Spreadsheet Modeling Homework # 1:

advertisement

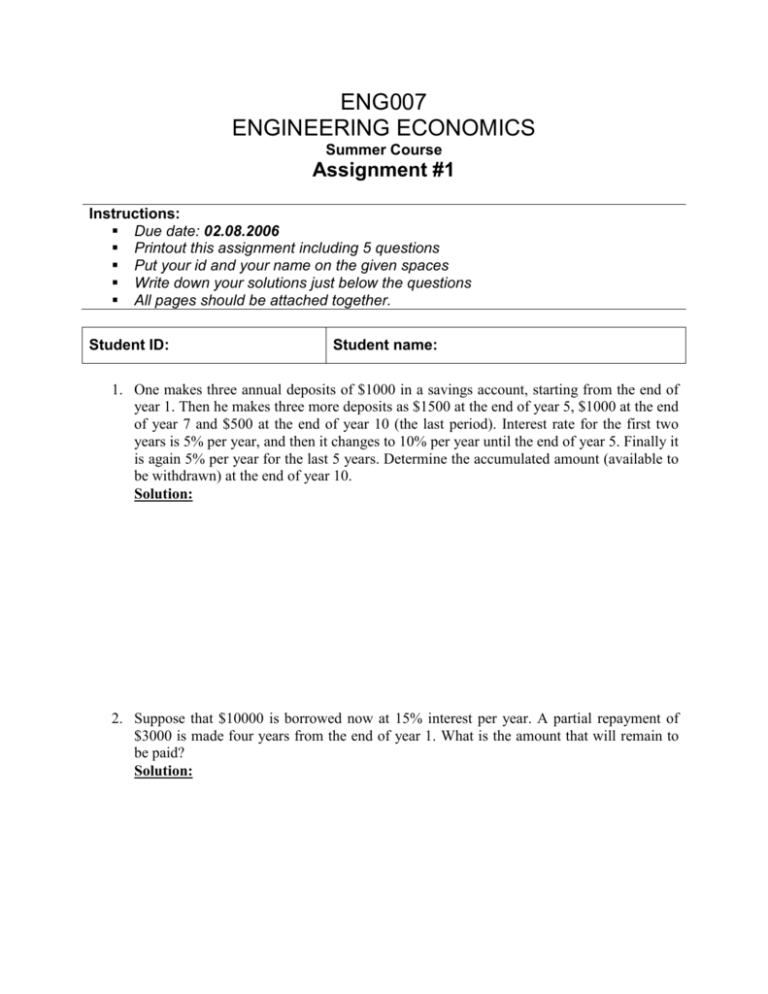

ENG007 ENGINEERING ECONOMICS Summer Course Assignment #1 Instructions: Due date: 02.08.2006 Printout this assignment including 5 questions Put your id and your name on the given spaces Write down your solutions just below the questions All pages should be attached together. Student ID: Student name: 1. One makes three annual deposits of $1000 in a savings account, starting from the end of year 1. Then he makes three more deposits as $1500 at the end of year 5, $1000 at the end of year 7 and $500 at the end of year 10 (the last period). Interest rate for the first two years is 5% per year, and then it changes to 10% per year until the end of year 5. Finally it is again 5% per year for the last 5 years. Determine the accumulated amount (available to be withdrawn) at the end of year 10. Solution: 2. Suppose that $10000 is borrowed now at 15% interest per year. A partial repayment of $3000 is made four years from the end of year 1. What is the amount that will remain to be paid? Solution: 3. You can buy a machine for $100,000 that will produce a net income of $10,000 per year. If you plan to keep the machine for four years, what must the market value be at the end of four years to justify the investment? You must make a 12% annual return on this investment. Solution: 4. Maintenance costs for a small bridge with an expected 60-year life are estimated to be $1000 each year for the first five years, followed by a $10,000 expenditure in the 15th year and a $10,000 expenditure in year thirty. If i=10% per year, what is the equivalent uniform annual cost over the entire 60-year-period? Solution: 5. A company is faced with a decision on an investment proposal. Specifically, the estimated income from the investment is $180,000 per year for 15 years; the investment cost is $640,000; and the investment requires an annual expenditure of $90,000 for the first 3 years, $10,000 in year 10 and $35,000 in year 13. Assume a 15-year- analysis period, no salvage value, and interest rate per year is 15%. Use AW, and IRR methods and determine if the investment is acceptable. Solution: