211.2notes

Trubnick

Accounting 211: Chapter 2

Class notes

Skip characteristics of useful information (pages 49 - 52)

Generally accepted accounting principles (GAAP)

Largely determined by rule -making institutions, especially the Financial

Accounting Standards Board (FASB.)

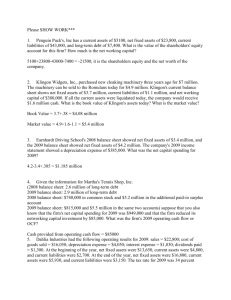

Income statements (Statements of Financial Operations) have two forms.

Single-step simply subtracts all expenses from all revenues.

Multiple-step highlights important components of revenues and expenses.

Revenues xx

Cost of goods sold

Gross profit xx xx

Operating expenses

Income from operations xx xx

Other revenues and expenses xx

Income before tax xx

Tax expense

Net income xx xx

Decision tools

Return on assets =

Profit margin = net income / average assets net income / sales

Balance sheets (Statements of Financial Position) may be presented in classified format.

ASSETS

Current assets are either used up or converted to cash within one year.

Plant, property and equipment have lives exceeding one year.

Intangible assets are noncurrent but are without physical substance.

Long-term investments in stocks and bonds are held for more than one year.

LIABILITIES

Current liabilities must be paid within one year

Long-term liabilities - you guessed it!

STOCKHOLDERS' EQUITY

Paid-in capital (contributed capital) reports resources received from shareholders.

Retained earnings reports increases in net resources resulting from income.

Retained earnings is reduced by dividends. Dividends distribute resources to shareholders.

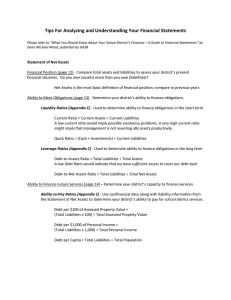

Decision Tools

Current ratio = current assets / current liabilities

Working capital = current assets- current liabilities

Debt to assets ratio = total liabilities / total assets

Statements of cashflows report cash from operating, financing and investing activities

Decision tools

Current cash debt coverage ratio = CFO/average current liabilities

Debt coverage ratio = CFO / average total liabilities

Depreciation

Depreciation expense expenses a portion of plant and equipment during the current year.

Accumulated depreciation (contra-asset) discloses all the depreciation pertaining to an asset since its purchase.