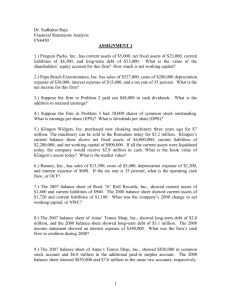

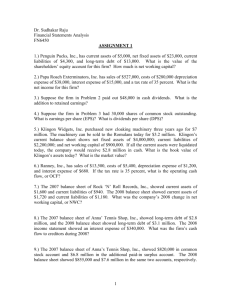

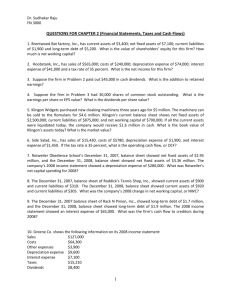

Financial Accounting Problems and Solutions

advertisement

Please SHOW WORK*** 1. Penguin Puck's, Inc has a current assets of $5100, net fixed assets of $23,800, current liabilities of $43,000, and long-term debt of $7,400. What is the value of the shareholders' equity account for this firm? How much is the net working capital? 5100+23800-43000-7400 = -21500, it is the shareholders equity and the net worth of the company. 2. Klingon Widgets, Inc., purchased new cloaking machinery three years ago for $7 million. The machinery can be sold to the Romulans today for $4.9 million. Klingon's current balance sheet shows net fixed assets of $3.7 million, current liabilities of $1.1 million, and net working capital of $380,000. If all the current assets were liquidated today, the company would receive $1.6 million cash. What is the book value of Klingon's assets today? What is the market value? Book Value = 3.7+.38 = $4.08 million Market value = 4.9+1.6-1.1 = $5.4 million 3. Earnhardt Driving School's 2008 balance sheet showed net fixed assets of $3.4 million, and the 2009 balance sheet showed net fixed assets of $4.2 million. The company's 2009 income statement showed a depreciation expense of $385,000. What was the net capital spending for 2009? 4.2-3.4+.385 = $1.185 million 4. Given the information for Martha's Tennis Shop, Inc. (2008 balance sheet: 2.6 million of long-term debt 2009 balance sheet: 2.9 million of long-term debt 2008 balance sheet: $740,000 in common stock and $5.2 million in the additional paid-in surplus account 2009 balance sheet: $815,000 and $5.5 million in the same two accounts) suppose that you also know that the firm's net capital spending for 2009 was $949,000 and that the firm reduced its networking capital investment by $85,000. What was the firm's 2009 operating cash flow or OCF? Cash provided from operating cash flow = $85000 5. Dahlia Industries had the following operating results for 2009: sales = $22,800; cost of goods sold = $16,050; depreciation expense = $4,050; interest expense = $1,830; dividends paid = $1,300. At the beginning of the year, net fixed assets were $13,650, current assets were $4,800, and current liabilities were $2,700. At the end of the year, net fixed assets were $16,800, current assets were $5,930, and current liabilities were $3,150. The tax rate for 2009 was 34 percent a. Net income for 2009 is $. 22800-16050-4050-1830 =$870 profit before tax – tax 295.8 = $574.2 net income b. The operating cash flow for 2009 is $. Net income 574.2 Add depreciation 4050 Less increase in current assets -1130 Add increase in current assets +450 Operating cash flow 3944.2 c. The cash flow from assets for 2009 is $. Is this possible? . It is not cash flow from assets but it is cash flow from investing activities for change in value of fixed assets, which is as follows +16800-13650+4050 =$7200 The cash used for investing activities d. If no new debt was issued during the year, the cash flow to creditors is $ and the cash flow to stockholders is $. The change in current liabilities belong to creditors and it has increased it measn that creditor account has been increased by 450 (3150-2700) To shareholders equity , the dividend paid =$1300 Detail Required: HIGH