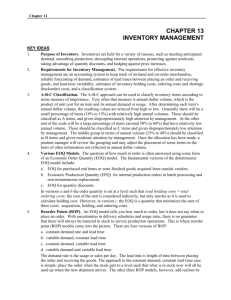

Inventory Management Models

advertisement

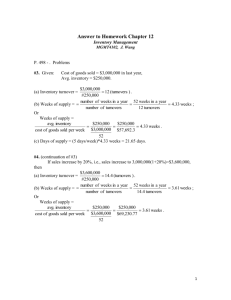

Inventory Management Models Single-Period Model (the newsboy model) Co = cost/unit for overestimating demand Cu = cost/unit for underestimating demand P = the probability that the unit will be sold P < Cu/(Co+Cu) Example: Your group wants to sell bags of popcorn at the homecoming football game. Data from the last 10 homecoming games reveals that sales have averaged 300 bags of popcorn with a standard deviation of 20 bags. The popcorn is bought from a local vendor who does not accept returns of unsold popcorn. Your cost is $0.55/ bag and you sell the popcorn for $1.00/bag. How many bags should your group buy to sell at the game? Co = $0.55 Cu = $0.45 P = $0.45/($0.55+$0.45) = 0.45 The 0.45 translates to the service level! Therefore, look up 0.45 in the body of a cumulative standard normal table to find the appropriate Z vale. Of course, since P<0.50, the Z value will be a negative number! Z = -1.26 Therefore, you would order 300 + (-1.26) x 20 = 274.8 => 274. Multi-Period Models Basic EOQ Assumptions: 1. Demand is uniform and known (d, D) 2. The item cost is fixed (P) 3. The order cost is fixed (S) 4. The holding cost is fixed (H, kP) 5. The lead time is constant (L) 6. Orders are received in completed form (no split shipments) 1 Two Basic Inventory Management Decisions: 1. How much should be ordered each time an order is placed (Q) 2. When should an order be placed (ROP) Simple EOQ Model: Q* = √(2DS)/H or Q* = √(2DS)/(kP) TC* = (D/Q*)S + (Q*/2)H or TC* = (D/Q*)S + (Q*/2)kP ROP = dL where d = D/T (T is the number of days or weeks open for business depending on the time unit for lead time) Simple EOQ Model with Safety Stock: If we relax assumptions 1 and/or 5, then we need to add a safety stock (SS) component to the ROP: ROP = dL + Z√Lσd2 + d2σL2 where Z√Lσd2 + d2σL2 = SS and Z represents the service level TC* = (D/Q*)S + (Q*/2)H + SS x H or TC* = (D/Q*)S + (Q*/2)kP + SS x kP Example: A product has a daily demand of 50 units on average with a standard deviation of 12 units. The lead time averages 3 days with a standard deviation of 1 day. Ordering cost is $100, holding cost is $2/unit/year, and the business is open 250 days/year. If we desire a 95% service level, then how much should we order each time we place an order and when should those orders be placed? Q* = √[2(50x250)100]/2 = 1,118 ROP = (50)(3) + 1.65√(3)(12)2 + (50)2(1)2 = 240 Production Run Model: If we go back to the original set of assumptions and then relax only assumption 6, then we need to compensate for split deliveries: Q* = √(2DS)/(H)(1-(D/R)) or Q* = √(2DS)/(kP)(1-(D/R)) or Q* = √(2DS)/(H)(1-(d/r)) or Q* = √(2DS)/(kP)(1-(d/r)) where R is the annual production rate, r = R/T, and R>D. TC = (D/Q*)S + (Q*/2)(H)(1-(d/r)) or TC = (D/Q*)S + (Q*/2)(kP)(1-(d/r)) (Note: The ratios D/R and d/r are identical!) 2 Example: A firm assembles 500 units of a product each day in the final assembly department. In one of the fabrication departments, a component used in the product can be produced at a rate of 750/day. Annual demand for the product is 125,000 units, the setup cost is $400, and the holding cost is $10/unit/year. How many units of the component should the final assembly department order each time it places an order? Q* = √(2x125,000x$400)/[$10(1-500/750)] = 5,477.23 => 5,477 TC = (125,000/5,477)$400 + [(5,477(1-500/750))/2]$10 = $9,129.09 + $9,128.33 Quantity Discount Models: If we go back to the original set of assumptions and then relax only assumption 2, then we need to compensate for price differences. To make the compensation, we use an algorithm that allows us to make price comparisons using the steps listed below: 1. Find the feasible EOQ and calculate it’s total cost where TC = (D/Q*)S + (Q*/2)H + PD or TC = (D/Q*)S + (Q*/2)kP + PD where k = percent holding cost. 2. If the feasible EOQ is associated with the lowest cost curve, then you are finished! If not, go to step 3. 3. Calculate total costs for each price break. 4. Choose the order quantity associated with the lowest total cost. Case I: Constant Holding Cost Q* = √(2DS)/H For Case I, there is only one EOQ calculation since Q* is not a function of price. This satisfies step 1 of the algorithm. Case II: Variable Holding Cost Q* = √(2DS)/(kP) For Case II, begin calculating Q* using the lowest value for P and continue to work up the price schedule until a feasible value for Q* is found. This satisfies step 1 of the algorithm. Example (Case I versus Case II): The following price schedule is in effect. Holding costs are (I) $5/unit/year or (II) 30% of the purchase price, order cost is $200, and annual demand is estimated to be 10,000 units. For each case, what is the least expense order plan? 3 Quantity Price/Unit 1-499 $10.00 500-799 $ 9.80 800-999 $ 9.75 1000 or more $ 9.65 Periodic Order Quantity Model: We now move away from the simple EOQ model and consider the situation where we are constrained in delivery schedule by a vendor or some other force. Instead of using a reorder point, we periodically count inventory and then determine how much we have to order to replenish our stock. The periods are fixed. Q* = d(L+RP) + Zσd√L+RP – I Where RP (Reorder Period) = the number of days, weeks, etc. between deliveries and I = the current inventory level Example: A grocery store that is open 6 days a week receives deliveries every 3 days from one of it’s suppliers. A particular product has a daily demand of 150 units with a standard deviation of 20 units. The lead time is fixed at 2 days. Currently there are 400 units of this product on the shelf and it’s time to call in an order. The grocery store likes to maintain a 95% service level for this item. How much should be ordered? P = 3 L = 2 I = 400 Z = 1.65 Q = 150(2+3) + 1.65(20)√2+3 - 400 = 750 + 74 – 400 = 424 4 Z Tables 5 6