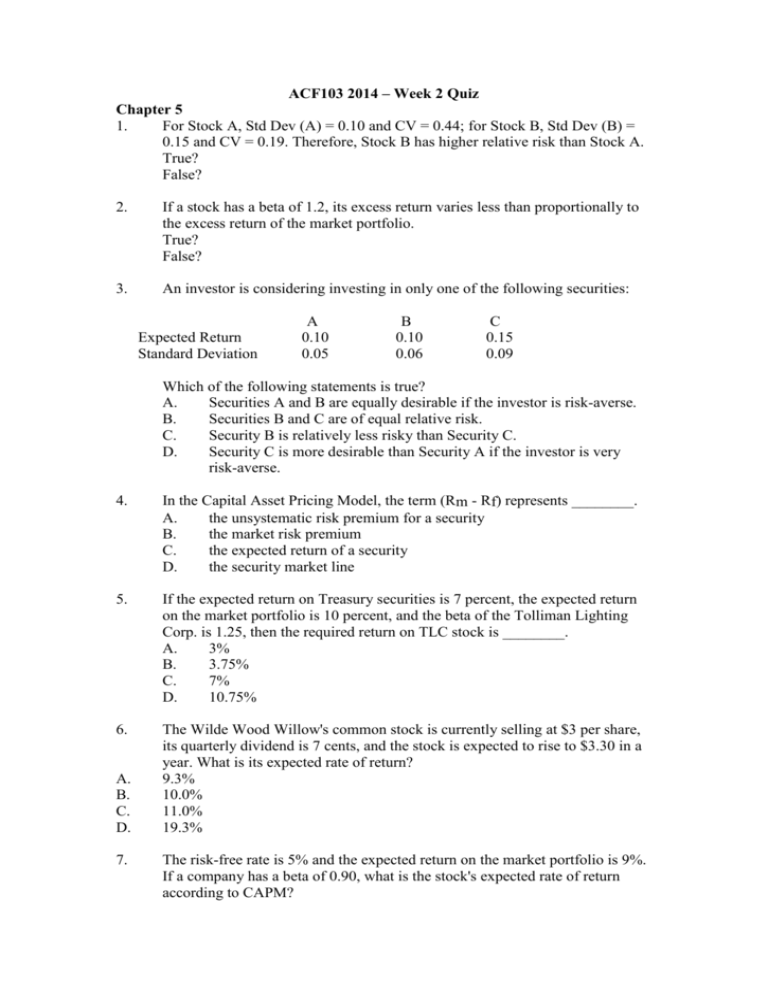

ACF103 2014 – Week 2 Quiz

advertisement

ACF103 2014 – Week 2 Quiz Chapter 5 1. For Stock A, Std Dev (A) = 0.10 and CV = 0.44; for Stock B, Std Dev (B) = 0.15 and CV = 0.19. Therefore, Stock B has higher relative risk than Stock A. True? False? 2. If a stock has a beta of 1.2, its excess return varies less than proportionally to the excess return of the market portfolio. True? False? 3. An investor is considering investing in only one of the following securities: Expected Return Standard Deviation A 0.10 0.05 B 0.10 0.06 C 0.15 0.09 Which of the following statements is true? A. Securities A and B are equally desirable if the investor is risk-averse. B. Securities B and C are of equal relative risk. C. Security B is relatively less risky than Security C. D. Security C is more desirable than Security A if the investor is very risk-averse. 4. In the Capital Asset Pricing Model, the term (Rm - Rf) represents ________. A. the unsystematic risk premium for a security B. the market risk premium C. the expected return of a security D. the security market line 5. If the expected return on Treasury securities is 7 percent, the expected return on the market portfolio is 10 percent, and the beta of the Tolliman Lighting Corp. is 1.25, then the required return on TLC stock is ________. A. 3% B. 3.75% C. 7% D. 10.75% 6. The Wilde Wood Willow's common stock is currently selling at $3 per share, its quarterly dividend is 7 cents, and the stock is expected to rise to $3.30 in a year. What is its expected rate of return? 9.3% 10.0% 11.0% 19.3% A. B. C. D. 7. The risk-free rate is 5% and the expected return on the market portfolio is 9%. If a company has a beta of 0.90, what is the stock's expected rate of return according to CAPM? 8. At present, the risk-free rate is 5% and the expected return on the market portfolio is 11%. The expected returns for four stocks are given below. On the basis of these expectations, which stock(s) is(are) overvalued and which undervalued? Why? __________________________________________________________________ Stock Expected Return Expected Beta __________________________________________________________________ 1. Dong Peng .200 1.2 2. Hua Wei .125 1.4 3. Bei Nan .100 0.8 4. Dong Xi .116 1.1 Chapter 8 1. Which of the following statements is true? A. Liquid assets yield a return higher than the return on other assets. B. A greater margin of safety would be provided by having more current liabilities and fewer current assets. C. Over an extended period of time, interest on long-term debt costs more than interest on short-term debt for the same amount of money borrowed. D. For current assets, the higher the proportion of liquid assets to total assets, the greater the return on investment. 2. Financial data for three firms is presented below. Each differs only with respect to philosophy on an aggressive vs. a conservative approach to current asset management. FIRM A Sales $2,000,000 EBIT 200,000 Current Assets 600,000 Fixed Assets 500,000 Total Assets 1,100,000 FIRM B $2,000,000 200,000 500,000 500,000 1,000,000 FIRM C $2,000,000 200,000 400,000 500,000 900,000 The firm with the most aggressive philosophy has an asset turnover of ________. A. 1.82:1 B. 2.22:1 C. 3.33:1 D. 5.00:1 3. A firm adopting a conservative financing policy ________. A. would have higher financial risk than if it adopted an aggressive financing policy B. would be more profitable than a firm adopting an aggressive financing policy C. may have to pay interest on debt at times when the funds are not needed D. would have to be a public utility Chapter 9 1. The two most likely motives in explaining why firms hold cash are the ________. A. transactions motive and the speculative motive B. speculative motive and the precautionary motive C. transactions motive and the precautionary motive D. precautionary motive and the managerial entrenchment motive 2. A good cash management system involves properly managing ________. A. collections, disbursements, cash balances, and marketable securities investment B. only collections and disbursements C. only collections, disbursements, and cash balances D. collections, disbursements, cash balances, and capital investment 3. Wisconsin Cheesecurd Brewery has a weekly payroll of $250,000 and paychecks are issued every Friday. On the average, Cheesecurd's employees cash their checks according to the following pattern: Day Checks Clear Payroll Account Friday Monday Tuesday Wednesday Percent of Checks Cleared 20 30 40 10 Assuming the company maintains a minimum balance in the account so as not to break any banking laws, how much should be in the payroll account on Tuesday morning? A. $250,000 B. $1125,000 C. $100,000 D. $0 4. Goodmonth Enterprises expects credit sales of $800 million next year. If the firm can invest funds at the rate of 8% a year, what is the value of collecting payment one day earlier (use a 365-day year)? Chapter 10 1. The expression 2/10, net 45 means that customers receive a 10 percent discount if they pay within 2 days; otherwise they must pay in full in 45 days. True? False? 2. An important part of the decision regarding a firm's credit and collection policies is the impact of alternative policies on the level of accounts receivable. True? False? 3. The economic order quantity (EOQ) is the lot size which minimizes total carrying costs. True? False? 4. The Florenza Furniture Company has credit sales of $600,000 and an average collection period of 45 days. The firm's level of accounts receivable (using a 360 day year) is ________. A. $50,000 B. $60,000 C. $75,000 D. $90,000 5. Mary's Auto Parts has annual credit sales of $6 million. Mary is considering offering a cash discount of 2% for payment within 10 days. If 60% of her customers (in dollar volume) take advantage of the discount, the cost of the discount would be ________. A. $120,000 B. $72,000 C. $60,000 D. $12,000 6. An increase in the firm's receivable turnover ratio means that ________. A. it is collecting credit sales more quickly than before B. cash sales have decreased C. it has initiated more liberal credit terms with no increase in sales D. inventories have increased 7. The ABC Company wishes to establish an EOQ for a particular item. The annual usage is 12,000 units, order costs are $20, and the annual carrying cost is $0.48 per unit. The EOQ equals ________. (EOQ = √2(O)(S)/C ) A. 10 units B. 100 units C. 1,000 units D. 10,000 units Chapter 11 1. The largest single source of short-term financing for businesses collectively is ________. A. bank loans B. commercial paper C. trade credit D. trade acceptances 2. If credit terms are 3/10, net 45, what is the approximate cost of foregoing the cash discount and paying on the final due date? (Use a 365-day year and round to nearest percent.) A. 3% B. 13% C. 25% D. 32% 3. What is the approximate cost of not taking the cash discount and paying on the final due date if credit terms are 1/10, net 30? (Use a 365-day year and round to the nearest percent.) A. 10% B. 18% C. 22% D. 30% 4. Suppose a firm has a bimonthly payroll of $250,000 with an average amount of accrued wages of $125,000. If the firm were to increase its pay period from bimonthly to monthly, accrued wages would amount to ________. A. $500,000 B. $375,000 C. $250,000 D. $125,000 5. Suppose a firm establishes a $4 million revolving line of credit with its bank. As part of its agreement, the firm will pay a commitment fee of 0.5% on the unused portion of the line. If the average borrowing is $3 million over the year, the commitment fee will be ________. A. $5,000 B. $10,000 C. $15,000 D. $50,000 6. When a firm factors its accounts receivable ________. A. collection costs increase B. it sells receivables to a financial institution C. it uses receivables as collateral against borrowing D. it gives up the ability to borrow from banks