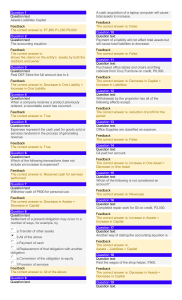

Balance Sheet Glossary Balance Sheet A financial statement that

advertisement

Balance Sheet Glossary Balance Sheet A financial statement that describes a person’s financial position at a given point of time Assets The items you own, whether it was purchased for cash or financed with debt Liabilities Debts that you owe Ex. credit card charges, loans, and mortgages Net Worth An individual’s or family’s actual wealth Net worth = total assets - total liabilities Liquid Assets Low-risk financial assets held in the form of cash or instruments that can be readily converted to cash with little or no loss in value Liquidity An asset’s nearness to cash Investments Assets acquired to earn a return rather than provide a service Ex. bond, stocks, mutual funds, and real estate Real Property Tangible, immovable assets Ex. land and anything fixed to it, such as a house Personal Property Tangible, movable assets that are used in everyday life Ex. a car, furniture Fair Market Value The actual value of an asset, the price that it can reasonably be expected to sell in the open market Current Liability Debt due within 1 year of the date of the balance sheet Long-term liability Any debt due 1 year or more from the date of the balance sheet Open account credit Type of obligation that represents the balance outstanding against established credit lines Equity The actual ownership interest in a specific asset or group of assets Insolvency The financial state in which net worth is less than zero