A Further Look at Financial Statements

advertisement

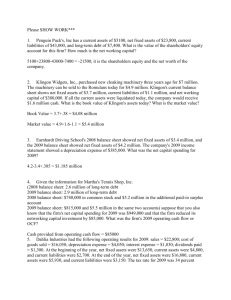

A Further Look at Financial Statements Chapter 2 # 1 Generally Accepted Accounting Principles • • • • GAAP Agreed-upon accounting rules Most U.S. companies use Promulgated by Financial Accounting Standards Board - FASB # 1 Basic Objective of Financial Reporting Provide information useful for decision making Recall Content and Purpose of Financial Statements • Income Statement • Retained Earnings Statement • Balance Sheet • Statement of Cash Flows Recall Users of Financial Statements • Internal Users • External Users # 2 Qualitative Characteristics of Accounting Information • • • • Relevance Reliability Comparability Consistency Relevance • Makes a difference to the decision • Confirms or corrects prior expectations, feedback value • Helps predict future events • It is timely Reliability • • • • Can be depended upon Verifiable – free of error Faithful representation - factual Neutral – does not favor anyone Comparability & Consistency • Comparability – different companies use similar accounting policies • Comparability – a firm uses similar accounting policies year to year # 3 Constraints in Accounting • Materiality • Conservatism Materiality • Will it influence the decision? – MATERIAL • No impact on decision? – IMMATERIAL © PhotoDisc/Getty Images © PhotoDisc/Getty Images Conservatism • When in doubt, choose method least likely to overstate assets and income • Do not intentionally understate! # 4 Identify the Sections of a Classified Balance Sheet • Helps users see if company has enough assets to pay debts • Can determine the short-term and long-term claims on total assets Classified Balance Sheet Generally contains the following standard classifications: – Current Assets – Long-Term Investments – Property, Plant, and Equipment – Intangible Assets – Current Liabilities – Long-Term Liabilities – Stockholders' Equity Current Assets • Assets that are expected to be converted to cash or used in the business within one year. • Current assets are listed in order of liquidity, or how quickly they will convert to cash or be used up . . . Current Assets • Examples: – Cash – Short-term investments – Receivables – Inventories – Supplies – Prepaid expenses Long-Term Investments • Assets that can be converted into cash, but whose conversion is not expected within one year. • Assets not intended for use within the business. Long-Term Investments • Example: – Investments of stocks and bonds of other corporations. Property, Plant, and Equipment • Assets with relatively long useful lives. • Assets used in operating the business. • Examples: – land – buildings – machinery – delivery equipment – furniture and fixtures Digital Vision Property, Plant, and Equipment - Depreciation • Depreciation expense allocates asset’s full purchase price to a number of years (on Income Statement) • Balance sheet shows total amount of depreciation taken over the life of the asset in the Accumulated Depreciation account Property, Plant, and Equipment - Depreciation Intangible Assets • Non-current assets • No physical substance Current Liabilities Obligations that are supposed to be paid within the coming year... Current Liabilities • • • • • • accounts payable wages payable bank loans payable interest payable taxes payable current maturities of long-term loans payable Long-Term Liabilities • Debts expected to be paid after one year • Examples… – bonds payable – mortgages payable – long-term notes payable – lease liabilities – obligations under employee pension plans Stockholders' Equity • Capital (Common) stock investments in the business by the stockholders • Retained earnings – net income retained for use in the business Ratio Analysis • Expresses relationship among selected items of financial statement data • Relationship can be expressed in terms of… – Percentage – Rate – Proportion Ratio Analysis - Classifications • Liquidity Ratios - measure short-term ability of company to pay maturing obligations and meet unexpected needs for cash Ratio Analysis - Classifications • Profitability Ratios - Measures of the income or operating success of a company for a given period of time Ratio Analysis - Classifications • Solvency Ratios - Measures of the ability of the company to survive over a long period of time Ratio Analysis – Use Multiple Measures! • Intracompany comparisons - covering two years of the same company • Industry average comparisons - based on average ratios for a particular industry • Intercompany comparisons - based on comparisons with a competitor in the same industry Profitability Ratios • Measures operating success (income) of a company for a given period of time • Two examples: – Earnings Per Share (EPS) – Price- Earnings Ratio (P-E) Earnings Per Share How does the company’s earning performance compare with that of previous years? EPS= Net income-Preferred stock dividends Average common shares outstanding Higher value = improved performance Price-Earnings Ratio How does the market perceive the company’s prospect for future earnings? Price-Earnings Ratio = Stock price per share Earnings per share High ratio suggests market has favorable expectations Ratio Examples # 7 Identify and Compute Ratios for Analyzing a Company’s Liquidity and Solvency Using a Balance Sheet Financial Ratio Classifications • Liquidity Ratios - measures of short-term ability to pay maturing obligations and to meet unexpected needs for cash •Working capital •Current ratio Working Capital •Measure of short-term ability to pay obligations •Difference between current assets and current liabilities Working Capital = Current Assets - Current Liabilities Positive working capital is favorable! Current Ratio •Another measure of short-term ability to pay obligations •Divide current assets by current liabilities Current Ratio = Current Assets Current Liabilities •More dependable indicator •Does not consider composition of current assets Current Ratio Industry average means? Current Ratio Industry average means? $1.49 of current assets for every $1 of current debt Financial Ratio Classifications • Solvency Ratios - measures of the ability of a company to survive over a long period of time •Debt to Total Assets Ratio Debt to Total Assets Ratio • Divide total debt (current and long-term liabilities) by total assets Total Debts Debt to Total Asset Ratio = Total Assets •Measures percentage of assets financed by creditors rather than stockholders Let’s Review Selected financial information for Drummond Company at 12/31/2005: Cash Receivables (net) Inventory Long-term assets Total Assets $60,000 $80,000 $70,000 $330,000 $540,000 Current Liabilities Long-term debt Total Liabilities $140,000 $130,000 $270,000 Let’s compute current ratio . . . Let’s Review – Compute Current Ratio Cash Receivables (net) Inventory Long-term assets Total Assets $60,000 $80,000 $70,000 $330,000 $540,000 Current Liabilities Long-term debt Total Liabilities $140,000 $130,000 $270,000 $210,000 $140,000 = 1.5 : 1 Let’s Review Selected financial information for Drummond Company at 12/31/2005: Cash Receivables (net) Inventory Long-term assets Total Assets $60,000 $80,000 $70,000 $330,000 $540,000 Current Liabilities Long-term debt Total Liabilities $140,000 $130,000 $270,000 Now, let’s compute debt to total assets . . . Let’s Review – Compute Debt to Total Assets Cash Receivables (net) Inventory Long-term assets Total Assets $60,000 $80,000 $70,000 $330,000 $540,000 Current Liabilities Long-term debt Total Liabilities $140,000 $130,000 $270,000 $270,000 $540,000 = 50%