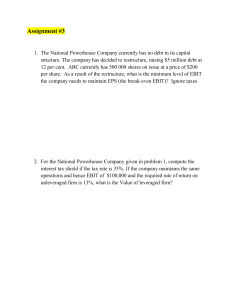

PRACTICE PROBLEMS FOR MODULE 7 CH 12, Determining the financing mix Be sure to carefully read through all of the solutions and accompanying notes. After working the practice problems, complete the homework. The notes and comments that are included here are intended to help support the text and lecture slides. Reading these notes and comments carefully will serve you well on the exam. The practice problems will start with some hints and examples, these are the yellow shaded boxes below. What is a fixed cost and what is a variable cost? Examples of fixed and variable Variable cost examples Fixed costs examples: insurance hourly labor annual rent direct materials sales commissions administrative salaries fixed advertising freight costs on products Examples of how to estimate next year's EPS Start with the following IS for 2019, then, let's assume that sales are forecast to increase by 20% 2019 2020 Sales $2,500,000 $3,000,000 Sales up by 20%, 2020 = 2019 sales * 1.2 Variable Costs 900,000 $1,080,000 Variable costs assumed to change with sales, 2020 = 2019 VC * 1.2 Fixed Operating Costs 700,000 $700,000 Fixed costs do not change, 2020 FC = 2019 FC EBIT 900,000 $1,220,000 EBIT = sales - VC - FC Interest Expense 200,000 $200,000 Interest is a fixed expense, so 2020=2019 EBT 700,000 $1,020,000 EBT = EBIT - interest Taxes (30%) 210,000 $306,000 Taxes = EBIT * 0.3 Net Income $490,000 $714,000 NI = EBT - taxes Earnings Per Share $4.90 $7.14 EPS = NI/#shares outstanding. We can calc that value based on 2019 # shares = 2019 NI/2019 EPS = 490,000/4.9 = 100,000 2020 EPS = 2020 NI/# shares = 714,000/100,000 = 7.14 1 HomeCraft makes wooden play sets. The company pays annual rent of $400,000 per year and pays administrative salaries totaling $150,000 per year. Each play set requires $400 of wood, ten hours of labor at $70 per hour, and variable overhead costs of $100. Fixed advertising expenses equal $100,000 per year. Each play set sells for $3,200. What is HomeCraft's breakeven output level? (See lecture slide: M4.1, slide 8) BE point in units = Hints: Determine total fixed costs and total variable costs per unit first, then solve for the BE point BE Point = the point at which the firm's EBIT = 0 We want to determine how many units need to be produced and sold for this firm to reach breakeven (Sales - variable costs fixed costs) = 0 1) total fixed costs = rent + admin salaries + fixed advertising = 400,000 + 150,000 + 100,000 = $650,000 2) variable cost per unit = (400 + (10 * 70) + 100) = $1,200 per unit 𝑓𝑖𝑥𝑒𝑑 𝑐𝑜𝑠𝑡𝑠 𝑠𝑎𝑙𝑒𝑠 𝑝𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡 𝑣𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑐𝑜𝑠𝑡 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡 BE point in units = 2 = , , , QuadCity Manufacturing, Inc. reported the following items: Sales = $6,000,000; Variable Costs of Production = $1,500,000; Variable Selling and Administrative Expenses = $550,000; Fixed Costs = $1,350,000; EBIT = $2,600,000; and the Marginal Tax Rate = 35%. What is QuadCity's break-even point in sales dollars? (See M4.1, slide 9) Break-even level of revenues = total fixed costs = 1,350,000 total variable costs = 1,500,000 + 550,000 = 2,050,000 The EBIT is not a part of the equation, we will ignore the given value The marginal tax rate is not a part of the equation, we will ignore that too Break-even level of revenues = , , , , , , Based on the following data, solve 3a & 3b Average selling price per unit Variable cost per unit Units sold Fixed costs Interest expense 3a = $2,050,633 $18.00 $13.00 400,000 $650,000 $50,000 The break-even point in units produced and sold (remember that unless something is both produced AND sold, the firm gets no revenues) Start with the right equation: BE point in units = 3b 325 𝑢𝑛𝑖𝑡𝑠 , $ BE point in units = 130,000 𝑢𝑛𝑖𝑡𝑠 The break-even point in sales dollars Break-even level of revenues (sales) = We have the total fixed costs, we need to calculate the total variable costs and revenues total variable costs = # units sold * variable cost per unit = 400,000 * 13 = 5,200,000 total revenues = # units sold * average selling price per unit = 400,000 * 18 = 7,200,000 Break-even level of revenues = 4a , , , , , = $2,340,000 Given the following data for a firm, what would we expect the firm's earnings per share (EPS) for 2020 if the firm is assuming a 15% increase in sales? Assume 150,000 shares outstanding Sales Variable Costs Fixed Operating Costs EBIT Interest Expense EBT Taxes (25%) Net Income Earnings Per Share 4b 2019 2020 projection $3,750,000 $4,312,500 Sales up by 15%, 2020 = 2019 sales * 1.15 1,260,000 $1,449,000 Variable costs assumed to change with sales, 2020 = 2019 VC * 1.15 1,120,000 $1,120,000 Fixed costs do not change, 2020 FC = 2019 FC 1,370,000 $1,743,500 EBIT = sales - VC - FC 290,000 $290,000 Interest is a fixed expense, so 2020=2019 1,080,000 $1,453,500 EBT = EBIT - interest 270,000 $363,375 Taxes = EBIT * 0.25 $810,000 $1,090,125 NI = EBT - taxes $5.40 $7.27 2020 EPS = 2020 NI/# shares = 1,090,125/150,000 = 7.27 What is the firm's operating leverage? OL = % % % Change in EBIT = (2020 EBIT/2019 EBIT) - 1 or (2020 EBIT - 2019 EBIT)/2019 EBIT % Change in EBIT = (1,743,500/1,370,000) - 1 = 27% % Change in sales = (4,312,500/3,750,000) - 1 15% OL = % chg in EBIT/% chg in Sales = 27%/15% (= 0.27/0.15) 1.8 What does this imply for the firm? The firm's operating leverage is > 1, meaning that changes in sales are multiplied when we look at the EBIT. We see sales increase by 15% and EBIT increased by 27%. This is great when sales increase, but what about periods when sales decrease? If sales had decreased by 15%, EBIT would have declines by 27%. This magnification effect on EBIT based on changes in sales shows the operating risk that investors in this firm are subject to. If the firm had no operating leverage (meaning that fixed costs = zero and all costs were variable), a 15% increase in sales would mean a 15% increase in EBIT. No operating leverage means that OL = 1.0, the percentage change in EBIT is the same as the percentage change in sales. 4c What is the firm's financial leverage? FL = % % % Change in EPS = (7.27/5.40) - 1 % Change in EBIT = (1,743,500/1,370,000) - 1 = FL = % chg in EPS/% chg in EBIT =26%/27% (0.26/0.27) 35% 27% 1.27 What does FL imply for the firm? We start by looking at the equation, where FL shows us the ratio of how much EPS changes for a change in EBIT. If a firm had no debt (and therefore no interest payments), the change in EPS would be the same as the change in EBIT. For this firm, they are paying interest, which needs to be paid, no matter what happens to sales. This puts the firm at risk in times of reduced revenues. For this firm, changes in EPS are less than the change in EPS. If the financial leverage value had been > 1, we would see that financial leverage magnified the effect of changes in EBIT on EPS. Below is the Income Statement for 2019 for Stellar Equipment, use this for problems 5 and 6 Sales $16,750,000 Variable Costs $8,250,000 Fixed Operating Costs 5,585,000 EBIT 2,915,000 Interest Expense 1,340,000 EBT 1,575,000 Taxes (25%) 393,750 Net Income $1,181,250 Earnings Per Share $5.91 (there are 200,000 shares outstanding) Assume that this firm has an operating leverage of 2.9 and a financial leverage of 1.85 5 If sales increase by 15%, by what percentage will EBIT change? OL = % change in EBIT/% change in sales OL * % change in sales = % change in EBIT 2.9 * 15% (or .15) = + 44% 44% (43.5% is fine too, I am rounding here) 6 If EBIT were to increase by 44%, but what percentage will EPS change? FL = % change in EPS/% change in EBIT FL * % change in EBIT = % change in EPS 1.85 * 44% = + 81% 81% (81.4% is fine too, I am rounding here) 7 Now look at the same information and the same firm Income Statement If sales decrease by 15%, by what percentage will EBIT change? OL = % change in EBIT/% change in sales OL * % change in sales = % change in EBIT 2.9 * -15% (or -.15) = -44% (-43.5% is fine too, I am rounding here) If EBIT were to decrease by 44%, but what percentage will EPS change? FL = % change in EPS/% change in EBIT FL * % change in EBIT = % change in EPS -81% (-81.4% is fine too, I am rounding here) 1.85 * -44% (or -0.44) = Concept check: a. b. c. d. e. f. g. Classic Car Corp. feels their stock price is relatively low right now and plans to buy back shares of common stock. The firm needs to sell bonds (take on more debt) in order to buy back the shares. Which of the following are true statements (select all that are true)? % of equity in capital structure increases % of equity in capital structure decreases % of debt in capital structure decreases % of debt in capital structure increases risk to common shareholders increases we would expect the firm's overall cost of capital to increase we would expect the firm's overall cost of capital to decrease Taking on more debt to buy back shares of stock will decrease the number of shares of common stock outstanding and CH 13increase the amount of the firm's debt. As the debt level increases, risk to common shareholders increases. Finally, as the percentage of debt in the capital structure increases, the overall cost of capital (think back to MCC) will decrease. 8 Queasy Corp. has a retained earnings balance of $4,500,000. The company reported net income of $1,600,000, sales of $9,800,000, and has 250,000 shares of common stock outstanding. The company announced a dividend of $3.25 per share. Therefore the company's dividend payout ratio is Payout ratio = dividends per share/earnings per share (EPS) Decide what information is needed from the setup and which is unnecessary. We are given dividends per share and need to calculate the EPS, which is net income (available to common shareholders)/# outstanding shares. Divs per share $3.25 net income $1,600,000 shares 250,000 EPS = $6.40 = net income/shares = 1,600,000/250,000 dividend payout ratio 50.8% = divs per share/EPS = $2.85/6.40 9 Plantain, Inc. declared a dividend of $1 per share on March 1. The ex-dividend date is (Monday) March 15th, and the payment date is April 1st. The record date is A) February 27th. B) March 16th. C) March 13th. D) March 29th. Anyone buying stock on the 15th or later does not receive the dividend. The dividend will be paid to anyone buying on March 14th or earlier because the bought BEFORE the ex-dividend date. The ex-dividend date is 1 business day prior to the date of record. We see that March 15th is a Monday, and 1 business day later would be Tuesay, March 16th. 10 EveningFall, Inc. pays a quarterly dividend of $3.40 per share. Which of the following statements is most accurate concerning which shareholders will receive the dividend payment? A) The shareholders who own the stock on the date the dividend is declared will receive the dividend, even if they sell their stock before the dividend checks are mailed. B) The shareholders who are identified as owning the stock on the record date will receive the dividend, even if they sell their stock before the dividend checks are mailed. C) The shareholders who own the stock the day the dividend is paid will receive the dividend. D) All shareholders who own the stock on the record date, but sell the stock before the dividend checks are mailed, forfeit their right to receive the dividend and the money reverts back to the corporation. 11 If Suzy owns 5% of ABC Co. stock before its 3 for 1 split, how much of the firm will show own after the split? A) 5% B) 1.67% C) 15% D) It depends upon the original stock price before the split. Just as the value of the firm does not change with a stock split (or a reverse split), an individual shareholder's percentage ownership in the firm does not change with a split. 12 AFB, Inc. stock is currently selling for $20 per share. The company completed a 5-for-1 stock split two days earlier. Two years ago, the company had a 2-for-1 stock split. If the stock splits had not happened, what would be the price of AFB, Inc. stock be today (assuming no market price changes)? Stock price today = $20 per share (after the 5 for 1 split) The stock price before the 5 for 1 split would have been $20 * 5 = $100 The stock price before the 2 for 1 split 2 years ago would have been $100 * 2 = $200 13 A firm wants to maintain a minimum stock price of $15 a share. Due to a recent market downturn, the stock is currently selling for $6 a share. The firm should consider a: A) 3-for-1 stock split. B) 4-for-1 stock split. C) 1-for-3 reverse stock split. D) 1-for-4 reverse stock split. E) 1-for-5 reverse stock split. We know that a stock split increases the number of shares outstanding and lowers the stock price, all without changing the market value of the firm (price per share * # shares outstanding) From this, we reject either of the stock split options. Start running the numbers: In a 1 for 3 reverse split is done, then for every 3 shares owned at $6 per share, the shareholder will now have 1 share at $18. In a 1 for 4, the shareholder having 4 shares at $6 ($24 total ownership), will now have 1 share at $24, this is a lot higher than the firm wants to maintain. Finally, in the 1 for 5, if you have 5 shares at $6 ($30 in total ownership), you will have 1 share at $30, this is way higher than the firm needs. 14 Ziggy Industries has 100,000 shares outstanding at a market price of $270. The firm is about to do a 3 for 1 split. a How many shares will be outstanding after the split? b What will be the new market price after the split? c Will the total number of shareholders (individuals holding stock) change? d Will the market value of the firm change? a) The total shares outstanding will go from 100,000 to 300,000 shares after the split b) The price per share will go firm $270/share to $90 per share (270/3) c) The total number of individual shareholders will not change. However many different investors own stock before the split, that will stay the same. Each of these shareholders will now own 3 times as many shares, each at a value of 1/3 the original price. Their ownership in the firm (as a percent) does not change. d) The market value of the firm does not change Market value before the split was 100,000 * $270 per share = $27,000,000 Market value after the split will be 300,000 * $90 per share = $27,000,000