Chapter 2: Introduction to Financial Statement Analysis

advertisement

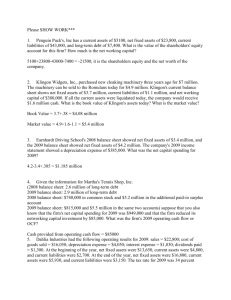

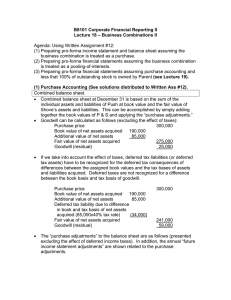

Chapter 2: Introduction to Financial Statement Analysis-1 Chapter 2: Introduction to Financial Statement Analysis Ratios to add or define: Total Debt Total Assets - as with the debt-equity ratio, the book value version of this ratio is not especially useful compared to the market value ratio Debt - Asset Rate Current Ratio Quick Ratio Current Assets Current Liabilities Current Assets Except Inventory Current Liabilities Interest Coverage Ratio Earnings Before Interest and Taxes Interest Expense Note: operating income or EBITDA is often used instead of EBIT Return on Assets Net Income Book Value of Assets The following are the comments and views of Dr. Rich: p. 22: Depreciation: Depreciation spreads the cost of long-term assets over some measure of the asset’s life on a dollar for dollar basis (and thus violates the time value of money). The book value of a long-term asset equals the remaining difference between what was spent to acquire the asset and what has been recognized as an expense through depreciation. p. 23: Goodwill: In June 2001, the FASB changed the guidelines so that firms are no longer required to amortize goodwill. Instead, goodwill is written down if worth less than shown on balance sheet. This write-down is called impairment. p. 24: Deferred taxes: Deferred taxes store the difference between IRS taxes and GAAP taxes. Since IRS taxes are what are owed but GAAP taxes are what are recognized (for statements), the balance sheet won’t balance without adding deferred taxes to the balance sheet. p. 26: Footnote 3 is important: - market value of debt generally not very different from book value of debt. - distinction between the market and book value of debt often ignored in practice. p. 29: Accounts Receivables Days: Number of days to collect receivables on average. Notes, additions, and corrections