1 Dr. Sudhakar Raju Financial Statements Analysis

advertisement

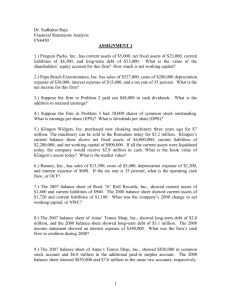

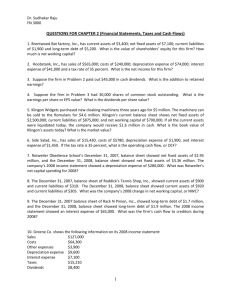

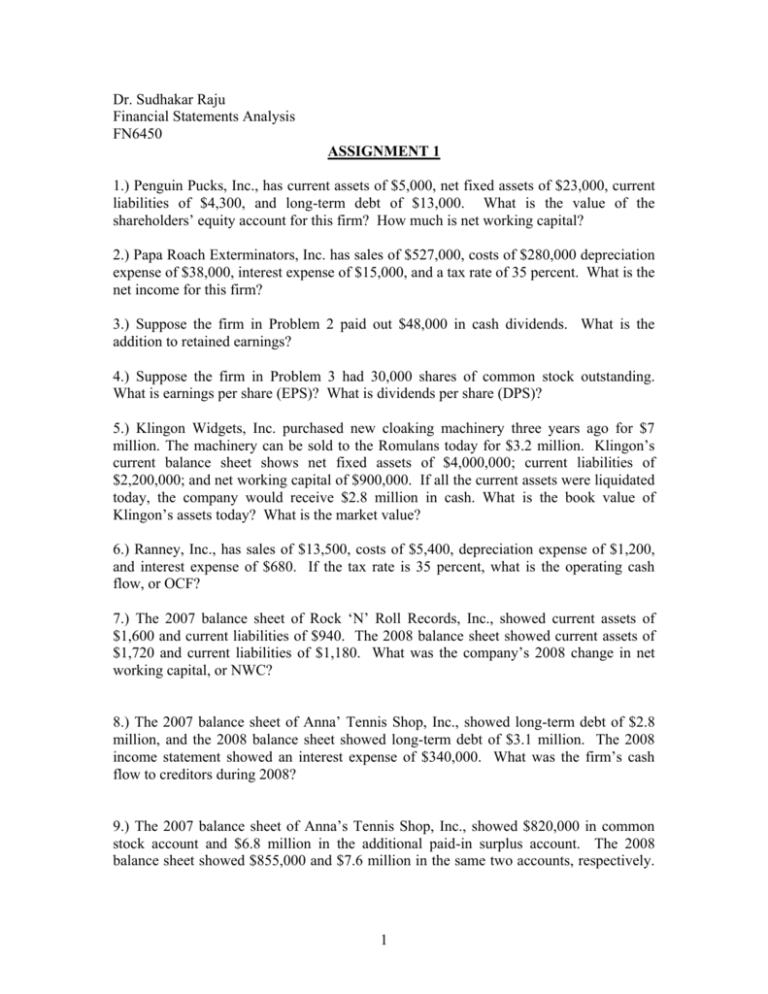

Dr. Sudhakar Raju Financial Statements Analysis FN6450 ASSIGNMENT 1 1.) Penguin Pucks, Inc., has current assets of $5,000, net fixed assets of $23,000, current liabilities of $4,300, and long-term debt of $13,000. What is the value of the shareholders’ equity account for this firm? How much is net working capital? 2.) Papa Roach Exterminators, Inc. has sales of $527,000, costs of $280,000 depreciation expense of $38,000, interest expense of $15,000, and a tax rate of 35 percent. What is the net income for this firm? 3.) Suppose the firm in Problem 2 paid out $48,000 in cash dividends. What is the addition to retained earnings? 4.) Suppose the firm in Problem 3 had 30,000 shares of common stock outstanding. What is earnings per share (EPS)? What is dividends per share (DPS)? 5.) Klingon Widgets, Inc. purchased new cloaking machinery three years ago for $7 million. The machinery can be sold to the Romulans today for $3.2 million. Klingon’s current balance sheet shows net fixed assets of $4,000,000; current liabilities of $2,200,000; and net working capital of $900,000. If all the current assets were liquidated today, the company would receive $2.8 million in cash. What is the book value of Klingon’s assets today? What is the market value? 6.) Ranney, Inc., has sales of $13,500, costs of $5,400, depreciation expense of $1,200, and interest expense of $680. If the tax rate is 35 percent, what is the operating cash flow, or OCF? 7.) The 2007 balance sheet of Rock ‘N’ Roll Records, Inc., showed current assets of $1,600 and current liabilities of $940. The 2008 balance sheet showed current assets of $1,720 and current liabilities of $1,180. What was the company’s 2008 change in net working capital, or NWC? 8.) The 2007 balance sheet of Anna’ Tennis Shop, Inc., showed long-term debt of $2.8 million, and the 2008 balance sheet showed long-term debt of $3.1 million. The 2008 income statement showed an interest expense of $340,000. What was the firm’s cash flow to creditors during 2008? 9.) The 2007 balance sheet of Anna’s Tennis Shop, Inc., showed $820,000 in common stock account and $6.8 million in the additional paid-in surplus account. The 2008 balance sheet showed $855,000 and $7.6 million in the same two accounts, respectively. 1 If the company paid out $600,000 in cash dividends during 2008, what was the cash flow to stockholders for the year? 10.) Given the information for Anna’s Tennis Shop, Inc., in Problems 11 and 12, suppose you also know that the firm’s net capital spending for 2008 was $760,000, and that the firm’s net capital spending for 2008 was $760,000, and that the firm reduced its net working capital investment by $165,000. What was the firm’s 2008 operating cash flow, or OCF? 11.) Bedrock Gravel Corp. shows the following information on its 2008 income statement: Sales Costs Other expenses Depreciation Expense Interest expense Taxes Dividends $145,000 $ 86,000 $ 4,900 $ 7,000 $ 15,000 $ 12,840 $ 8,700 In addition, you’re told that the firm issued $6,450 in new equity during 2008, and redeemed $6,500 in outstanding long-term debt. a. b. c. What is the 2008 operating cash flow? What is the 2008 cash flow to creditors? What is the 2008 cash flow to stockholders? 12.) Given the following information for Papa Joe Pizza Co., calculate the depreciation expense: sales = $29,000; costs = $13,000; addition to retained earnings = $45,000; dividends paid = $900; interest expense = $1,600; tax rate = 35 percent. 13.) Prepare a 2008 balance sheet for Tim’s Couch Corp. based on the following information: Cash $ 175,000 Patents & copyrights $ 720,000 Accounts payable $ 430,000 Accounts receivable $ 140,000 Tangible net fixed assets $2,900,000 Inventory $265,000 Notes payable $180,000 Accumulated retained earnings $1,240,000 Long-term debt $1,430,000 2 14.) Clapper’s Clippers, Inc., is obligated to pay its creditors $3,500 during the year. a. What is the market value of the shareholders’ equity if assets have a market value of $4,300? b. What if assets equal $3,200? 15.) During 2008, Raines Umbrella Corp. had sales of $850,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $630,000, $120,000 and $130,000, respectively. In addition, the company has an interest expense of $85,000 and a tax rate of 35 percent. (Ignore any tax loss carry-back or carry-forward provisions.) a. What is Raines’ net income for 2008? b. What is its operating cash flow? c. Explain your results in (a) and (b)? 16.) Cusic Industries had the following operating results for 2008: Sales Cost of goods sold Depreciation expense Interest expense Dividends paid $12,800 $10,400 $1,900 $450 $500 At the beginning of the year, net fixed assets were $9,100, current assets were $3,200, and current liabilities were $1,800. At the end of the year, net fixed assets were $9,700, current assets were $3,850, and current liabilities were $2,100. The applicable tax rate was 34 percent. a. b. c. d. What is net income for 2008? What is the operating cash flow for 2008? What is the cash flow from assets for 2008? Is this possible? Explain. If no new debt was issued during the year, what is the cash flow to creditors? What is the cash flow to stockholders? Explain and interpret the positive and negative signs of your answers in (a) through (d). 3 17.) Consider the following abbreviated financial statements for Parrothead Enterprises: Parrothead Enterprises – 2007 and 2008 Partial Balance Sheets Assets Liabilities and Owner’s Equity 2007 2008 2007 2008 Current $ 650 $ 705 Current $ 265 $ 290 Assets Liabilities Net Fixed 2,900 3,400 Long-term 1,500 1,720 Assets debt Parrothead Enterprises – 2008 Income Statement Sales $8,600 Costs 4,150 Depreciation 800 Interest paid 216 a. b. c. d. What is owners’ equity for 2007 and 2008? What is the change in net working capital for 2008? In 2008, Parrothead Enterprises purchased $1,500 in new fixed assets. How much in fixed assets did Parrothead Enterprises sell? What is the cash flow from assets for the year? (The tax rate is 35 percent.) During 2008, Parrothead Enterprises raised $300 in new long-term debt. How much long-term debt must Parrothead Enterprises have paid off during the year? What is the cash flow to creditors? 18.) Draw up an income statement and balance sheet for the company below for 2007 and 2008. Calculate the cash flow to creditors, cash flow to stockholders and cash flow to assets. Assume that the tax rate is 34 percent. 2007 2008 Sales $4,018 $4,312 Depreciation 577 578 Cost of goods sold 1,382 1,569 Other expenses 328 274 Interest 269 309 Cash 2,107 2,155 Accounts receivable 2,789 3,142 Short-term notes payable 407 382 Long-term debt 7,056 8,232 Net fixed assets 17,669 18,091 Accounts payable 2,213 2,146 Inventory 4,959 5,096 Dividends 490 539 4