Note: an assumption in the MM theory: a firm is viewed as perpetuity

advertisement

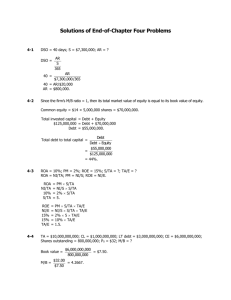

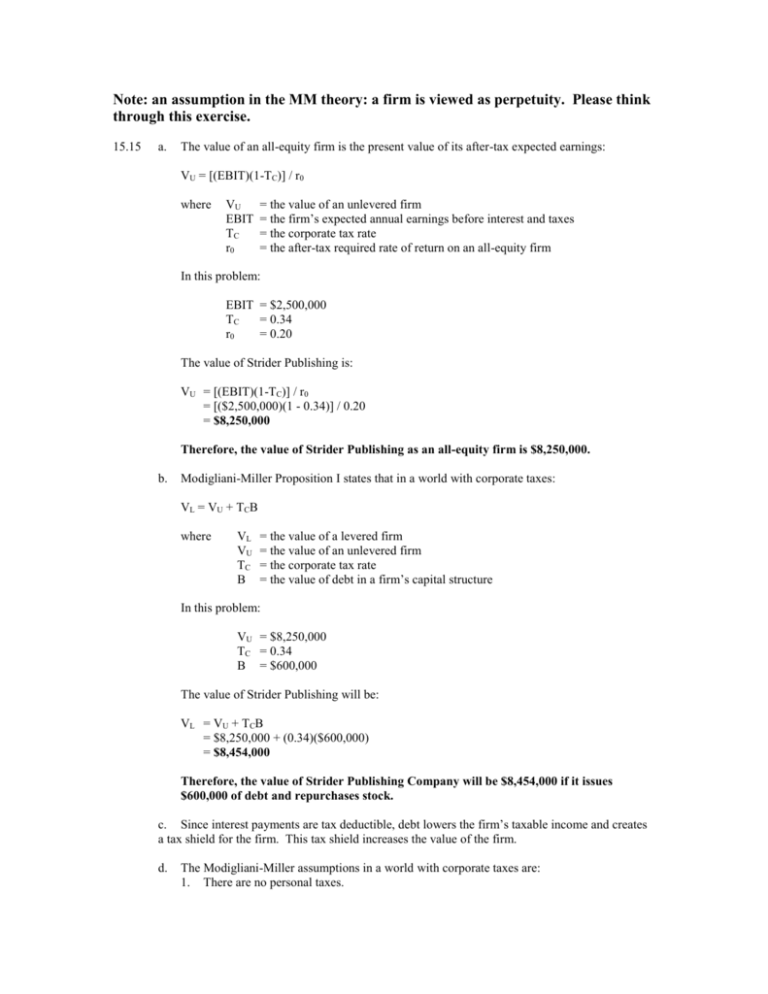

Note: an assumption in the MM theory: a firm is viewed as perpetuity. Please think through this exercise. 15.15 a. The value of an all-equity firm is the present value of its after-tax expected earnings: VU = [(EBIT)(1-TC)] / r0 where VU EBIT TC r0 = the value of an unlevered firm = the firm’s expected annual earnings before interest and taxes = the corporate tax rate = the after-tax required rate of return on an all-equity firm In this problem: EBIT = $2,500,000 TC = 0.34 r0 = 0.20 The value of Strider Publishing is: VU = [(EBIT)(1-TC)] / r0 = [($2,500,000)(1 - 0.34)] / 0.20 = $8,250,000 Therefore, the value of Strider Publishing as an all-equity firm is $8,250,000. b. Modigliani-Miller Proposition I states that in a world with corporate taxes: VL = VU + TCB where VL VU TC B = the value of a levered firm = the value of an unlevered firm = the corporate tax rate = the value of debt in a firm’s capital structure In this problem: VU = $8,250,000 TC = 0.34 B = $600,000 The value of Strider Publishing will be: VL = VU + TCB = $8,250,000 + (0.34)($600,000) = $8,454,000 Therefore, the value of Strider Publishing Company will be $8,454,000 if it issues $600,000 of debt and repurchases stock. c. Since interest payments are tax deductible, debt lowers the firm’s taxable income and creates a tax shield for the firm. This tax shield increases the value of the firm. d. The Modigliani-Miller assumptions in a world with corporate taxes are: 1. There are no personal taxes. 2. 3. There are no costs of financial distress. The debt level of a firm is constant through time.