Document

advertisement

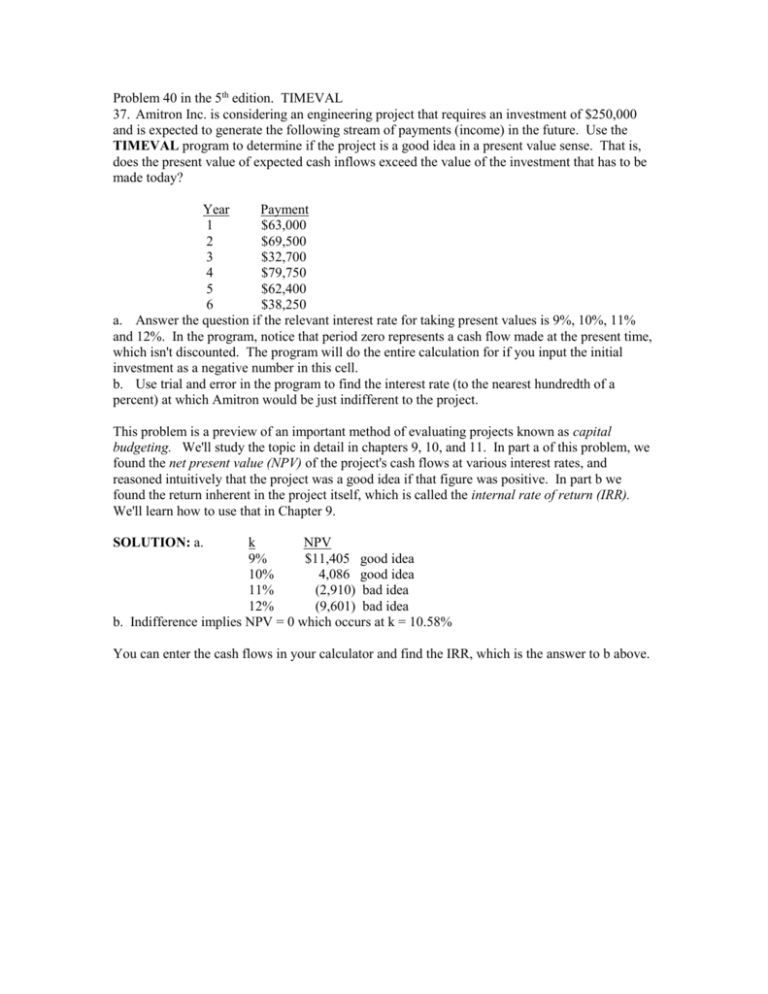

Problem 40 in the 5th edition. TIMEVAL 37. Amitron Inc. is considering an engineering project that requires an investment of $250,000 and is expected to generate the following stream of payments (income) in the future. Use the TIMEVAL program to determine if the project is a good idea in a present value sense. That is, does the present value of expected cash inflows exceed the value of the investment that has to be made today? Year Payment 1 $63,000 2 $69,500 3 $32,700 4 $79,750 5 $62,400 6 $38,250 a. Answer the question if the relevant interest rate for taking present values is 9%, 10%, 11% and 12%. In the program, notice that period zero represents a cash flow made at the present time, which isn't discounted. The program will do the entire calculation for if you input the initial investment as a negative number in this cell. b. Use trial and error in the program to find the interest rate (to the nearest hundredth of a percent) at which Amitron would be just indifferent to the project. This problem is a preview of an important method of evaluating projects known as capital budgeting. We'll study the topic in detail in chapters 9, 10, and 11. In part a of this problem, we found the net present value (NPV) of the project's cash flows at various interest rates, and reasoned intuitively that the project was a good idea if that figure was positive. In part b we found the return inherent in the project itself, which is called the internal rate of return (IRR). We'll learn how to use that in Chapter 9. SOLUTION: a. k NPV 9% $11,405 good idea 10% 4,086 good idea 11% (2,910) bad idea 12% (9,601) bad idea b. Indifference implies NPV = 0 which occurs at k = 10.58% You can enter the cash flows in your calculator and find the IRR, which is the answer to b above.