The Rivoli Company has no debt outstanding and its

advertisement

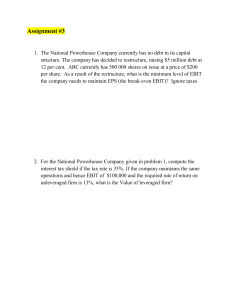

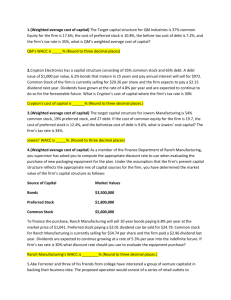

The Rivoli Company has no debt outstanding and its financial position is given by the following data: Assets (book = market) EBIT Cost of equity rs Stock price P0 Shares outstanding, n0 Tax rate, T(federal-plus-state) $3,000,000 500,000 10% $15 200,000 40% The firm is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 11% to reflect the increased risk. Bonds can be sold at a cost , rd, of 7%. Rivoli is a no-growth firm. Hence, all its earnings ate paid out as dividends, and earnings are expectationally constant over time. a- What effect would this use of leverage have on the value of the firm? Original value of the firm (D = $0): V = D + S = 0 + ($15)(200,000) = $3,000,000. Original cost of capital: WACC = wd rd(1-T) + wers = 0 + (1.0)(10%) = 10%. With financial leverage (wd=30%): WACC = wd rd(1-T) + wers = (0.3)(7%)(1-0.40) + (0.7)(11%) = 8.96%. Because growth is zero, the value of the company is: V= FCF ( EBIT )(1 T ) ($500,000)(1 0.40) $3,348,214.286. . WACC WACC 0.0896 Increasing the financial leverage by adding $900,000 of debt results in an increase in the firm’s value from $3,000,000 to $3,348,214.286. b- What would be the price of Rivoli’s stock? Using its target capital structure of 30% debt, the company must have debt of: D = wd V = 0.30($3,348,214.286) = $1,004,464.286. Therefore, its debt value of equity is: S = V – D = $2,343,750. Alternatively, S = (1-wd)V = 0.7($3,348,214.286) = $2,343,750. The new price per share, P, is: P = [S + (D – D0)]/n0 = [$2,343,750 + ($1,004,464.286 – 0)]/200,000 = $16.741. c- What happens to the firm’s earnings per share after the recapitalization? The number of shares repurchased, X, is: X = (D – D0)/P = $1,004,464.286 / $16.741 = 60,000.256 60,000. The number of remaining shares, n, is: n = 200,000 – 60,000 = 140,000. Initial position: EPS = [($500,000 – 0)(1-0.40)] / 200,000 = $1.50. With financial leverage: EPS = [($500,000 – 0.07($1,004,464.286))(1-0.40)] / 140,000 = [($500,000 – $70,312.5)(1-0.40)] / 140,000 = $257,812.5 / 140,000 = $1.842. Thus, by adding debt, the firm increased its EPS by $0.342. d- The $500,000 EBIT given previously is actually the expected value from the following probability distribution: Probability 0.10 0.20 0.40 0.20 0.10 EBIT ($100,000) 200,000 500,000 800,000 1,100,000 Determine the times interest earned ratio for each probability. What is the probability of not covering the interest payment at the 30% debt level? 30% debt: TIE = EBIT EBIT = . I $70,312.5 Probability 0.10 0.20 0.40 0.20 0.10 TIE ( 1.42) 2.84 7.11 11.38 15.64 The interest payment is not covered when TIE < 1.0. The probability of this occurring is 0.10, or 10 percent.