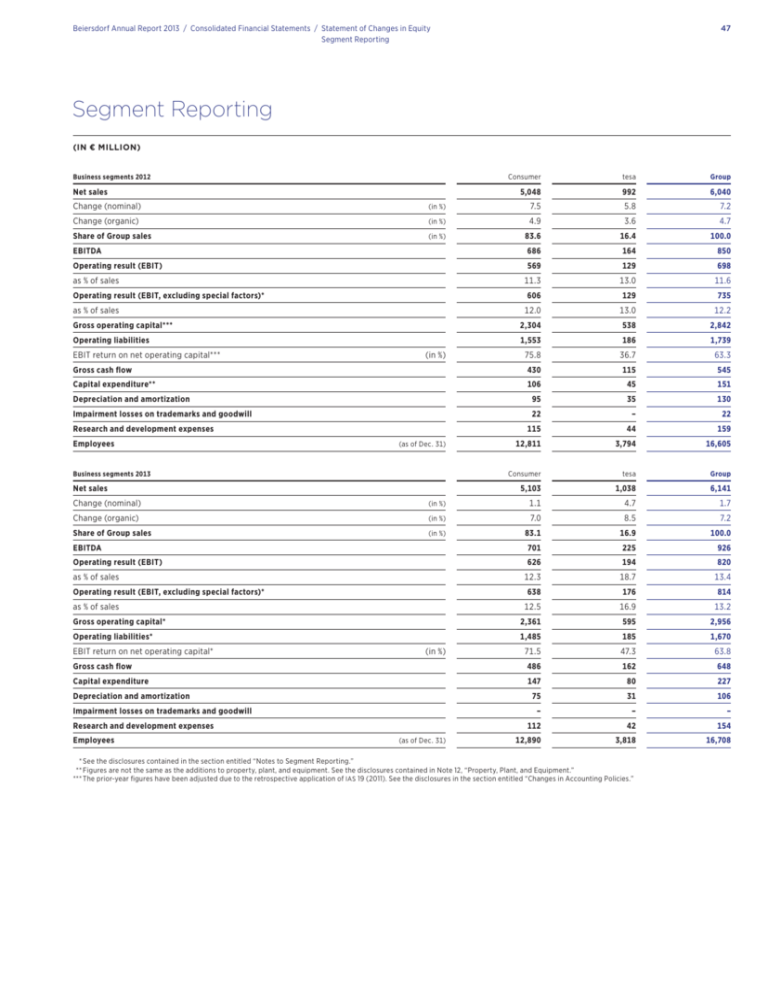

Segment Reporting - Beiersdorf Annual Report 2013

advertisement

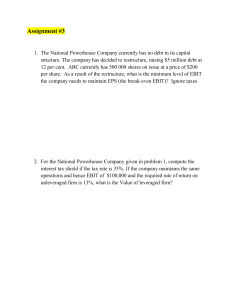

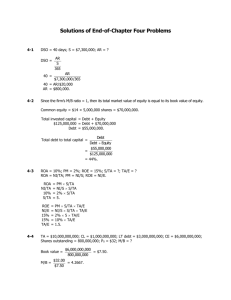

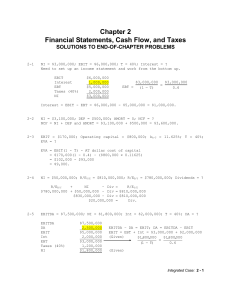

47 Beiersdorf Annual Report 2013 / Consolidated Financial Statements / Statement of Changes in Equity Segment Reporting Segment Reporting (IN € MILLION) Business segments 2012 Net sales Consumer tesa Group 5,048 992 6,040 Change (nominal) (in %) 7.5 5.8 7.2 Change (organic) (in %) 4.9 3.6 4.7 Share of Group sales (in %) 83.6 16.4 100.0 EBITDA 686 164 850 Operating result (EBIT) 569 129 698 11.3 13.0 11.6 as % of sales Operating result (EBIT, excluding special factors)* as % of sales 606 129 735 12.0 13.0 12.2 Gross operating capital*** 2,304 538 2,842 Operating liabilities 1,553 186 1,739 75.8 36.7 63.3 Gross cash flow 430 115 545 Capital expenditure** 106 45 151 95 35 130 EBIT return on net operating capital***(in %) Depreciation and amortization Impairment losses on trademarks and goodwill Research and development expenses Employees (as of Dec. 31) Business segments 2013 Net sales 22 – 22 115 44 159 12,811 3,794 16,605 Consumer tesa Group 5,103 1,038 6,141 1.7 Change (nominal) (in %) 1.1 4.7 Change (organic) (in %) 7.0 8.5 7.2 Share of Group sales (in %) 83.1 16.9 100.0 EBITDA 701 225 926 Operating result (EBIT) 626 194 820 12.3 18.7 13.4 638 176 814 12.5 16.9 13.2 as % of sales Operating result (EBIT, excluding special factors)* as % of sales Gross operating capital* 2,361 595 2,956 Operating liabilities* 1,485 185 1,670 71.5 47.3 63.8 Gross cash flow 486 162 648 Capital expenditure 147 80 227 75 31 106 EBIT return on net operating capital*(in %) Depreciation and amortization Impairment losses on trademarks and goodwill Research and development expenses Employees (as of Dec. 31) – – – 112 42 154 12,890 3,818 16,708 * See the disclosures contained in the section entitled “Notes to Segment Reporting.” ** Figures are not the same as the additions to property, plant, and equipment. See the disclosures contained in Note 12, “Property, Plant, and Equipment.” *** The prior-year figures have been adjusted due to the retrospective application of IAS 19 (2011). See the disclosures in the section entitled “Changes in Accounting Policies.”