Cost of Capital: WACC, Debt, Equity, and Flotation Costs

advertisement

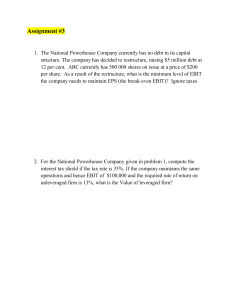

15 Cost of Capital Adapted from Ross, Westerfield, Instructor: Hung DuongJordan (10th) Adapted from Ross Westerfield Jordan (2007) and Hudgins (2007) McGraw-Hill/Irwin Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved. Chapter Outline The Cost of Capital: Some Preliminaries The Costs of Debt, Equity and Preferred Stock The Weighted Average Cost of Capital Flotation Costs and the Weighted Average Cost of Capital (WACC) 15-1 Required Rates on a Project In order to estimate correct required rate, companies must find their own unique cost of raising capital 110 If R=9.5%, ACCEPT R 1 0 If R=10.5%, Reject -100 Accept or reject? 15-2 What is the cost of capital? Cost of using money for a particular purpose You pay rent for using a car, fee for using cable.. You may pay higher rent if driving out state, or higher fee of cable for business You pay interest for using capital: higher rate if investment is riskier What are the sources of capital? Debt (loans, bonds,..) Equity (stocks) Firm’s Cost of capital = Investors’ Required return 15-3 Why Cost of Capital Is Important Riskier the firm higher investors’ required return Higher Firm’s COC the required return on assets depends on the risk of those assets Our COC how the market views the risk of our assets. Do you know how risky you are? Knowing our cost of capital the required return for capital budgeting projects 15-4 How to determine Cost of capital? Cost of capital= Weighted Average of + cost of debt + cost of common stock + cost of preferred stock 15-5 #1: Cost of Debt What is the cost of debt? Debt 0 Debt 100@10% Equity 200 Equity 100 Sales 100 Sales - Costs -60 - Costs EBIT 40 - Interest EBT - Tax (40%) EBIT -0 40 -16 100 -60 40 - Interest EBT -10 30 - Tax (40%) -12 Net Income 24 Net Income 18 ROE 12% ROE 18% Debt magnifies ROE Before tax: RD=10/100=10% Tax saving: 16-12=4 After Tax: R*D=(10-4)/100=6% 15-6 R*D=RD (1-T) #1: Cost of Debt The cost of debt is the required return on our company’s debt Bank loan: R*D=[Interest rate] . (1-T) Bond: R*D=[YTM] . (1-T) (*) indicates After tax The cost of debt is NOT the coupon rate We usually focus on the cost of long-term debt or bonds 15-7 Example: Cost of Debt Suppose we have a bond issue currently outstanding that has 25 years left to maturity. The coupon rate is 9% and coupons are paid semiannually. The bond is currently selling for $908.72 per $1,000 bond. What is the cost of debt? 1000 45 r 0 1 -908.72 2 … 50 10%*(1-T)=6% Maturity N = 50; PMT = 45; FV = 1000; PV = -908.72; CPT I/Y = 5%; YTM = 5(2) = 10% What is the after-tax cost of debt if the tax rate is 40%? 15-8 Cost of Equity Sales 100 - Costs EBIT -60 -10 30 - Tax (40%) Net Income Returns to shareholders 40 - Interest EBT What is the cost of equity? D1 Rc g P0 -12 18 - Dividend -9 Dividend Yield (D1/P0) ∆ Retained Earning +9 Growth (capital gain, Price appreciation,..) Do we need to adjust tax effect? "NO" Interest tax not DIV nor RE tax 15-9 #2: Cost of Equity The cost of equity is the return required by equity investors given the risk of the cash flows from the firm Business risk Financial risk There are two major methods for determining the cost of equity Dividend growth model CAPM 15-10 Dividend Growth Model Example Suppose that your company is expected to pay a dividend of $1.50 per share next year. There has been a steady growth in dividends of 5.1% per year and the market expects that to continue. The current price is $25. What is the cost of equity? D1 Rc g P0 1 .50 Rc .051 .111 11 .1 % 25 15-11 Example: Estimating the Dividend Growth Rate (g)? One method for estimating the growth rate is to use the historical average Year 2002 2003 2004 2005 2006 Dividend 1.23 1.30 1.36 1.43 1.50 Percent Change (1.30 – 1.23) / 1.23 = 5.7% (1.36 – 1.30) / 1.30 = 4.6% (1.43 – 1.36) / 1.36 = 5.1% (1.50 – 1.43) / 1.43 = 4.9% Average = (5.7 + 4.6 + 5.1 + 4.9) / 4 = 5.1% 15-12 Advantages and Disadvantages of Dividend Growth Model Advantage – easy to understand and use Disadvantages Only applicable to companies currently paying dividends Not applicable if dividends aren’t growing at a reasonably constant rate Extremely sensitive to the estimated growth rate – an increase in g of 1% increases the cost of equity by 1% Does not explicitly consider risk 15-13 #3: Cost of Preferred Stock Reminders Constant Dividends are expected to be paid every period forever RP = D / P 0 (g=0) 15-14 Example: Cost of Preferred Stock Your company has preferred stock that has an annual dividend of $3. If the current price is $25, what is the cost of preferred stock? RP = 3 / 25 = 12% 15-15 Weighted Average Cost of Capital WACC = wE*RE +Cost wP*RP of + wCapital Weighted D*RD*(1-TC) Components of COC Debt Pref. Stock Common Stock * R d Rd .(1 T ) Rp Dp Weight WACC Wd WdR*d Wp W p Rp Wc W c Rc Pp D1 Rc g P0 15-16 Capital Structure Weights Long Term Liabilities and Equity WACC = wERE + wPRP + wDRD(1-TC) • • • Weights of each source should reflect expected financing mix Market Value Weights are preferred Balance Sheet percentages are often used if market values are not available to calculate the weighted average cost of capital. 15-17 Capital Structure Weights Notation E = market value of equity = # of outstanding shares times price (NS*PS) (assume no preferred stock) D = market value of debt = # of outstanding bonds times bond price (NB*PB) V = market value of the firm = D + E Weights wE = E/V = percent financed with equity wD = D/V = percent financed with debt 15-18 Example: Capital Structure Weights Green Apple Company Market Values Bonds Preferred Stock Common Stock 4,000 1,000 5,000 40% 10% 50% 10,000 When money is raised for capital projects, approximately 40% of the money comes from selling bonds, 10% comes from selling preferred stock and 50% comes from retained earnings or selling common stock. 15-19 Example: WACC? Green Apple Company Market Values Source of Capital Cost Bonds Preferred Stock Common Stock Rd = 10% Rps = 11.9% Rcs = 15.5% Bonds Preferred Stock Common Stock 4,000 1,000 5,000 40% 10% 50% 10,000 Green Apple’s tax rate is 40% WACC =.4*10%*(1-.4) +0.1*11.9% + 0.5*15.5% =11.34% 15-20 Using WACC for All Projects - Example What projects will be accepted if using WACC? RR? Assume Blackwater’s WACC = 15%. It is considering three investment opportunities: Project RR IRR A Iraq missions 20% B Protect Paris Hilton 15% C Protect ODU students 10% 17% 18% 12% What rate to be used as discount rate? Why? 15-21 Project Costs of Capital The required return of a project is determined by its risk, not by its source of capital Project Risk RR Firm Risk WACC Investors Using the WACC as our discount rate is only appropriate for projects that have the same risk as the firm’s current operations. If we are looking at a project that does NOT have the same risk as the firm, then we need to determine the appropriate discount rate for that project. Divisions also often require separate discount rates. 15-22 Divisional and Project Costs of Capital Using the WACC as our discount rate is only appropriate for projects that have the same risk as the firm’s current operations. If we are looking at a project that does NOT have the same risk as the firm, then we need to determine the appropriate discount rate for that project. Divisions also often require separate discount rates. 15-23 Subjective Approach - Example Consider the project’s risk relative to the firm overall Risk Level Discount Rate Very Low Risk WACC – 8% Low Risk WACC – 3% Same Risk as Firm WACC High Risk WACC + 5% Very High Risk WACC + 10% 15-24 Flotation Costs The cost of issuing new securities Basic Approach Compute the weighted average flotation cost Use the target weights because the firm will issue securities in these percentages over the long term 15-25 Flotation Costs - Example Your company is considering a project that will cost $1 million. The WACC is 15% and the firm’s target D/E ratio is .6 The flotation cost for equity is 5% and the flotation cost for debt is 3%. What is the project’s WACC? How many percents of TA are financed by Debt? Equity? D/E=0.6 E=1, D=0.6 D+E=1.6 WD=0.6/1.6=.375 ; WE=1-.375=0.625 fA = (.375)(3%) + (.625)(5%) = 4.25% What is the true cost of the project taking into account flotation costs? X*(1-.0425) =1,000,000 X=1,044,386.42 (CP thực sự) PV of future cash flows = 1,040,105 NPV of Project? NPV = 1,040,105 - 1,044,386.42 = -4,281 --> Reject 15-26 15 Cost of Capital Adapted from Ross, Westerfield, Instructor: Hung DuongJordan (10th) Adapted from Ross Westerfield Jordan (2007) and Hudgins (2007) McGraw-Hill/Irwin Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved. Financial Leverage Degree of Financial Leverage Finance a portion of the firm’s assets with debt Financial Leverage measures changes in earnings per share as EBIT changes. Degree of Financial Leverage (DFL) at one level of EBIT: % Change in EPS DFLEBIT = % Change in EBIT Unique Level of EBIT 15-30 Financial Leverage Interpretation: When EBIT changes 1% (from an existing level of $500,000) Earnings Per Share will change 1.67% How much would be DFL if there were no interest? DFL*=EBIT/EBIT=1 (if I=0) If EBIT changes by 1%, EPS will also change by 1% EBIT DFLEBIT = EBIT – I Example: EBIT = $500,000 Interest Charges = $200,000 500,000 DFLEBIT=500,000 = 500,000 – 200,000 = 1.67 times 15-31 The Effects of Financial Leverage A Proposed Change in Financial Leverage: Current Proposed Assets $5,000,000 $5,000,000 Debt $0 $2,500,000 Equity $5,000,000 $2,500,000 Debt/Equity 0 1 Share Price $10 $10 Shares Outstanding 500,000 250,000 Interest Rate 10% n/a 15-32 The Effects of Financial Leverage Current Capital Structure:No Debt (Ignore Taxes) Recession Expected Expansion $300,000 $650,000 $800,000 0 0 0 Net Income $300,000 $650,000 $800,000 EBIT Interest ROE 6% 13% 16% EPS $.60 $1.30 $1.60 With no debt: ROE=NI/$5,000,000 EPS = NI/500,000 15-33 The Effects of Financial Leverage Proposed Capital Structure:Debt/Equity=1 Recession Expected Expansion EBIT $300,000 $650,000 $800,000 Interest 250,000 250,000 250,000 Net Income $ 50,000 $400,000 $550,000 13% 16% 16% 22% ROE 6% EPS $.60 $.20 With debt: 2% $1.30 $1.60 $1.60 $2.20 ROE=NI/$2,500,000 EPS = NI/250,000 15-34 Computing Break-even EBIT (ignoring tax) A. EPS = EBIT/500,000 B. With $2,500,000 in debt at 10%: EPS = (EBIT - $250,000)/250,000 C. With no debt: These are equal when: EPSBE = EBITBE/500,000 = (EBITBE - $250,000)/250,000 D. With a little algebra: EBITBE = $500,000 So EPSBE = $1.00/share 15-35 Computing Break-even EBIT EPS ($) 3 D/E = 1 2.5 2 D/E = 0 1.5 1 0.5 0 – 0.5 –1 EBIT ($ millions, no taxes) 0 0.2 0.4 0.6 0.8 1 15-36