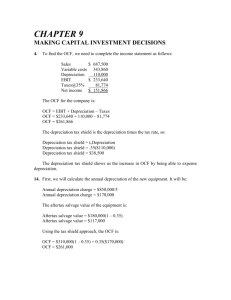

Bethesda Mining Project: Capital Budgeting Analysis

advertisement

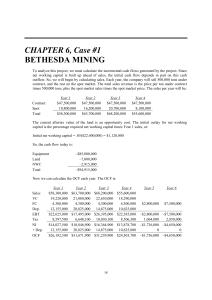

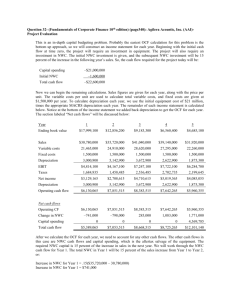

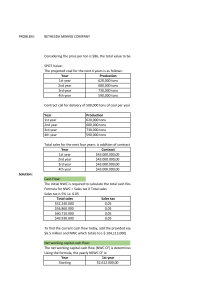

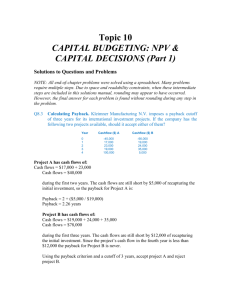

CHAPTER 7, Case #1 BETHESDA MINING To analyze this project, we must calculate the incremental cash flows generated by the project. Since net working capital is built up ahead of sales, the initial cash flow depends in part on this cash outflow. So, we will begin by calculating sales. Each year, the company will sell 600,000 tons under contract, and the rest on the spot market. The total sales revenue is the price per ton under contract times 600,000 tons, plus the spot market sales times the spot market price. The sales per year will be: Contract Spot Total Year 1 $20,400,000 2,000,000 $22,400,000 Year 2 $20,400,000 5,000,000 $25,400,000 Year 3 $20,400,000 8,400,000 $28,800,000 Year 4 $20,400,000 5,600,000 $26,000,000 The current aftertax value of the land is an opportunity cost. The initial outlay for net working capital is the percentage required net working capital times Year 1 sales, or: Initial net working capital = .05($22,400,000) = $1,120,000 So, the cash flow today is: Equipment Land NWC Total –$30,000,000 –5,000,000 –1,120,000 –$36,120,000 Now we can calculate the OCF each year. The OCF is: Sales Var. costs Fixed costs Dep. EBT Tax Net income + Dep. OCF Year 1 Year 2 Year 3 Year 4 $22,400,000 $25,400,000 $28,800,000 $26,000,000 8,450,000 9,425,000 10,530,000 9,620,000 2,500,000 2,500,000 2,500,000 2,500,000 4,290,000 7,350,000 5,250,000 3,750,000 $7,160,000 $6,125,000 $10,520,000 $10,130,000 2,720,800 2,327,500 3,997,600 3,849,400 $4,439,200 $3,797,500 $6,522,400 $6,280,600 4,290,000 7,350,000 5,250,000 3,750,000 $8,729,200 $11,147,500 $11,772,400 $10,030,600 Year 5 $4,000,000 Year 6 $6,000,000 –$4,000,000 –$6,000,000 –1,520,000 –2,280,000 –$2,480,000 –$3,720,000 –$2,480,000 –$3,720,000 CHAPTER 7 CASE #1 C-21 Years 5 and 6 are of particular interest. Year 5 has an expense of $4 million to reclaim the land, and it is the only expense for the year. Taxes that year are a credit, an assumption given in the case. In Year 6, the charitable donation of the land is an expense, again resulting in a tax credit. The land does have an opportunity cost, but no information on the aftertax salvage value of the land is provided. The implicit assumption in this calculation is that the aftertax salvage value of the land in Year 6 is equal to the $6 million charitable expense. Next, we need to calculate the net working capital cash flow each year. NWC is 5 percent of next year’s sales, so the NWC requirement each year is: Beg. NWC End NWC NWC CF Year 1 $1,120,000 1,270,000 –$150,000 Year 2 $1,270,000 1,440,000 –$170,000 Year 3 $1,440,000 1,300,000 $140,000 Year 4 $1,300,000 0 $1,300,000 The last cash flow we need to account for is the salvage value. The fact that the company is keeping the equipment for another project is irrelevant. The aftertax salvage value of the equipment should be used as the cost of equipment for the new project. In other words, the equipment could be sold after this project. Keeping the equipment is an opportunity cost associated with that project. The book value of the equipment is the original cost, minus the accumulated depreciation, or: Book value of equipment = $30,000,000 – 4,290,000 – 7,350000 – 5,2502,000 – 3,750,000 Book value of equipment = $9,360,000 Since the market value of the equipment is $18 million, the equipment is sold at a gain to book value, so the sale will incur the taxes of: Taxes on sale of equipment = ($18,000,000 – 9,360,000)(.38) = $3,283,200 And the aftertax salvage value of the equipment is: Aftertax salvage value = $18,000,000 – 3,283,200 Aftertax salvage value = $14,716,800 So, the net cash flows each year, including the operating cash flow, net working capital, and aftertax salvage value, are: Time 0 1 2 3 4 5 6 Cash flow –$36,120,000 8,579,200 10,977,500 11,912,400 26,047,400 –2,480,000 –3,720,000 C-22 CASE SOLUTIONS So, the capital budgeting analysis for the project is: Payback period = 3 + $4,650,900/$26,047,400 Payback period = 3.18 years Profitability index = ($8,579,200/1.12 + $10,977,500/1.122 + $11,912,400/1.123 + $26,047,400/1.124 – $2,480,000/1.125 – $3,720,000/1.126) / $36,120,000 Profitability index = 1.0563 To calculate the AAR, we divide the average net income by the average book value. Since the cash flows from the project extend for two years past the end of mining operation, we will include an average book value of zero for the last two years. So, the AAR is: AAR = [($4,439,200 + 3,797,500 + 6,522,400 + 6,280,600 – 2,480,000 – 3,720,000) / 6] / [($25,710,000 + 18,360,000 + 13,110,000 + 9,360,000 + 0 + 0) / 6] AAR = .1487 or 14.87% The equation for IRR is: 0 = –$36,120,000 + $8,579,200/(1 + IRR) + $10,977,500/(1 + IRR)2 + $11,912,400/(1 + IRR)3 + $26,047,400/(1 + IRR)4 – $2,480,000/(1 + IRR)5 – $3,720,000/(1 + IRR)6 Using a spreadsheet or financial calculator, the IRRs for the project are: IRR = 14.41%, –61.75% MIRR = 12.94% NPV = –$36,120,000 + $8,579,200/1.12 + $10,977,500/1.122 + $11,912,400/1.123 + $26,047,400/1.124 – $2,480,000/1.125 – $3,720,000/1.126 NPV = $2,031,914.04 In the final analysis, the company should accept the project since the NPV is positive.