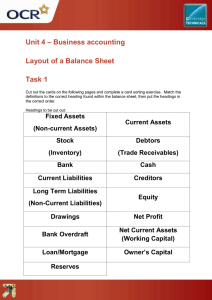

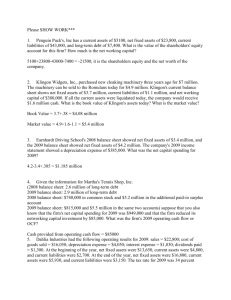

MAIN ISSUES OF ACCOUNTING AND FINANCIAL STATEMENTS Accounting shows a financial picture of the firm. In general accounting means keeping financial records, recording income and expenditure, valuing assets and liabilities, and so on. An accounting department records and measures the activity of business. It reports on the effects of the transactions on the firm's financial condition. Accounting records give a very important data. It's used by management, stockholders, creditors, independent analysts, banks and government. There are several types of accounting. Managerial A. implies preparing budgets and other financial reports necessary for management. Tax A. is calculating an individual's or a company's liability for tax. Cost A. means working out the unit cost of products, including materials, labour and all other expenses. There is also a special type of A. - 'creative A.', which means using all available accounting procedures and trick to disguise the true financial position of a company. Creative A. is divided into 'Chinese A.', 'window dressing' and 'cook the books'. Probably there are two major questions that the managers or owners of the business want to know: first, whether or not the business is operating at a profit, second, they will want to know whether or not the business will be able to meet its commitments as they fall due; and so not have to close down owing to lack of funds. Both of these questions should be answered by the use of the accounting data of the firm. The most common accounting which records assets at their original purchase price minus accumulated depreciation charges. In times of inflation, this underestimates the value of appreciating assets such as land, but overstates profits as it doesn't record the replacement cost of plant or inventory. The value of a business's assets under historical cost A. - purchase price minus depreciation is known as net book value. Countries with persistently high inflation often prefer to use current cost or replacement cost A., which values assets (and related expenses like depreciation) at a price that would have to be paid to replace them today. Company law specifies that shareholders must be given certain financial information. Companies generally include three financial statements in their annual report. The profit and loss account or income statement shows revenue and expenditure. It usually gives figures for total sales or turnover and costs and overheads. The first figure should obviously be higher than the second - there should be a profit. Part of the profit goes to the government in taxation. Part is usually distributed to shareholders as a dividend and part is retained by the company. The balance sheet shows the company's financial situation on a particular date, generally the last day of the financial year. It lists the company's assets, its liabilities and shareholders' funds. Business's assets include debtors as it is assumed that these will be paid. There are several tapes of assets. Current assets include 1.cash in the bank; 2.securities: investments in other companies; 3.stocks or raw materials, unfinished goods and finished goods, that are going to be sold; 2. Debtors, money owed to the company by the customers. Fixed or tangible assets are equipment, machinery, buildings, land. And intangible assets : things which you cannot see - goodwill, company brands. Liabilities include creditors, as these will have to be paid. These are debts to suppliers, lenders, the tax authorities. Debts that have to be paid within a year are current liabilities, and those payable in more than a year are long-term liabilities, for example bank loans. In accordance with principle of double-entry bookkeeping (that all transactions are entered as a credit it one account and as a debit in another), the basic accounting equation is Assets=Liabilities + Owners' Equity or Net Assets. This includes share capital (money received from issue of shares), share premium or paid-in surplus(any money realized by selling shares at above nominal their value) and the company's reserves including the year's retained profits. Financial statement has various names including source and application of funds statement, and cashflow statement. It shows the flow of cash in and out of the business between balance sheet dates. Sources of funds include trading profits, depreciation provisions, sales of assets, borrowing, and the issuing of shares. Applications of funds include purchases of fixed or financial assets, payment of dividends, repayment of loans, and - in a bad year- trading losses. Also there is the Statement of owner's equity which represents a summary of the changes in the owner's equity during a specific time period, such as a month or a year - dynamics. 1 accounting – бухгалтерский учет profit – прибыль assets – активы financial statement – финансовый отчет loss - убыток 2 Plan What is accounting? Accounting shows a financial picture of the firm. In general accounting means keeping financial records, recording income and expenditure, valuing assets and liabilities, and so on Types of accounting There are several types of accounting. Managerial A. implies preparing budgets and other financial reports necessary for management. Balance sheet The balance sheet shows the company's financial situation on a particular date, generally the last day of the financial year. It lists the company's assets, its liabilities and shareholders' funds. What obligations include Liabilities include creditors, as these will have to be paid. These are debts to suppliers, lenders, the tax authorities. Debts that have to be paid within a year are current liabilities, and those payable in more than a year are long-term liabilities, for example bank loans. Financial statements Financial statement has various names including source and application of funds statement, and cashflow statement. It shows the flow of cash in and out of the business between balance sheet dates. Sources of funds include trading profits, depreciation provisions, sales of assets, borrowing, and the issuing of shares. 3 Accounting is an orderly system of collecting, registering and summarizing information in monetary terms about the state of the property, obligations and capital of the organization and their changes through a continuous, continuous and documented reflection of all business operations. Accounting is necessary to collect information about the business, about income and losses, the information is used to prevent losses of the company