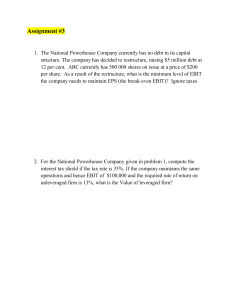

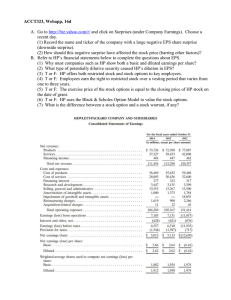

EBIT-EPS Analysis Basics of EBIT-EPS Approach It is important to understand what EBIT and EPS mean to understand what the analysis is meant to be. EBIT refers to earnings before interest and tax. The metric makes interest and taxes irrelevant. Therefore, an investor can understand how the company is performing out of the balance sheet’s composition which essentially makes interest and taxes the focal point of consideration. In terms of EBIT, there is no difference if a company has huge debt or no debt at all. The repercussions will be the same. EPS or earnings per share is the metric that shows a company’s earnings including interests and taxes. It is an important metric because it shows the earnings on a per-share basis which helps the investors understand how a company performs on an overall basis. If a company’s overall profit soars high but the payment to investors is low, it is a bad gesture for investors owning a fixed number of shares. EPS shows this dynamic rule simply and in a clear manner. The ratio between these two metrics can show how the bottomline results, the company’s EPS, are related to its performance irrespective of its capital structure, the EBIT. Option A: Issuing $1,000,000 of 8% bonds Interest expense on bonds = 8% x $1,000,000 = $80,000 Earnings before taxes (EBT) = EBIT - interest expense = $500,000 - $80,000 = $420,000 Taxes (at 40% tax rate) = 0.4 x $420,000 = $168,000 Net income available to common shareholders = EBT - taxes = $420,000 - $168,000 = $252,000 Earnings per share (EPS) = Net income available to common shareholders / number of common shares outstanding Assuming 100,000 shares of common stock outstanding: EPS = $252,000 / 100,000 = $2.52 per share Option B: Issuing $500,000 of 10% preferred stock and $500,000 of common stock Preferred stock dividend = 10% x $500,000 = $50,000 Net income available to common shareholders = EBIT - preferred dividends Net income available to common shareholders = $500,000 - $50,000 = $450,000 Taxes (at 40% tax rate) = 0.4 x $450,000 = $180,000 Net income available to common shareholders after taxes = $450,000 - $180,000 = $270,000 Earnings per share (EPS) = Net income available to common shareholders after taxes / number of common shares outstanding Assuming 100,000 shares of common stock outstanding: EPS = $270,000 / 100,000 = $2.70 per share Various advantages derived from EBIT‐EPS analysis may be enumerated below: Financial Planning: Use of EBIT‐EPS analysis is indispensable for determining sources of funds. In case of financial planning the objective of the firm lies in maximizing EPS. EBIT‐ EPS analysis evaluates the alternatives and finds the level of EBIT that maximizes EPS. Comparative Analysis: EBIT‐EPS analysis is useful in evaluating the relative efficiency of departments, product lines and markets. It identifies the EBIT earned by these different departments, product lines and from various markets, which helps financial planners rank them according to profitability and also assess the risk associated with each. Performance Evaluation: This analysis is useful in comparative evaluation of performances of various sources of funds. It evaluates whether a fund obtained from a source is used in a project that produces a rate of return higher than its cost. Determining Optimum Mix: EBIT‐EPS analysis is advantageous in selecting the optimum mix of debt and equity. By emphasizing on the relative value of EPS, this analysis determines the optimum mix of debt and equity in the capital structure. It helps determine the alternative that gives the highest value of EPS as the most profitable financing plan or the most profitable level of EBIT as the case may be. https://www.upwork.com/resources/types-of-levera ge https://www.indeed.com/career-advice/career-deve lopment/what-is-operating-cycle