Corporate Finance Assignment: Capital Structure & Valuation

advertisement

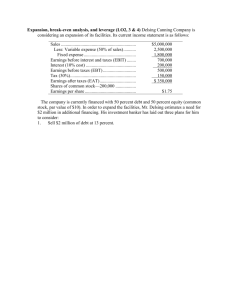

Assignment #3 1. The National Powerhouse Company currently has no debt in its capital structure. The company has decided to restructure, raising $5 million debt at 12 per cent. ABC currently has 500 000 shares on issue at a price of $200 per share. As a result of the restructure, what is the minimum level of EBIT the company needs to maintain EPS (the break-even EBIT)? Ignore taxes 2. For the National Powerhouse Company given in problem 1, compute the interest tax shield if the tax rate is 35%. If the company maintains the same operations and hence EBIT of $100,000 and the required rate of return on unleveraged firm is 13%, what is the Value of leveraged firm?