Question: - JustAnswer

advertisement

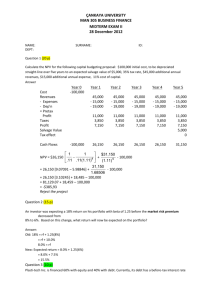

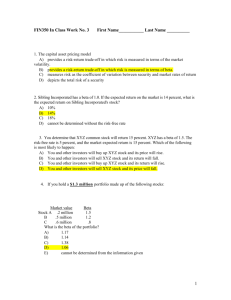

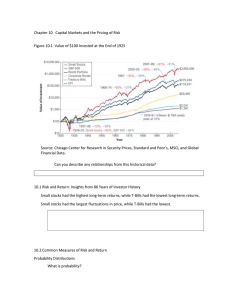

Question: 7-8, Page 275: Year 1 2 3 4 5 6 7 8 9 10 11 Mean= σ= Historical Rates of Return NYSE 4.0% 14.3 19.0 (14.7) (26.5) 37.2 23.8 (7.2) 6.6 20.5 30.6 9.8% 19.6% Stock Y 3.0% 18.2 9.1 (6.0) (15.3) 33.1 6.1 3.2 14.8 24.1 18.0 9.8% 13.8% a. Construct a scatter diagram showing the relationship between returns on Stock Y and the market, and then draw a freehand approximation of the regression line. What is the approximate value of the beta coefficient? If you have a calculator with a linear regression function or a spreadsheet, check the approximate value of beta obtained from the graph. Approximate Value of Beta is 0.6 – please see the attached excel sheets for calculations and scatter diagram b. Give a verbal interpretation of what the regression line and the beta coefficient show about Stock Y’s volatility and relative riskiness as compared with those of other stocks. The Beta Coefficient is a measure of risk, it shows how volatile stock Y is with respect to the NYSE index. A Beta Value of 0.6 means that, when the NYSE index is up by 1%, stock Y is up by 0.6%. From this we can see that Stock Y is less risky than other stocks. c. Suppose the scatter of points had been more spread out, but the regression line was exactly where your present graph shows it. How would this effect (1) the firm’s risk if the stock is held in a one-asset portfolio and (2) the actual risk premium on the stock if the CAPM holds exactly? If the stock is held in a one-asset portfolio, we are concerned about both systematic and unsystematic risks. When the points are scattered, this means that the Unique risk (unsystematic risk) is high, hence a one-asset portfolio would be a risky portfolio. When the stock is held in a big portfolio and follows CAPM, we are concerned with the Systematic (market) risk, the Unsystematic risk is somewhat eliminated by diversification. In this situation, there will not be any change in the risk premium, the only thing of concern would be the slope. If the slope is the same, the risk premium will be the same no matter how spread the data is. d. Suppose the regression line had been downward sloping and the beta coefficient had been negative. What would this imply about (1) Stock Y’s relative riskiness, (2) its correlation with the market, and (3) its probable risk premium? A downward sloping regression line and a negative beta coefficient indicate that the stock is negatively correlated with the NYSE index. Stocks with such a negative relationship with NYSE reduce the overall risk of a portfolio. From this we can see that stock Y has a low relative risk and a negative correlation with the market. With such stocks, there is usually a negative risk premium (risk discount) since the stock reduces the overall risk of the portfolio; the risk premium however will depend on the standard deviation of the stock. e. Construct an illustrative probability distribution graph of returns on portfolios consisting of (1) only Stock Y, (2) 1% each of 100 stocks with beta coefficients similar to that of Stock Y, and (3) all stocks (i.e. the distribution of returns on the market). Use as the expected rate of return the arithmetic mean as given previously for both Stock Y and the market and assume that the distributions are normal. Are the expected returns “reasonable”; that is, is it reasonable that % 8 . 9 ˆ ˆ = = M Y k k ? Please see the attached excel sheet

![Cost of Capital - of [www.mdavis.cox.smu.edu]](http://s3.studylib.net/store/data/008952041_1-d815507e779b91930bdfd4a584f3c02a-300x300.png)