Financial Records

advertisement

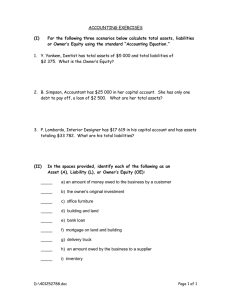

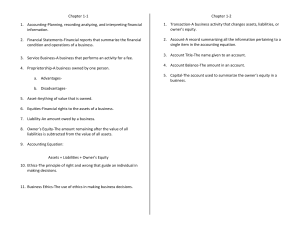

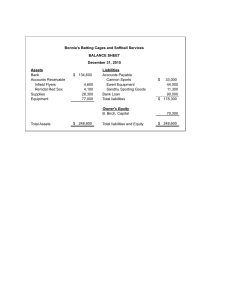

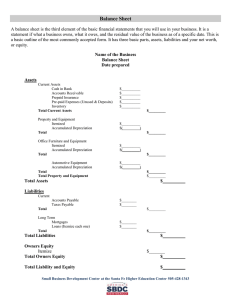

Financial Records & Statements Ch. 12-2 PoB 2011 Financial Records Financial Records – are used to record and analyze the financial performance are maintained Types of Records Assets Records – identify the buildings and equipment owned by the business, their original and current value, and the amount owed if money was borrowed to purchase the assets Depreciation Records – identify the amount assets have decreased in value due to their age and use Inventory Records - identify the type and quantity of resources and products on hand along with the current value of each Types of Records Records of Accounts – identify all purchases and sales made using credit Cash Records – list all cash received and spent by the business Payroll Records – contain information on all employees of the company, their compensation, and benefits Tax Records – show all taxes collected, owed and paid Financial Statements The three most important elements of a company’s financial strength are: Assets – what a company owns Liabilities - what a company owes Owner’s Equity – is the value of the owner’s investment in the business Financial Statement – report that sums up the financial performance of a business Balance Sheet – reports a company’s assets, liabilities and owner’s equity Balance Sheet Income Statement Three other key financial elements for a business are the amount of: Sales Expenses Profits All are reported on the company’s Income Statement Income Statement Profit and Loss Statement Shows the total sales and revenue over a period of time, normally quarterly, to determine if their was a profit or loss in sales Review 1. How has the process of maintaining financial records been affected by technology? 2. What is the difference between a balance sheet and an income statement?