IENG 302 Lecture 10: Incremental Analysis & IRR

advertisement

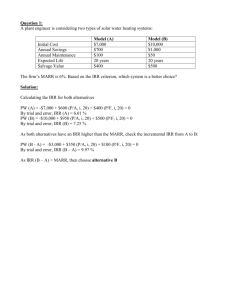

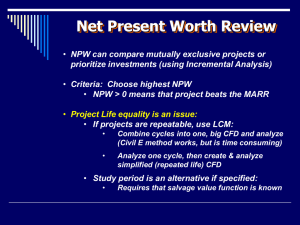

Steps of the Incr. Analysis Process 1. Order alternatives from lowest to highest initial investment. 2. Let Alternative A0 (do nothing) be considered the current best. 3. Consider next Alternative ( j = j+ 1) 4. Determine cash flows for “current best” and Alternative j. 5. Determine incremental cash flows between “current best” and Alternative j. 6. Calculate PW, AW, FW, IRR (or Benefit/Cost) of only the incremental cash flows. 1 Steps of the Incr. Analysis Process 7. If incremental investment yields NPW, EAW, or a NFW > 0*, then the new “current best” becomes Alternative j. * (B/C ratio > 1, or IRR > MARR) 8. If there are remaining alternatives, go to Step 3. 9. If all alternatives have been considered, select the “current best” alternative as the preferred alternative. 2 Internal Rate of Return Internal Rate of Return (IRR): The interest rate i* at which NPW = 0 Note: This is the same as finding the roots of a polynomial equation. If there is more than one sign change in the net annual cash flows over the life of the project, then there is more than one internal rate of return (root)! We may find the IRR by either the manual method we used for the bond yield, or we may use the computer to find the roots by either plots or numerical methods 3 IRR Incr. Analysis Example Life = 9 years Project A Project B Project C Project D Project E 1st Cost 75 25 15 45 65 Annual Revenue 25 5 2 20 20 Salvage 40 ----10 50 IRR 20.6% 12.7% 8.0% 23.8% 15.3% Find the single, best option if: 1.) MARR = 11%/year a.) What is the comparison order? b.) For the 1st Comparison: Increment IRR Increment A-B 27.6% A-C 26.8% A-D 16.7% A-E 50.0% Find the incremental 1st Cost: Find the incremental Ann. Revenue: Increment IRR Increment B-A 27.6% B-C 24.0% B-D 55.7% B-E 19.1% Find the incremental Salvage: Give the IRR Equation: Increment IRR Increment C-A 26.8% C-B 24.0% C-D 41.2% C-E 20.6% Increment IRR Increment D-A 16.7% D-B 55.7% D-C 41.2% D-E 0.0% 2.) MARR = 18%/year 3.) MARR =15 22%/year Increment IRR Increment E-A 50.0% E-B 19.1% E-C 20.6% E-D 0.0% 4.) MARR = 7%/year 5.) MARR = 25%/year Perform the incremental comparison: c.) Perform (b.) for the 2nd Comparison: 4