Final Solution Assignment II

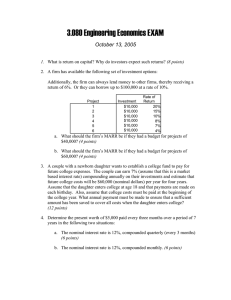

advertisement

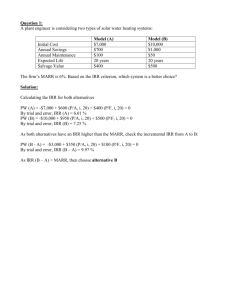

Majmaah University GE 407 Engineering Economics College of Engineering Assignment 2 Due Date: April 23, 2015 Q1. A machine is engaged in production of forged parts. The purchase price of machine is 100,000 SR. The annual maintenance and operating costs are 50,000 SR. The salvage value is 25,000 SR at the end of machine life. Life of machine is 5 years. The rate of interest = 8%. Calculate the cost per part due to this machine. i) ii) A company will produce 10,000 parts per year with this machine. Also what is the cost per part if machine makes 8000 parts per year. Sol: Equivalent Uniform Annual worth (EUAW) EUAW = -100,000(A/P, 8%, 5)-50,000+ 25000(A/F, 8%,5) = - 100,000x 0.25046- 50000+ 25000x 0.17046 = - 70784.5 SR Annual cost = 70784.5 SR Ans i) cost per product = 70784.5 /10000= 7.078 SR Ii) Cost per product = 70784.5 /8000 = 8.848 SR Q2. A person is planning a new business. The initial investment and cash flows for the new business are as listed below. The expected life of the business is five years. The interest rate is 10%. Should the person go for the business? If yes why ? and find the IRR value that the business will yield. Period (year) Cash flow (SR) 0 1 2 3 4 5 –1,00,000 30,000 30,000 30,000 30,000 30,000 Key: PW = -100,000 + 30,000(P/A,10%,5) = -100000+ 30000*3.791 = 13,730 SR The business makes positive present worth at discounted interest rate 10%. Thus there exist better IRR. When i = 15%, PW(15%) = –1,00,000 + 30,000(P/A, 15%, 5) = –1,00,000 + 30,000(3.3522) = Rs. 566. When i = 18%, PW(18%) = –1,00,000 + 30,000(P/A, 18%, 5) = –1,00,000 + 30,000(3.1272) = Rs. – 6,184 Hence 𝑖 = 15 + 566∗3 566+6184 = 15.21555 % Q3. Two mutually exclusive alternative projects with cash flow are shown below for three years. Which project is better and why? The minimum attractive rate of return (MARR) is 10%. End of year 0 1 2 3 3 Alternative Project C Project D -380000 -415000 -38100 -27400 -39100 -27400 -40100 -27400 0 26000 Solution: End of year 0 1 2 3 3 Alternative Project C Project D -380000 -415000 -38100 -27400 -39100 -27400 -40100 -27400 0 26000 ∆ (D-C) -35000 10700 11700 12700 26000 At irr = 10% PW(∆(D-C)= -35000+10700(P/A, irr,3)+1000(P/G,irr,3)+ 26000(P/F, irr, 3) =-35000+10700*2.4869+1000*2.329+ 26000*.7513 = 13,472 which is positive hence irr can be even more to bring the ∆ PW(irr) = 0 Hence Project D is selected. Q4. Two die making machines DMA and DMB can be used for tool room. Select the most economical machine. Assume MARR = 21% per year First cost ($) Annual cost, ($ per year) Salvage value, $ Life, years DMA -50,000 -100,000 DMB -95,000 -85,000 5000 3 11000 6 Solution DMA -50,000 DMB -95,000 DMB-DMA -45000 Annual cost, ($ per year) year 1 -100,000 -85,000 15000 Year 2 -100,000 -85,000 15000 Year 3 -100,000 -85,000 15000 Year 3 (-50,000 + 5000) 0 45000 Year 4 -100,000 -85,000 15000 Year 5 -100,000 -85,000 15000 Year 6 -100,000 -85,000 15000 Year 6 5000 (Salvage value) 11000 6000 First cost ($) PW(i) = -45000+ 15000(P/A, i, 6) + 45000(P/F, i, 3) +6000(P/F,i,6) At I =22% PW(i= 22) = -45000+15000* 3.1669+ 45000*.5507 +6000*0.3033 = 29104 I =20% PW(i) = -45000+ 15000(P/A, i, 6) + 45000(P/F, i, 3) +6000(P/F,i,6) = -45000+15000* 3.3255+ 45000*.5787+6000*0.3349 = 32933.3 DMB is preferable. At i@20 PW(∆ i) is positive. So I is above MARR. DMB should be selected.