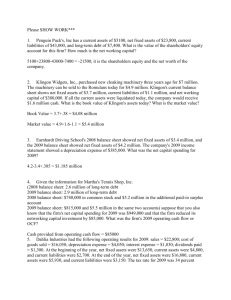

Current Liabilities

advertisement

Letter to Shareholders Corey Leskanic (CEO) Major Accomplishments 2012 • • • • Introduced 500-plus new products in 2012, including more than 100 low- and no-calorie choices Coca-Cola volume grew 3%-nearly 300 million unit cases (comparable to adding another Germany and two Russias) In 2012, we announced our new organizational structure of 3 operating businesses: Coca-Cola America, Coca-Cola International, and Bottle Investments Groups #1 Beverage company for environment, social, and governance performance by Goldman Sachs 2012 vs. 2011 Revenue 2012 vs. 2011 decreased $222 million Net income Growth 2012 vs. 2011 Decreased $72 Million Stock Performance 2012 vs. 2011 $25.78 Dec. 30, 2011--- $31.73 Dec. 31, 2012 o increase 23% • • • 2013 Growth Opportunities • • • Emphasize core brands (Coca-Cola, CocaCola Light, Diet Coke, Coca-Cola Zero) o Coca-Cola Light 6.5% volume growth (growth in physical volume of sales) o Most popular, big potential growth Natural Sweeteners (new consumer preference)- stevia w/ Sprite & Vitamin Water Environment- Bottling Business Review Mark Dowicz (COO) Business Review New Products: Ayataka (Green Tea) I Lohas (Water) Partnership with JBF INdustries Ltd. Zico Coconut Water Dasani Drops Odwalla Smoothie Refreshers New Markets: Business Review (continued) Competition Pepsico, Inc. Nestle S.A. Dr. Pepper Snapple Group Inc. • • • Regulatory or Legal Issues Workers sue based on discrimination Discontinue Membership at American Legislative Exchange Council • • Business Review (continued) Risks: • • • • Lack of popularity of many products Changing health consciousness attitude Health issues Commodity costs are rising Income Statement Gabriella Grippa (CFO) Something to keep in mind... • • • sales of products are seasonal 2nd and 3rd quarters account for higher unit sales Earn more than 60% of operating income during 2nd and 3rd quarters Revenue (in millions) 2011 2012 Percent Decrease $8,284 $8,062 2.68% Why did the company's revenue go down? • • Customer marketing programs o allowances o coupon programs Result: reduction in net sales ($1.0 billion in 2011 and 2012) Unfavorable currency exchange rate changes, impact of volume decline, bottle and can net pricing per case growth, challenging operating conditions, ongoing macroeconomic weakness Cost of Revenue (in millions) • • 2011 2012 Percent Decrease $5,254 $5,162 1.75% Payments to licensors for marketing programs = reduction in cost of sales 2012 packaging costs per case grew due to increase cost of key raw materials like sugar. Gross Margin Percentage & Expenses GDP 2011 36.6% 2012 Percent Decrease 35.9% 0.68% Operating Expenses 2011 2012 4.1% 4.1% Operating Income (in millions) 2011 2012 Percent Decrease $1,033 $928 10.2% Operating Income (continued) Taxes (in millions) 2011 2012 Decrease $196 $160 $36 • 21% 19% 2% Increase French excise tax on beverages w/ added sweetener • Tax rate reductions in UK and Sweden • Tax law change in Belgium Net Income (in millions) • • • 2011 2012 Percent Decrease $749 $677 9.6% Charges totaling $85 million related to restructuring activities Net mark-to-market losses totaling $4 million Tax benefit of $62 million from tax rate reductions in UK and Sweden, and tax law change in Belgium. Earnings per Share (in millions) • • 2011 2012 Percent Decrease $2.35 $2.30 2.12% 2012 paid dividends of $187 million February 2012, increase dividend from $0.13 to $0.16 per share Return on Investment (in millions) 2011 2012 Decrease 10.4% 8.8% 1.6% • Became less efficient Balance Statement Danielle Tantillo (CFO) Balance Sheet (continued) Balance Sheet 2012 2011 Up/ Down Current Assets 2,762 2,686 Up Long Term Assets 6,748 6,408 Up Current Liabilities 2,579 1,848 Up Long Term Liabilities 4,238 4,347 Down Shareholders Equity 2,693 2,899 Down Retained Earnings 638 Up 1,126 2012 Current Asset • • • 2,762 2011 2,686 Cash increased (net income higher in 2011) Accounts Receivables (increased) Inventory- decreased 2012 Long Term Assets • 6,748 Property, Plant, and Equipment 2011 6,408 2012 Long Term Assets • 6,748 (continued) 2011 6,408 Franchise License Intangible Assets and Goodwill 2012 Current Liabilities • 2,579 2011 1,848 Accounts Payable and Accrued Expenses 2012 Current Liabilities • Debt 2,579 2011 1,848 2012 Long Term Liabilities4,238 • Long Term Debt 2011 4,347 2012 Shareholders Equity2,693 • • 2011 2,899 339,064,025 shares of common stock Share Repurchases 65 million shares (no more than $1.5 billion) o 2011: $1,014 million o 2012: $1,831 million o 2012 Retained Earnings 1,126 • • • Dividends $187 million Increased net income Bought back more common stock o o 2012: 1,831 2011: 1,014 2011 638 Key Ratios 2012 2011 better/ worse Current Ratio 1.07 1.45 Worse Quick Ratio .92 1.24 Worse Debt to Asset Ratio 36.5% 33.12% Worse Time Covered Ratio 30.85 35.65 Worse Inventory Turnover 13.37 13.04 Worse Days Sales Outstanding 53.29 50.23 Worse Ratio Interpretations Current Ratio 2012- current assets were barely larger than current liabilities • assets should be higher than liabilities o should be greater than one= IS NOT o the ratios show that at 1.07 in 2012 o Current debt increased $616 million dollars o Ratio Interpretations Quick Ratio Ability of current assets (without inventory) to cover the current liabilities. • o o Shows if coca-cola has the resources necessary to cover its current liabilities Worse from 2011--> 1.24 to 0.92 Ratio Interpretations Debt to Asset Ratio Coca-cola's financial risk increased from 33.12% to 36.5% I • Increased debt over their assets o Debt increased by $616 million dollars. o Times-Covered Ratio Decreased from 35.65 to 30.85 • o Profits can still keep declining and they will still be able to meet interest charges Ratio Interpretations Inventory Turnover Increased from 13.04 to 13.37 from 2011 to 2012 • cost of sales decrease from 2011 to 2012 o Inventory increased from 2011 to 2012. o Took longer to get rid of all the inventory o Days Sales Outstanding Increased from 50.23 in 2011 to 53.29 in 2012 • o Take longer to receive what customers owe