CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE

advertisement

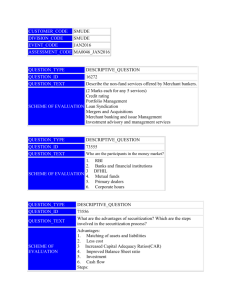

CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE EVENT_CODE SMUAPR15 ASSESSMENT_CODE MA0042_SMUAPR15 QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 16512 QUESTION_TEXT Examine the role of Financial System in the Indian Perspective. Discuss the impact of Liberalization on the financial system. SCHEME OF EVALUATION A. Role of financial system is to accelerate the rate of capital formation. a.Positive initiatives that are taken up by regulatorsand government only can achieve it. b.Two categories of peoples exists in any system. 1.People whose income exceedstheir expenditure 2.People whose expenditureexceeds their income c.Creates opportunity for savers a surplus forspending (Points to be elaborated) B. Liberalization– a.Radical measures taken in 1992–1993 torestructure the economic system b.Focus was to remove structural weakness anddevelop markets on stable grounds c.Reforms had an impact in government securities d.It develops a active secondary market e.Developing market structure and strengtheningrisk management and systems in the stockexchange f.Increase in the number of participants in thestock market g.Introduction of new instruments QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 16514 QUESTION_TEXT Explain the concept of a Treasury Dealing Room and its Organizational Structure. SCHEME OF EVALUATION It refers to the bank’s interface with financial markets both national and international. The dealing room is the primary unit for managing the market risks of the bank and is therefore allocated some discretionary limits. All dealers provide written undertakings to the bank to adhere to the rule. [Some guidelines to be mentioned] Organizational structure of the dealing room– A.Front office operation B.Middle office operation C.Back office operation [Above points to be explained in one or two paras] QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 73593 QUESTION_TEXT Explain the different parties involved in ADR/GDR issues. 1. 2. 3. 4. SCHEME OF EVALUATION 5. 6. 7. Issuer company (1 mark) Lead manager (2 marks) Co-managers/underwriters (1 mark) Depository (2 marks) Custodian (2 marks) Legal advisors (1 mark) Auditors (1 mark) (1.5 6 = 10 marks) QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 73595 QUESTION_TEXT Explain the different criteria which are used to assess the earning quality of banks. SCHEME OF EVALUATION 1. Operating profit to average working funds ratio. 2. Net interest margin to total assets ratio. 3. Return on average capital employed ratio. 4. Interest income to total income ratio. 5. Non-interest income to total income ratio. (2 5 = 10 marks) QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 125863 QUESTION_TEXT Write a short note on Derivative markets. Meaning: 3 Marks * Forward rate agreement * Swap * Options * Futures * Forwards * Call options * Put options SCHEME OF EVALUATION QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 125866 QUESTION_TEXT What are the pillars of balanced score card that rate performance of banks? SCHEME OF EVALUATION 1. Financial performance 2. Customer performance 3. Internal process management 4. Innovation and learning