Chapter 2 beginning on page 43

advertisement

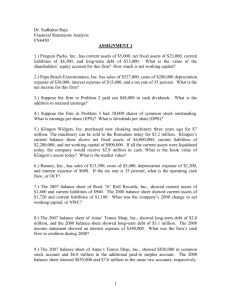

Dr. Sudhakar Raju FN 3000 QUESTIONS FOR CHAPTER 2 (Financial Statements, Taxes and Cash Flows) 1. Brentwood Bat factory, Inc., has current assets of $3,400; net fixed assets of $7,100; current liabilities of $1,900 and long-term debt of $5,200. What is the value of shareholders’ equity for this firm? How much is net working capital? 2. Hoobstank, Inc., has sales of $565,000; costs of $240,000; depreciation expense of $74,000; interest expense of $41,000 and a tax rate of 35 percent. What is the net income for this firm? 3. Suppose the firm in Problem 2 paid out $45,000 in cash dividends. What is the addition to retained earnings? 4. Suppose the firm in Problem 3 had 30,000 shares of common stock outstanding. What is the earnings per share or EPS value? What is the dividends per share value? 5. Klingon Widgets purchased new cloaking machinery three years ago for $5 million. The machinery can be sold to the Romulans for $4.6 million. Klingon’s current balance sheet shows net fixed assets of $2,500,000; current liabilities of $875,000; and net working capital of $700,000. If all the current assets were liquidated today, the company would receive $1.6 million in cash. What is the book value of Klingon’s assets today? What is the market value? 6. Side Salad, Inc., has sales of $15,430, costs of $5780, depreciation expense of $1,900, and interest expense of $1,450. If the tax rate is 35 percent, what is the operating cash flow, or OCF? 7. Rotweiler Obedience School’s December 31, 2007, balance sheet showed net fixed assets of $2.95 million, and the December 31, 2008, balance sheet showed net fixed assets of $3.36 million. The company’s 2008 income statement showed a depreciation expense of $280,000. What was Rotweiler’s net capital spending for 2008? 8. The December 31, 2007, balance sheet of Roddick’s Tennis Shop, Inc., showed current assets of $900 and current liabilities of $310. The December 31, 2008, balance sheet showed current assets of $920 and current liabilities of $305. What was the company’s 2008 change in net working capital, or NWC? 9. The December 31, 2007 balance sheet of Rack N Pinion, Inc., showed long-term debt of $1.7 million, and the December 31, 2008, balance sheet showed long-term debt of $1.9 million. The 2008 income statement showed an interest expense of $65,000. What was the firm’s cash flow to creditors during 2008? 10. Greene Co. shows the following information on its 2008 income statement: Sales $127,000 Costs $64,300 Other expenses $3,900 Depreciation expense $9,600 Interest expense $7,100 Taxes $15,210 Dividends $8,400 1 In addition, you’re told that the firm issued $2,500 in new equity during 2008, and redeemed $3,800 in outstanding long-term debt. a. What is the 2008 operating cash flow? b. What is the 2008 cash flow to creditors? c. What is the 2008 cash flow to stockholders? d. If net fixed assets increased by $13,600 during the year, what was the addition to NWC? 11. Prepare a balance sheet for Florida Potato Corp. as of December 31, 2008, based on the following information: Cash Patents and copyrights Accounts payable Accounts receivable Tangible net fixed assets Inventory Notes payable Accumulated retained earnings Long-term debt $234,000 $818,000 $627,000 $241,000 $4,700,000 $498,000 $176,000 $4,230,000 $913,000 12. During 2008, Belyk Paving Co. had sales of $3,100,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $1,940,000; $475,000; and $530,000 respectively. In addition, the company had an interest expense of $210,000 and a tax rate of 35 percent. (Ignore any tax loss carry back or carry forward provisions). a. What is Belyk’s net income for 2008? b. What is its operating cash flow? c. Explain your results in (a) and (b). 13. In the problem above, suppose Belyk Paving Co. paid out $500,000 in cash dividends. Is this possible? If no new investments were made in net fixed assets or net working capital, and if no new stock was issued during the year, what do you know about the firm’s long-term debt account? 14. Titan Football Manufacturing had the following operating results for 2008: Sales Cost of goods sold Depreciation expense Interest expense Dividends paid $380 $15,370 $11,340 $2,020 $210 At the beginning of the year, net fixed assets were $10,080, current assets were $2,520, and current liabilities were $1,890. At the end of the year, net fixed assets were $10,580; current assets were $3,910; and current liabilities were $2,270. The tax rate for 2008 was 35 percent. 2 a. b. c. d. What is net income for 2008? What is the operating cash flow for 2008? What is the cash flow from assets for 2008? Is this possible? Explain. If no new debt was issued during the year, what is the cash flow to creditors? What is the cash flow to stockholders? Explain and interpret the positive and negative signs of your answers in (a) through (d). 15. Consider the following abbreviated financial statements for Cabo Wabo, Inc.: CABO WABO, INC. Partial Balance Sheets as of December 31, 2007 and 2008 2007 2008 2007 Assets Current assets $1,710 $1,811 Net fixed assets 7,920 8,280 CABO WABO, INC. 2008 Income Statement Sales $ 25,560 Costs 12,820 Depreciation 2,160 Interest paid 389 Liabilities and Owner's Equity Current liabilities Long-term debt $738 $4,320 2008 $1,084 5,040 a. What is owners’ equity for 2007 an 2008? b. What is the change in net working capital for 2008? c. In 2008, Cabo Wabo purchased $3,600 in new fixed assets. How much in fixed assets did Cabo Wabo sell? What is the cash flow from assets for the year? (The tax rate is 35 percent.) d. During 2008 Cabo Wabo raised $1,080 in new long-term debt. How much long-term debt must Cabo Wabo have paid off during the year? What is the cash flow to creditors? 16. Find Your Way Back, Inc. reported the following financial statements for the last two years. Construct the cash flow identity for the company. Explain what each number means. FIND YOUR WAY BACK, INC. Balance Sheet as of December 31, 2007 Assets Liabilities Cash $18,500 Accounts Payable Accounts receivable 26,380 Notes payable Inventory 19,157 Current liabilities Current assets $64,037 Net fixed assets $13,200 20,150 $33,350 $478,370 Long-term debt $190,000 Owners' equity $319,057 Total Assets $542,407 Total Liabilities & Owners Equity $542,407 3 FIND YOUR WAY BACK, INC. Balance Sheet as of December 31, 2008 Assets Liabilities Cash $19,870 Accounts Payable Accounts receivable 29,305 Notes payable Inventory 31,603 Current liabilities Current assets $80,778 Net fixed assets $14,600 22,870 $37,470 $564,320 Long-term debt $210,000 Owners' equity $397,628 Total Assets $645,098 Total Liabilities & Owners Equity $645,098 2008 Income Statement Sales $785,000 Cost of goods sold 380,590 Selling & administrative 173,240 Depreciation 75,800 EBIT $155,370 Interest 26,800 EBT $128,570 Taxes 44,999 Net income $83,571 Dividends Addition to retained earnings $15,000 $68,571 4