Reporting and Interpreting Sales Revenue

advertisement

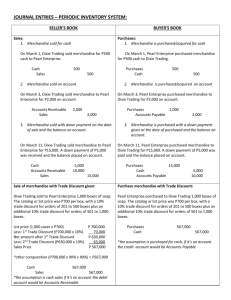

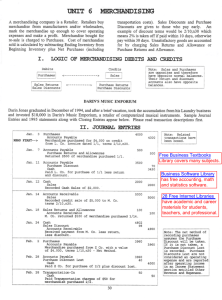

Reporting and Interpreting Sales Revenue, Receivables, and Cash Chapter 6 McGraw-Hill/Irwin © 2009 The McGraw-Hill Companies, Inc. Accounting for Sales Revenue The revenue principle requires that revenues be recorded when earned: Goods or services have been delivered. Amount of customer payments known. Collection is reasonably assured. When to record a sale? When title transfers (risks of ownership). Look to the shipping terms FOB (Free on board) destination – Title transfers when goods reach final destination. Seller pays shipping to the final destination. FOB (Free on board) shipping point Title transfers when goods reach the shipping point (loading dock) Buyer usually pays for shipping to final destination. Recording a Sale Sale for Cash (never a problem) Cash Sales $XXX $XXX Sale on account (focus on these issues) Accounts Receivable Sales $XXX $XXX Credit Card Sales Companies accept credit cards for several reasons: 1. To increase sales. 2. To avoid providing credit directly to customers. 3. To avoid losses due to bad checks. 4. To avoid losses due to fraudulent credit card sales. 5. To receive payment quicker. When credit card sales are made, the company must pay the credit card company a fee for the service it provides. Recording a Credit Card Sale ABC Company sells $1,000 of merchandise to a customer who pays with a Visa credit card. Visa charges a 2% credit card fee. Account Debit Cash $980 Credit Card Discount Sales Credit $20 $1,000 Sales Discounts When customers purchase on open account, they may be offered a sales discount to encourage early payment. 2/10, n/30 Discount Percentage # of Days in Discount Period Otherwise, the Full Amount Is Due Read as: “Two ten, net thirty” Maximum Days in Credit Period Recording a Sales Discount ABC Company sells $10,000 of products to ZYX Company. ABC offers ZYX a sales discount 2/15, net 30. Account Debit Accounts Receivable $10,000 Sales Credit $10,000 ZYX pays ABC in full in 12 days. Account Debit Cash $9,800 Sales Discounts Accounts Receivable Credit $200 $10,000 Sales Returns and Allowances Debited for damaged merchandise. Debited for returned merchandise. Contra revenue account. Recording Sales Returns & Allowances ABC sells $5,000 of merchandise to MNO Company on account. Account Debit Accounts Receivable $5,000 Sales Credit $5,000 MNO returns $1,000 of merchandise that was not of sufficient quality. Account Debit Sales Returns $1,000 Accounts Receivable Credit $1,000 Recording Sales Returns & Allowances MNO contacts ABC over certain merchandise that was sent of a different color than was ordered. NMO asks for and is granted an allowance of $250. Account Debit Sales Returns and Allowances $250 Accounts Receivable Credit $250 MNO pays the remainder of the amount owed to ABC (no discount). Account Cash Accounts Receivable $3,750 $3,750 Recording Sales Returns & Allowances What if ABC had granted MNO a discount of 4/10, net 30 for paying early. What entry is made if MNO pays what they owe ABC within the discount period? Accounts Debit Cash $3,600 Sales Discounts Accounts Receivable Credit $150 $3,750 Reporting Net Sales Companies record credit card discounts, sales discounts, and sales returns and allowances separately to allow management to monitor these transactions. Sales revenue Less: Credit card discounts Sales discounts Sales returns and allowances Net sales Do E6-3 Issues with the Other Side of the Transaction Accounts Receivable Measuring and Reporting Receivables When companies allow customers to purchase merchandise on an open account, the customer promises to pay the company in the future for the purchase. Accounts Receivable Trade receivables are amounts owed to the business for credit sales of goods, or services. Nontrade receivables are amounts owed to the business for other than business transactions.