Lot sizing in MRP systems

Lot sizing in MRP systems

• Lot for lot (also l-f-l or L4L) policy is the most basic approach for planned order releases. However it is most of the time impractical and uneconomical.

• Fixed batch size policy is more reasonable if the setup times are considerably long.

• EOQ policy is fine when demand is almost constant.

However when demand pattern is dynamic it becomes unlikely to have close-to-optimal solutions with the EOQ approach. As an example, consider the following:

– Recalling the net requirements of subassembly D in the previous example: 0 in week 1, 10 in w2, 480 in w3, 440 in w4, 800 in w5,

400 in w6, and 0 in weeks 7 and 8. Let the setup and holding costs be: A=$400, h=$0.5.

– Average demand for the planning horizon is:

• D = (0+10+480+440+800+400+0+0)/8 ~= 266 items per week.

– So EOQ value becomes:

• EOQ = sqrt(2*A*D/h) ~= 652 and the new schedule of order releases will become:

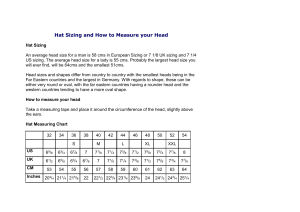

Week

Subassembly D requirements (1 week lead time)

1

Gross requirements

Projected inventory balance 110

2

110

3

120

642

4

480

162

5

440

374

10 480 440 Net requirements

Planned receipts (EOQ)

Planned order release (EOQ) 652

652

652

652

652

6

800

226

800

652

652

7

400

478

400

652

478

8

Alternative lot sizing techniques

• Heuristics for dynamic lot sizing:

– Silver-Meal heuristic (S-M).

– Least unit cost heuristic (LUC).

– Part period balancing (PPB).

• Optimal lot sizing: The Wagner-Whitin (W-W) algorithm:

– Dynamic programming approach.

– Assume no capacity restrictions.

– The algorithm owes its efficiency to a peculiarity which is known as the Wagner-Whitin property.

– Wagner-Whitin property says that there is an optimal solution for the dynamic lot sizing problem in which for each period k either the beginning inventory or the production quantity is zero. The property states that at least one optimal solution will satisfy this condition: (More formally I k-1

*Q k

= 0 for all k = 1,2, … n .)

– We will search through all solutions which satisfy this condition, because it restricts the solution set to enable efficient computation.

– W-W property guarantees that the optimal solution which we are going to find for the restricted problem is also optimal for the unrestricted problem. We can restate the property alternatively as:

– Wagner-Whitin property (identical restatement): An optimal lotsizing policy has the property that each value of Q is exactly the sum of a set of future demands.

• W-W algorithm:

– We start from the final period, and by definition f n+ 1

= 0.

Iteratively we compute: f k

= min j>k

( c kj

+ f j

) for k = 1 , … n. “c kj

” is defined to be the cost of producing in period k sufficient to fulfill the accumulated demand in periods k through j -1.

– When f

1 is determined the algorithm is terminated. f

1 optimal value of the dynamic lot-sizing problem. The yields the corresponding solution of Q

1

, Q

2

, … Q n production schedule.

gives us the optimal

Wagner-Whitin example

• Fixed setup cost, A is $50 and holding cost, h is $0.5. For convenience variable unit production cost is ignored (assumed to be unchanging throughout the planning horizon.

Period, k 1

Predicted demand, D 100

Setup cost, A

Holding cost, h

50

0.5

W-W example

2

100

50

0.5

3

50

50

0.5

4

50

50

0.5

5

210

50

0.5

1 c_k,j values k

1

4

5

2

3 j 2

50

3

100

50

4

150

75

50

5

225

125

75

50

6

645

440

285

155

50

Wagner-Whitin solution

• f

6

= 0.

• f

5

= min ( c

56

+ f

6

) = 50 + 0 = 50.

• f

4

= min ( c

45

+ f

5

, c

46

+ f

6

) = min ( 50 + 50 , 155 + 0 ) = 100.

• f

3

= min (

0) = 125.

c

34

+ f

4

, c

35

+ f

5

, c

36

+ f

6

) = min ( 50 + 100 , 75 + 50 , 285 +

• f

2

= min ( c

23

+ f

3

, c

24

+ f

4

, c

25

+ f

100 , 125 + 50 , 440 + 0 ) = 175.

5

, c

26

+ f

6

) = min ( 50 + 125 , 75 +

• f

1

= min ( c

12

+ f

2

, c

13

+ f

3

, c

14

+ f

4

, c

15

+ f

5

, c

16

+ f

6

100 + 125 , 150 + 100 , 225 + 50 , 645 + 0 ) = 225.

) = min ( 50 + 175 ,

• Optimal solution has a cost of $225.

• So W-W algorithm gives alternative optimal solutions of this dynamic lot sizing problem (2 examples with cost $225 listed below):

– Q = (100, 100, 100, 0, 210)

– Q = (200, 0, 100, 0, 210)

Lot-sizing Heuristics

• Silver-Meal heuristic (consider the same example):

– K ( m ) = (A + hD

2

+ 2hD

3

+ 3hD

4

+ … + ( m -1)hD m

)/m

– And we stop accumulating demand when K ( m +1) > K ( m ).

– So,

• m =1 K (1) = 50.

• m =2 K (2) = (50 + (0.5)100) / 2 = 50, continue.

• m =3 K (3) = (50 + (0.5)100 + (2)(0.5)50) / 3 = 50, continue.

• m =4 K (4) = (50 + (0.5)100 + (2)(0.5)50 + (3)(0.5)50) / 4 = 56.25 so stop!

Q

1

= 100+100+50 = 250.

• Continue from the 4 th month, m =1 K (1) = 50.

• m =2 K (2) = (50 + (0.5) 210) / 2 = 72.5 so stop! Q

4

= 50.

• Continue from the 5 th month, m =1 K (1) = 50, but we are already at the final month, so we conclude that Q

5

= 210.

• Hence S-M solution is: Q = (250, 0, 0, 50, 210) and it costs us 50 + 50

+ 50 + (0.5)100 + (2)(0.5)50 = $250. This solution is not optimal!

• Least Unit Cost heuristic

– K’ ( m ) = (A + hD

2

+ 2hD

3

+ 3hD

4

+ … + ( m -1)hD m

)/(D

1

+ ... +D m

)

– And we stop accumulating demand when K’ ( m +1) > K’ ( m ).

– So,

• m =1 K’ (1) = 50/100 = 0.5.

• m =2 K’ (2) = (50 + (0.5)100) / (100+100) = 0.5, continue.

• m =3 K’ (3) = (50 + (0.5)100 + (2)(0.5)50) / (100+100+50) = 0.6 so stop!

Q

1

= 100 + 100 = 200.

• Continue from the 3 rd month, m =1 K’ (1) = 50/50 = 1.

• m =2 K’ (2) = (50 + (0.5)50) / (50+50) = 0.75, continue.

• m =3 K’ (3) = (50 + (0.5)50 + (2)(0.5)210) / (50+50+210) = 0.92 so stop!

Q

3

= 50 + 50 + 210 = 310.

• We stop since all demand is met. So LUC solution is: Q = (200, 0,

310, 0, 0) and it costs us 50 + 50 + (0.5)100 + (0.5)50 + (2)(0.5)210

= $385. This solution is not optimal!

• Part Period Balancing

– PP m

= 0 + D

2

+ 2D

3

+ 3D

4

+ … + ( m -1)D m

– We stop accumulating when PP m exceeds A/h. We should choose the m value which gives the closest PP m value to A/h.

– So, A/h = 50 / 0.5 = 100 and:

– PP

1

= 0.

– PP

2

= 0 + 100 = 100, continue.

– PP

3

= 0 + 100 + (2)(50) = 200, stop!

Q

1

= 100 + 100 = 200.

– Continue from the 3 rd month, PP

1

= 0.

– PP

2

= 0 + 50 = 50, continue.

– PP

3

= 0 + 50 + (2)(210) = 470, stop!

Q

3

= 50 + 50 = 100.

– Since month 5 is the ending period we conclude that Q

5

= 210.

– So the PPB solution is: Q = (200, 0, 100, 0, 210) and the cost of this solution is 50 + 50 + 50 + (0.5)(100) + (0.5)(50) = $225.

This solution is optimal (compare with W-W solution).