Chapter 6

advertisement

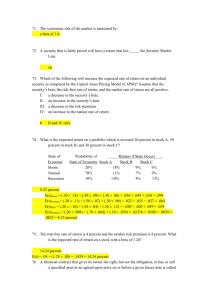

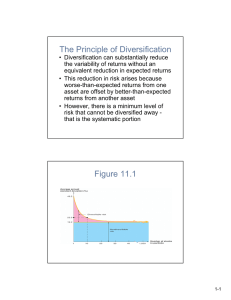

Chapter 6 The Meaning and Measurement of Risk and Return Chapter Objectives Define and measure the expected rate of return of an individual investment Define and measure the riskiness of an individual investment Compare the historical relationship between risk and rates of return in the capital markets Explain how diversifying investments affect the riskiness and expected rate of return of a portfolio or combination of assets Explain the relationship between an investor’s required rate of return and the riskiness of the investment Rate of Return Determined by future cash flows, not reported earnings Expected Rate of Return Weighted average of all the possible returns, weighted by the probability that each return will occur Expected Rate of Return Jazzfestival (in August) has 2 possible outcomes – bad weather (20% chance); return 30.000 zloty – good weather (80% chance); return 100.000 zloty – expected return; 86.000 zloty Risk Potential variability in future cash flows The greater the range of possible events that can occur, the greater the risk Standard Deviation of Return Quantitative measure of an asset’s riskiness Measures the volatility or riskiness of portfolio returns Square root of the weighted average squared deviation of each possible return from the expected return Real Average Annual Rate of Return Nominal rate of return less the inflation rate For example; savings account inTurkey Nominal intrest rate is 40% Inflation (expected) is 38% Real intrest rate is 2% (plus - minus) Risk Premium Additional return received beyond the riskfree rate (Treasury Bill rate) for assuming risk Risk and Diversification Diversification can reduce the risk associated with an investment portfolio, without having to accept a lower expected return Annual Rates of Return 1926 to 2000 Security Nominal Average Annual Returns Standard Deviation of Returns Real Average Annual Returns Risk Premium Common Stocks Small Cmpy Stk L-T Corp bonds L-T Govt bonds Int. Govt bonds U.S. Treas. Bills Inflation 13.0 % 20.2 % 9.8 % 9.1 % 17.3 % 33.4 % 14.1 % 13.4 % 6.0 % 8.7 % 2.8 % 2.1 % 5.7 % 9.4 % 2.5 % 1.8 % 5.5 % 5.8 % 2.3 % 1.6 % 3.9 % 3.2 % 0.7 % 0% 3.2 % 4.4 % Diversification If we diversify investments across different securities, the variability in the returns declines Total Risk or Variability Company-Unique Risk (Unsystematic) Market Risk (Systematic) Company-Unique Risk Unsystematic risk Diversifiable -Can be diversified away Market Risk Systematic Non-diversifiable Can not be eliminated through random diversification Market Risk Events that affect market risk Changes in the general economy, major political events, sociological changes Examples: Interest Rates in the economy Changes in tax legislation that affects all companies Beta Average relationship between a stock’s returns and the market’s returns Measure of a firm’s market risk or the risk that remains after diversification Slope of the characteristic line—or the line that measures the average relationship between a stock’s returns and the market Beta A stock with a Beta of 0 has no systematic risk A stock with a Beta of 1 has systematic risk equal to the “typical” stock in the marketplace A stock with a Beta greater than 1 has systematic risk greater than the “typical” stock in the marketplace Most stocks have betas between .60 and 1.60 Portfolio Beta Weighted average of the individual stock betas with the weights being equal to the proportion of the portfolio invested in each security Portfolio beta indicates the percentage change on average of the portfolio for every 1 percent change in the general market Asset Allocation Diversification among different kinds of assets Examples: Treasury Bills Long-Term Government Bonds Large Company Stocks Required Rate of Return Minimum rate of return necessary to attract an investor to purchase or hold a security Considers the opportunity cost of funds Opportunity Cost The next best alternative Required Rate of Return k=kfr + krp Where: k = required rate of return kfr = Risk Free Rate krp = Risk Premium Risk-Free Rate Required rate of return for risk-less investments Typically measured by U.S. Treasury Bill Rate Risk Premium Additional return expected for assuming risk As risk increases, expected returns increase Risk Premium = Required Return – Risk Free rate krp = k - kfr Where: k = required rate of return kfr = Risk Free Rate krp = Risk Premium If required return is 15% and the risk free rate is 5%, then the risk premium is 10%. The 10% risk premium would apply to any security having a systematic risk equivalent to general market or a Beta of 1. If beta is 2, then risk premium = 20%. Capital Asset Pricing Model Equation that equates the expected rate of return on a stock to the risk-free rate plus a risk premium for the systematic risk CAPM CAPM CAPM suggests that Beta is a factor in required returns kj = krf + B(market rate – risk free rate) Example: Market risk = 12% Risk Free rate = 5% 5% + B(12% - 5%) If B = 0 Required rate = 5% If B = 1 Required rate = 12% If B = 2 Required rate = 19%